Question

Using the table, plot the opportunity set of risky assets in Excel. Then vary the correlation between stocks and bonds from + 1 to -1

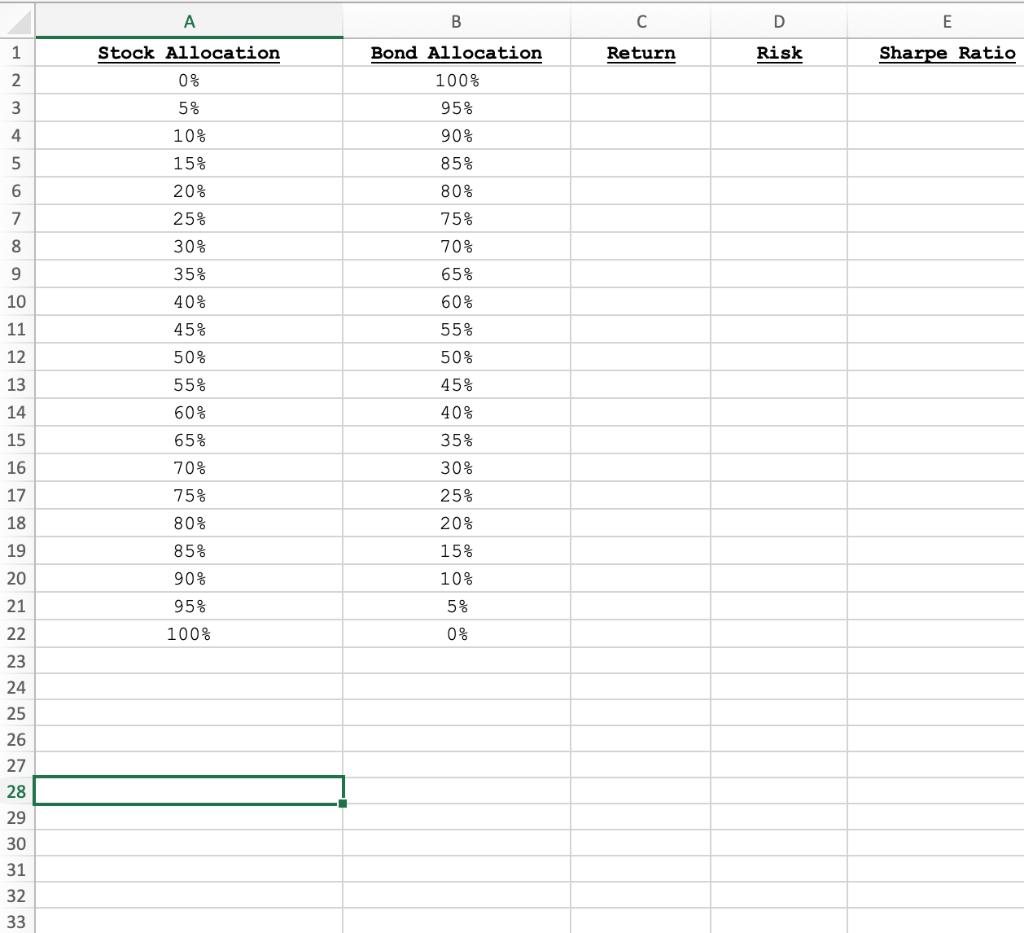

Using the table, plot the opportunity set of risky assets in Excel.

Then vary the correlation between stocks and bonds from + 1 to -1 and describe the changes in shape of the efficient frontier as you do so.

Upload the Excel file that contains the table & graph.

Also include in Excel file a description of the efficient frontier's shape as you vary the correlation. (10 pts)

Using the graph of the opportunity set of risky assets, answer the following:

a) Change the correlation of stocks and bonds back to 0.25 and observe the shape of the efficient frontier.

b) Starting at the point that corresponds to 100% Bonds & 0% Stocks, describe what happens to portfolio risk and return as you increase the stock allocation and decrease the bond allocation? Why is this happening?

c) Now change the correlation between stocks & bonds to -1. What is the lowest risk achievable?

A B D E 1 Return Risk Sharpe Ratio Stock Allocation 0% 2. 3 Bond Allocation 100% 95% 90% 5% 4 10% 5 6 7 15% 20% 85% 80% 25% 8 9 30% 35% 75% 70% 65% 60% 10 11 12 40% 45% 50% 55% 50% 45% 40% 13 14 35% 15 16 17 55% 60% 65% 70% 75% 80% 30% 25% 18 19 85% 20% 15% 10% 5% 20 90% 21 95% 100% 0% 22 23 24 25 26 27 28 29 30 31 32 33 A B D E 1 Return Risk Sharpe Ratio Stock Allocation 0% 2. 3 Bond Allocation 100% 95% 90% 5% 4 10% 5 6 7 15% 20% 85% 80% 25% 8 9 30% 35% 75% 70% 65% 60% 10 11 12 40% 45% 50% 55% 50% 45% 40% 13 14 35% 15 16 17 55% 60% 65% 70% 75% 80% 30% 25% 18 19 85% 20% 15% 10% 5% 20 90% 21 95% 100% 0% 22 23 24 25 26 27 28 29 30 31 32 33Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started