Answered step by step

Verified Expert Solution

Question

1 Approved Answer

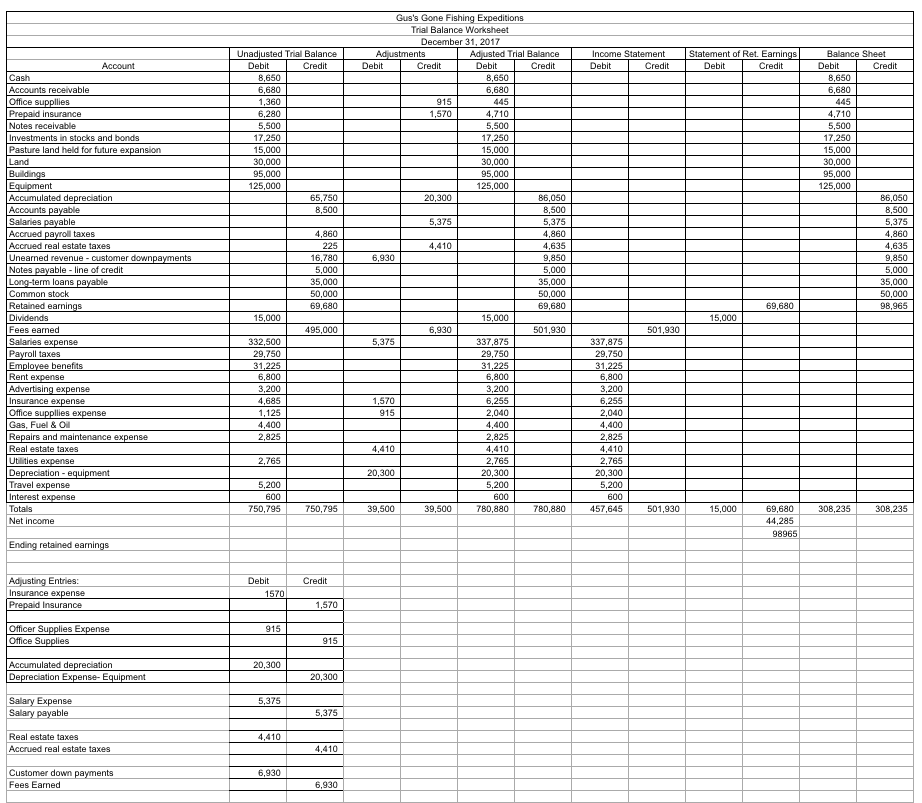

Using this information I have to make a income statement Income Statement Debit Credit Statement of Ret. Earnings Debit Credit Balance Sheet Debit Credit 8,650

Using this information I have to make a income statement

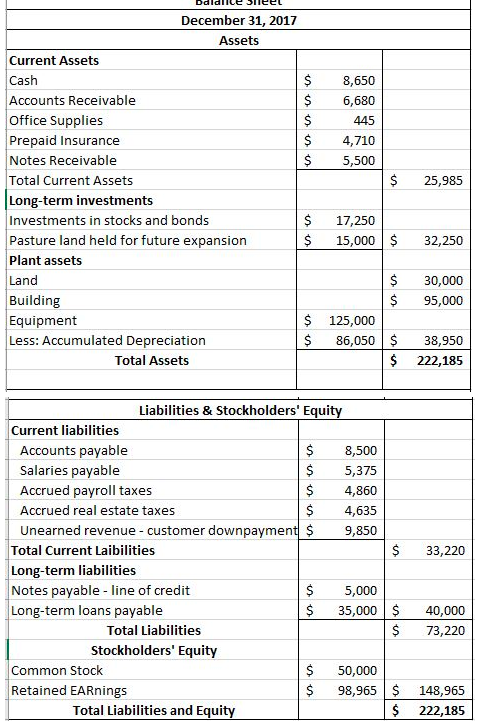

Income Statement Debit Credit Statement of Ret. Earnings Debit Credit Balance Sheet Debit Credit 8,650 6 680 Accounts receivable tice sunnleg Prepad insurance Notes receivabla Investments in stocks and bonds Pasture land held for future expansion Unadiusted Trial Balance Debit Credit 8.650 6.680 1.360 6.280 5.500 17.250 15.000 30.000 95.000 125.000 4.710 5.500 17.250 15.000 3000 95.000 125 000 dings Equipment Accumulated depreciation 65.750 R500 Salaries pavable Accrued payroll taxes ACCnrad real estate taxes Unearned revenue - customer downpayment Notes pavable - line of credit Long-term loans payable Common stock Retained earnings Dividends Fees earned Salaries expense 4.860 225 16.780 5.000 35.000 50,000 69.680 Gus's Gone Fishing Expeditions Trial Balance Worksheet December 31, 2017 Adiustments Adjusted Trial Balance Debit Credit Debit Credit 8.650 6.680 915 445 1.570 4.710 5.500 17.250 15.000 30.000 95.000 125.000 20,300 86.050 8500 5.375 5.375 1860 4.410 4.635 9850 5.000 35.000 50,000 69 680 15,000 6.930 501.930 337.875 29.750 31.225 6,800 3.200 1.570 6,255 915 2.040 4,400 2.825 4.410 4.410 2.765 20,300 20.300 5.200 600 39.500 39.500 780,880 780,880 8.500 5.375 4.860 4.635 9.850 5.000 35,000 50.000 98.965 69 680 15,000 15,000 495.000 Payroll 332.500 29.750 31.225 6,800 3.200 4,685 1,125 4,400 2,825 Employee benefits Rent expense Advertising expense Insurance expense Office supplies expense Gas, Fuel & Ol Repairs and maintenance expense Real estate taxes Utilities expense Depreciation - equipment Travel expense Interest expense Totals Net Income 337,875 29 750 31.225 6,800 3.200 6,255 2,040 4,400 2.825 4.410 2.765 20,300 5,200 600 457,645 2.765 5.200 600 750.795 750.795 501,930 15,000 308,235 308,235 6 9,680 44,285 98965 Ending retained earnings Credit Adjusting Entries: Insurance expense Prepaid Insurance Debit 1570 1.570 915 Officer Supplies Expense Office Supplies 1 915 20.300 Accumulated depreciation Depreciation Expense-Equipment 20,300 5,375 Salary Expense Salary payable 5.375 4.410 Real estate taxes Accrued real estate taxes 4.410 1 6 ,930 Customer down payments Fees Earned vaidlice Steel December 31, 2017 $ $ $ $ $ 8,650 6,680 445 4,710 5,500 $ 25,985 Current Assets Cash Accounts Receivable Office Supplies Prepaid Insurance Notes Receivable Total Current Assets Long-term investments Investments in stocks and bonds Pasture land held for future expansion Plant assets Land Building Equipment Less: Accumulated Depreciation Total Assets $ $ 17,250 15,000 $ 32,250 30,000 95,000 $ $ $ $ 125,000 86,050 $ $ 38,950 222,185 $ 33,220 Liabilities & Stockholders' Equity Current liabilities Accounts payable $ 8,500 Salaries payable $ 5,375 Accrued payroll taxes $ 4,860 Accrued real estate taxes $ 4,635 Unearned revenue - customer downpayment $ 9,850 Total Current Laibilities Long-term liabilities Notes payable - line of credit $ 5,000 Long-term loans payable $ 35,000 Total Liabilities Stockholders' Equity Common Stock $ 50,000 Retained EARnings $ 98,965 Total Liabilities and Equity $ $ 40,000 73,220 $ $ 148,965 222,185 Gus's Gone Fishing Expeditions Income Statement For the Year Ended December 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started