Question

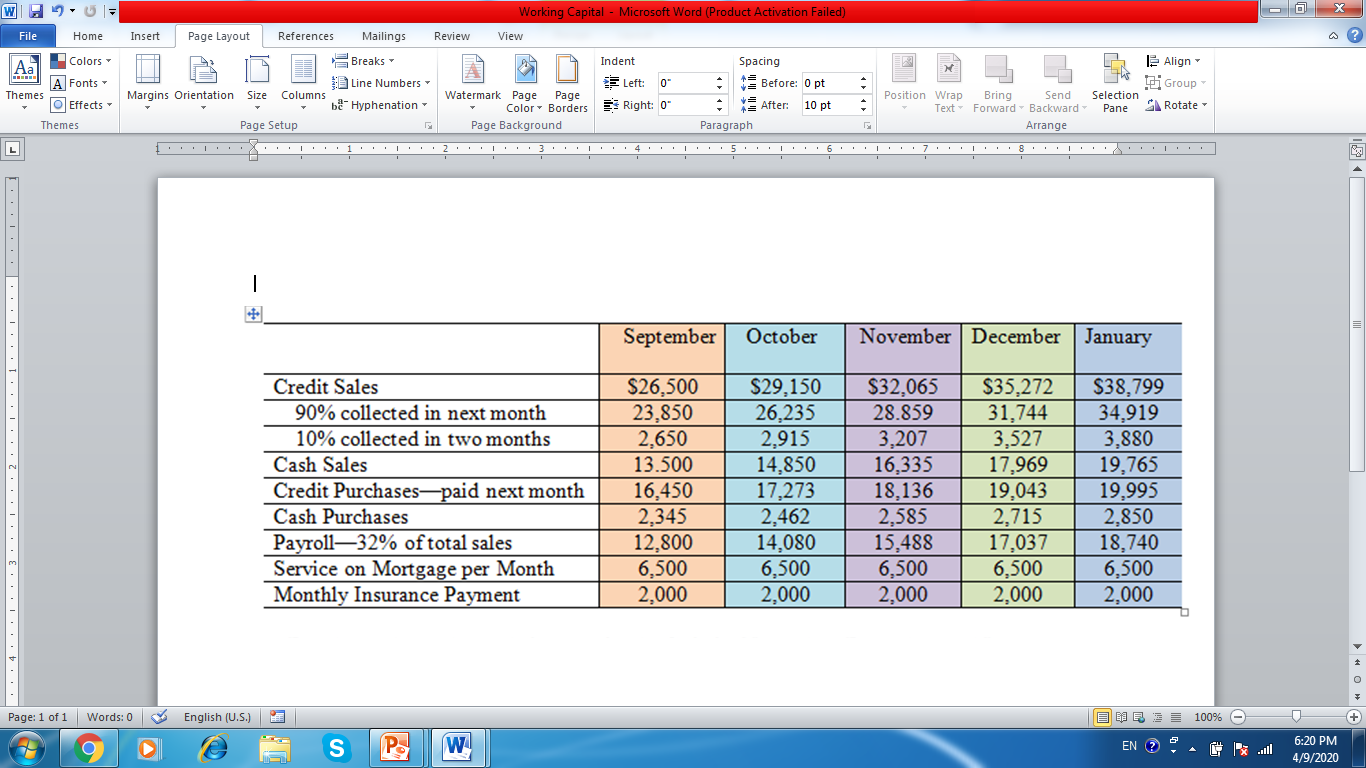

Utilizing the information provided by Juan Carlos, assist him to determine the monthly cash inflows and needs for his Caf. The following table provides a

Utilizing the information provided by Juan Carlos, assist him to determine the monthly cash inflows and needs for his Caf. The following table provides a breakdown of the cash inflows and outflows for September through January. The September figures are provided, so all you have to do is to place them in the correct row in the chart. Credit and cash sales are projected to grow at 10% each month, which can be calculated by simply multiplying the previous months sales figure by 1.1 (26,500 x1.1= 29,150). The same calculation can be utilized for increased credit and cash purchases, but instead of multiplying by 1.1, you would multiply by 1.05 to account for the 5% increase

Develop a ninety-day cash forecast for the Cafe for November, December, and January. Assume a beginning cash balance of $5,000 for November (Use the example in the class for Theresas Catering as a guide). Required:

- The first item to consider is the beginning cash balance, which is $5,000 for the Cafe.

- The first major section in the ninety-day cash forecast is cash receipts. Input the amount of cash sales for November, credit sales for October that were collectable in one month, and credit sales for September that were collectable in two months, and add them to get total cash available.

- The next section, which is cash disbursements, includes all of the cash outflows. This section includes cash purchases for November, credit purchases from October that were payable in one month, payroll expenses (32% of monthly sales), monthly debt service payment, and monthly insurance premium payment. Now, total the cash disbursements for November.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started