Answered step by step

Verified Expert Solution

Question

1 Approved Answer

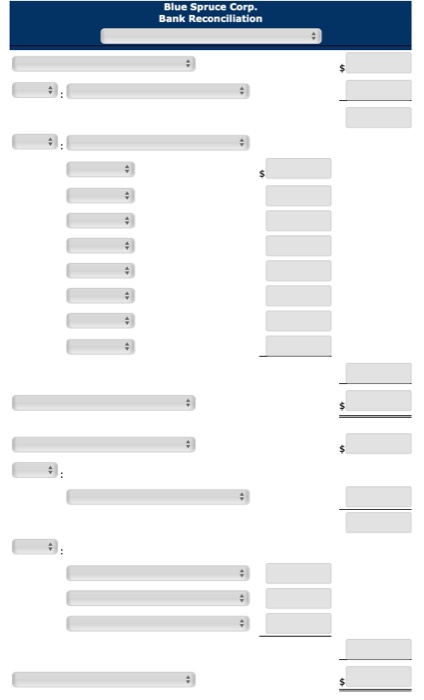

using the steps in the reconciliation procedure, prepare a bank reconciliation at Nov. 30, 2019. The bank portion of the bank reconciliation for Blue Spruce

using the steps in the reconciliation procedure, prepare a bank reconciliation at Nov. 30, 2019.

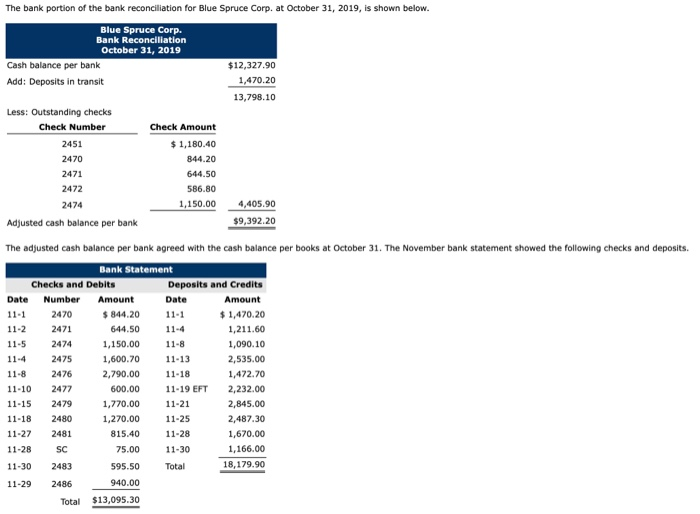

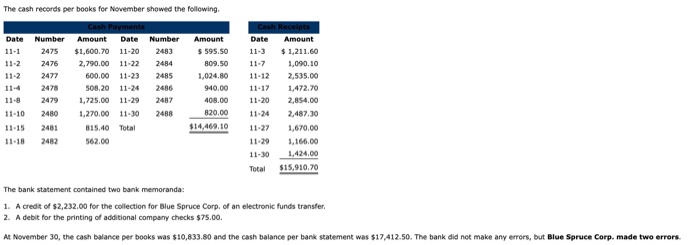

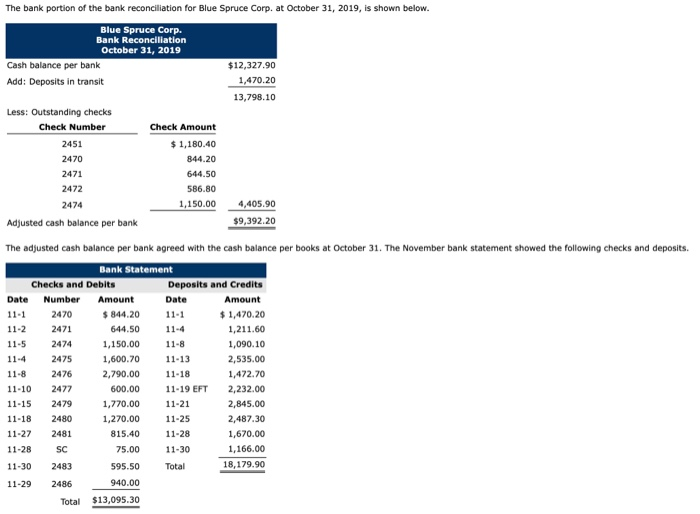

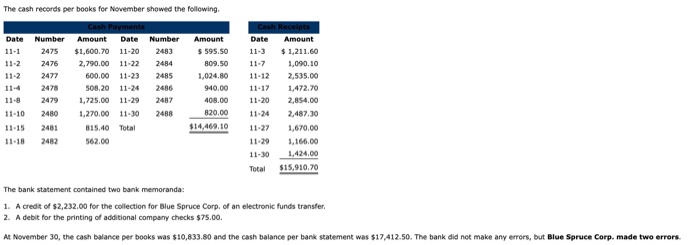

The bank portion of the bank reconciliation for Blue Spruce Corp. at October 31, 2019, is shown below. Blue Spruce Corp. Bank Reconciliation October 31, 2019 Cash balance per bank Add: Deposits in transit $12,327.90 1,470.20 13,798.10 Less: Outstanding checks Check Number 2451 2470 2471 Check Amount $1,180.40 844.20 644.50 586.80 1,150.00 2472 2474 Adjusted cash balance per bank 4,405.90 $9,392.20 The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following checks and deposits. Bank Statement Checks and Debits Deposits and Credits Date Number Amount Date Amount 11-1 2470 $ 844.20 $1,470.20 11-2 2471 644.50 1,211.60 11-5 2474 1,150.00 11-8 1,090.10 11-4 2475 1,600.70 11-13 2,535.00 11-8 2476 2,790.00 11-18 1,472.70 11-10 2477 600.00 11-19 EFT 2,232.00 11-15 2479 1,770.00 11-21 2,845.00 11-18 2480 1,270.00 11-25 2,487.30 11-27 2481 815.40 11-28 1,670.00 11-28 SC 75.00 11-30 1,166.00 11-30 2483 595.50 Total 18,179.90 11-29 2486 940.00 Total $13,095.30 The cash records per books for November showed the following. Date Number 2475 2476 2477 2478 2479 2480 2481 2482 Cash Payments Amount Date Number $1,600.70 11-20 2483 2,790.00 11-22 2484 600.00 11-23 2485 508.2011-24 2486 1,725.00 11-29 2487 1,270.00 11-30 2488 815,40Total 562.00 Amount $ 595.50 809.50 1,024.80 940.00 408.00 820.00 $14,469.10 Cash Receipts Date Amount $ 1,211.60 11-7 1,090.10 11-12 2,535.00 11-17 1,472.70 11-20 2,854.00 2,487.30 11-27 1,670,00 1.166.00 11-30 1,424.00 Total $15,910.70 11-10 The bank statement contained two bank memoranda: 1. Acredit of $2,232.00 for the collection for Blue Spruce Corp. of an electronic funds transfer 2. A debit for the printing of additional company checks $75.00. At November 30, the cash balance per books was $10,833.80 and the cash balance per bank statement was $17,412.50. The bank did not make any errors, but Blue Spruce Corp. made two errors. Blue Spruce Corp. Bank Reconciliation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started