Answered step by step

Verified Expert Solution

Question

1 Approved Answer

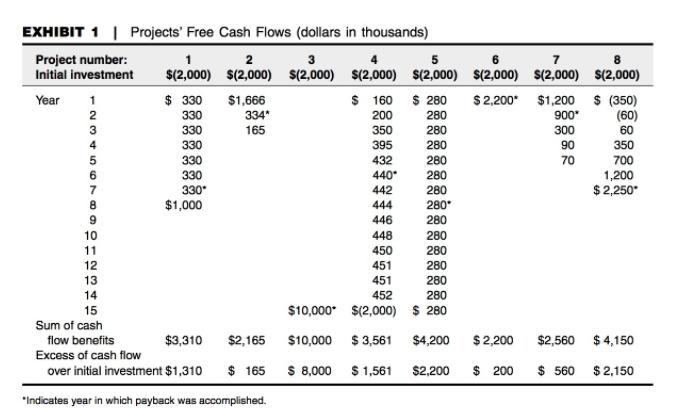

Utilize various methods to determine the ranking of the projects based on the cash flows provided. Be certain to use NPV and IRR calculations in

Utilize various methods to determine the ranking of the projects based on the cash flows provided. Be certain to use NPV and IRR calculations in your analysis. Then, complete the same analysis with a higher discount rate using the same evaluation methods.

Why do the rankings become more stable and similar between the 2 methods with a higher discount rate? Explain with example from your work.

EXHIBIT1 I Projects' Free Cash Flows (dollars in thousands) Project number: Initial investment $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) 3 6 5 $ 330 $1,666 334* 165 Year 1 $ 160 280 2,200* $1,200 (350) 280 280 280 280 440 280 280 280 280 280 280 280 280 280 $10,000* 2,000) 280 1,200 $2,250 $1,000 10 12 13 14 450 451 451 452 Sum of cash flow benefits $3,310 $2,165 $10,000 3,561 $4,200 2,200 $2,560 4,150 Excess of cash flow over initial investment $1,310 165 8,000 $1,561 $2,200 200 560 $2,150 Indicates year in which payback was accomplishedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started