Answered step by step

Verified Expert Solution

Question

1 Approved Answer

using these pictures can someone found the following entries that are in the photos? Sheffield Hardware has four employees who are paid on an hourly

using these pictures can someone found the following entries that are in the photos?

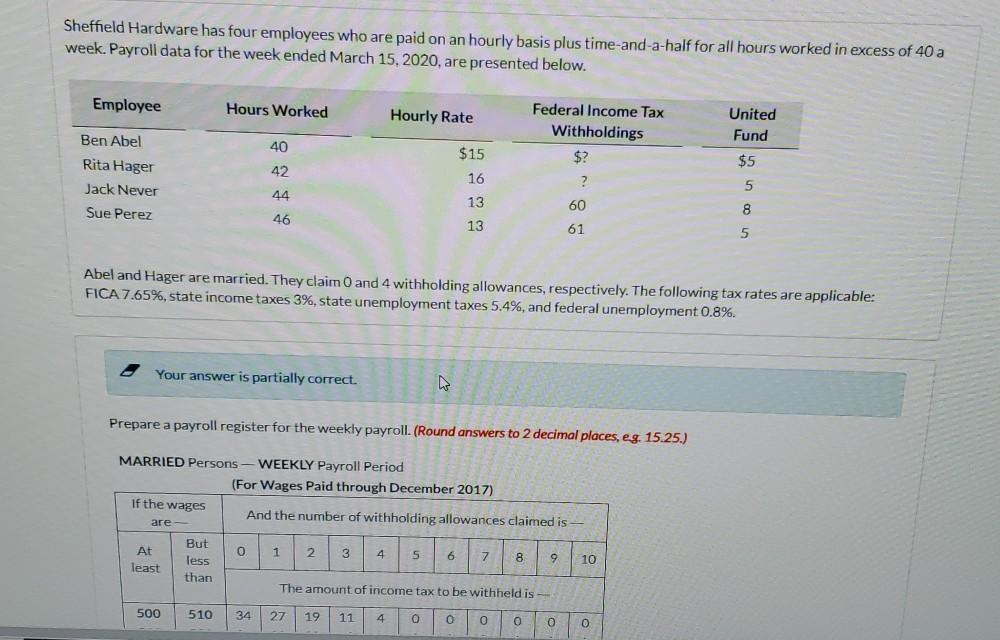

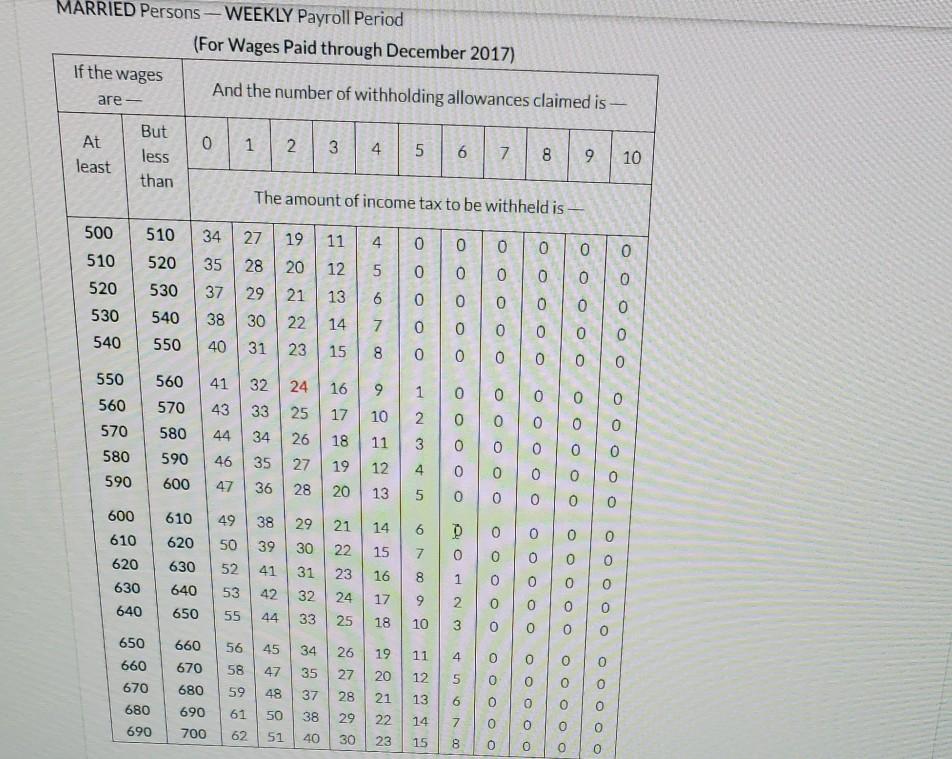

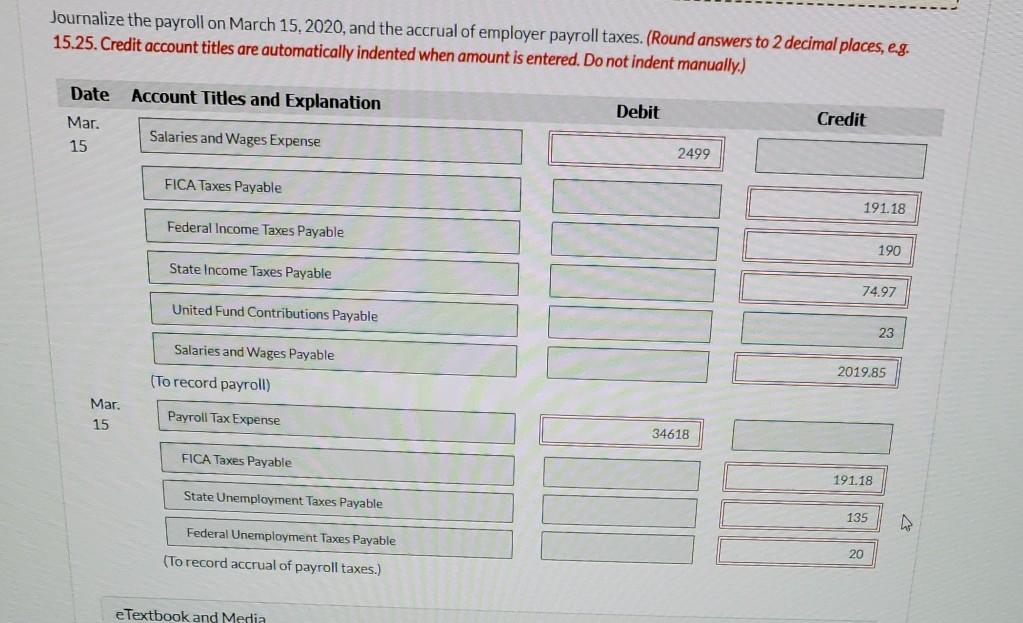

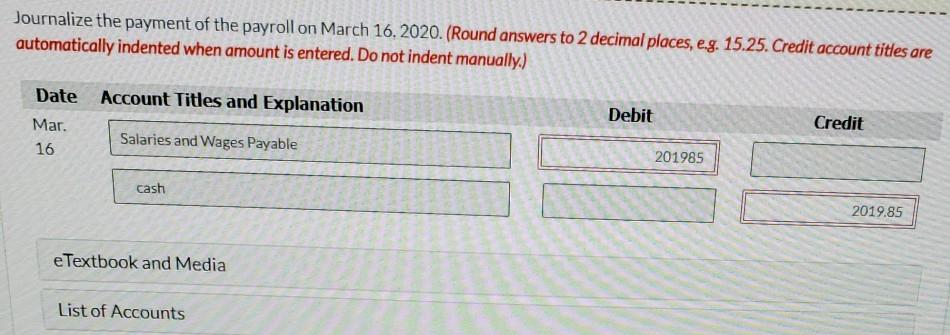

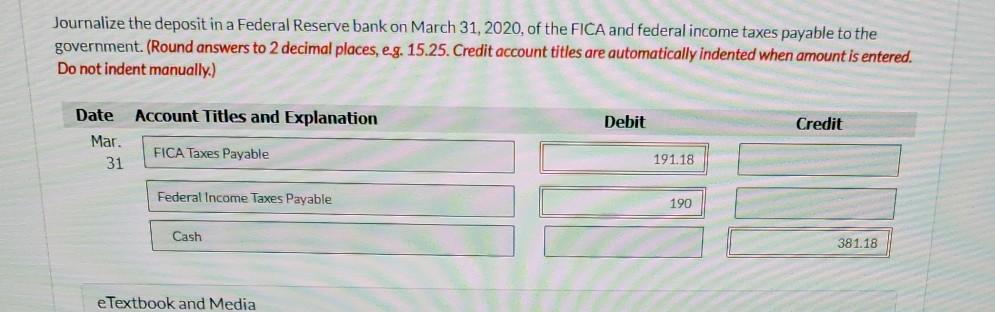

Sheffield Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2020, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings $? United Fund 40 Ben Abel Rita Hager Jack Never $15 $5 42 16 ? 44 5 8 Sue Perez 60 13 13 46 61 5 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Your answer is partially correct. Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, eg. 15.25.) MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017) If the wages And the number of withholding allowances claimed is - are - 0 1 2 At least 4 But less than 3 5 6 7 8 9 9 10 The amount of income tax to be withheld is 500 510 34 27 19 11 4 0 0 0 0 0 MARRIED Persons -WEEKLY Payroll Period (For Wages Paid through December 2017) If the wages And the number of withholding allowances claimed is are - 0 1 1 N 3 At least 3 4 5 But less than 5 6 7 8 8 9 10 The amount of income tax to be withheld is 500 34 27 19 510 520 11 4 4 0 0 0 510 35 28 0 0 20 12 0 0 0 0 0 530 37 29 21 0 0 0 0 13 6 6 0 520 530 540 0 0 0 0 540 38 30 0 0 22 14 7 0 0 550 40 31 23 15 8 8 0 0 0 0 0 550 560 41 32 24 16 1 0 0 0 0 0 570 43 25 17 2 9 10 11 33 34 0 0 0 560 570 580 590 0 580 44 2 3 26 18 0 0 0 0 0 0 46 590 600 27 19 4 35 36 4 0 0 0 0 0 47 28 20 5 0 0 0 0 0 49 38 29 21 14 6 0 0 0 0 39 610 620 630 640 30 D 0 50 52 22 600 610 620 630 640 15 7 0 0 41 16 8 0 23 24 0 53 31 32 33 42 17 9 0 0 0 0 650 0 o 0 55 44 25 18 1 2 3 4 5 10 0 0 0 56 45 11 o 0 650 660 670 0 19 20 0 58 47 34 35 37 12 0 660 670 680 690 700 0 26 27 28 29 0 59 48 21 13 6 0 0 680 0 61 50 38 22 7 0 0 690 0 62 14 15 51 40 30 23 00 0 0 O 0 Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 15 Salaries and Wages Expense 2499 FICA Taxes Payable 191.18 Federal Income Taxes Payable 190 State Income Taxes Payable 74.97 United Fund Contributions Payable 23 Salaries and Wages Payable 2019.85 (To record payroll) Mar, 15 Payroll Tax Expense 34618 FICA Taxes Payable 191.18 State Unemployment Taxes Payable 135 Federal Unemployment Taxes Payable 20 (To record accrual of payroll taxes.) e Textbook and Media Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. Salaries and Wages Payable 16 Debit Credit 201985 cash 2019.85 e Textbook and Media List of Accounts Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government. (Round answers to 2 decimal places, e g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Date Mar. 31 FICA Taxes Payable 191.18 Federal Income Taxes Payable 190 Cash 381.18 e Textbook and MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started