Answered step by step

Verified Expert Solution

Question

1 Approved Answer

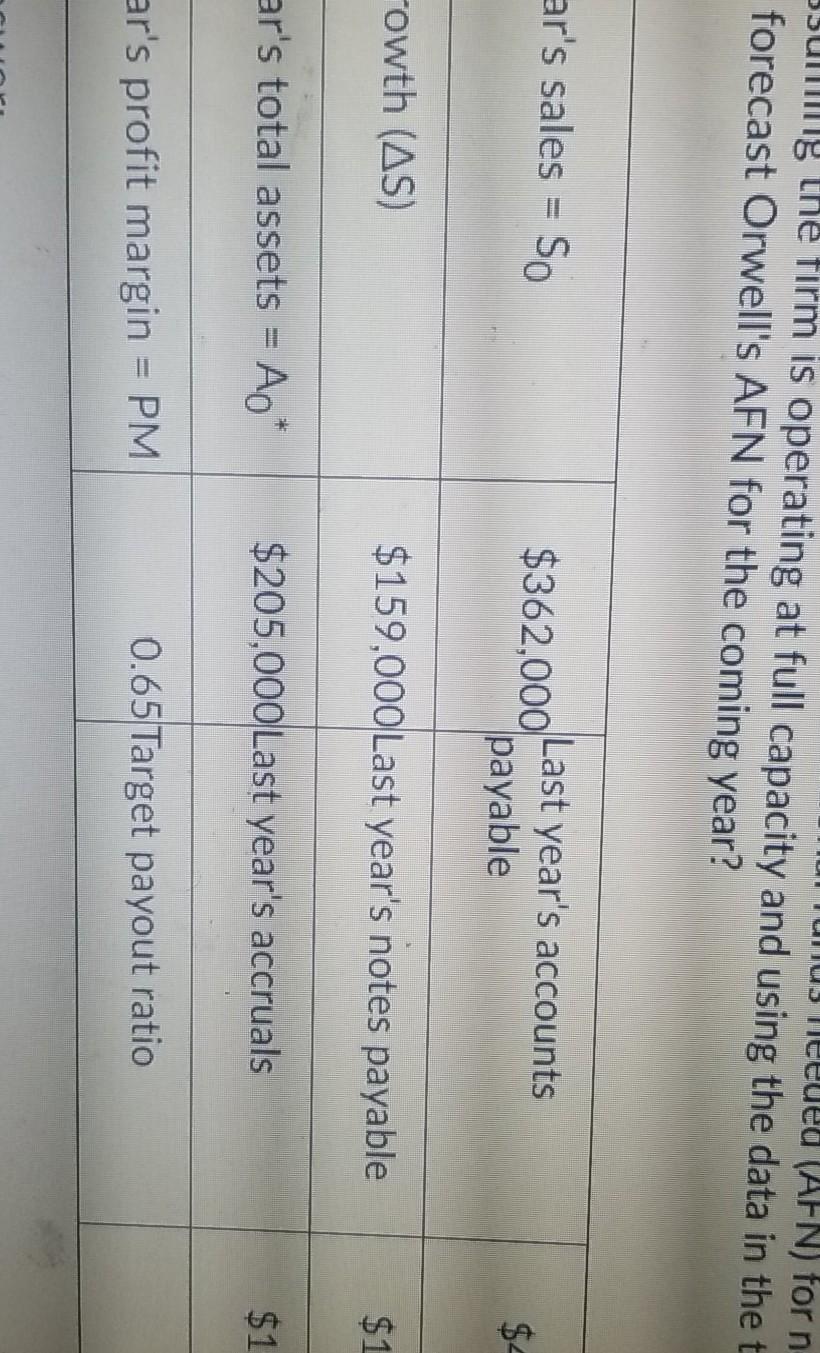

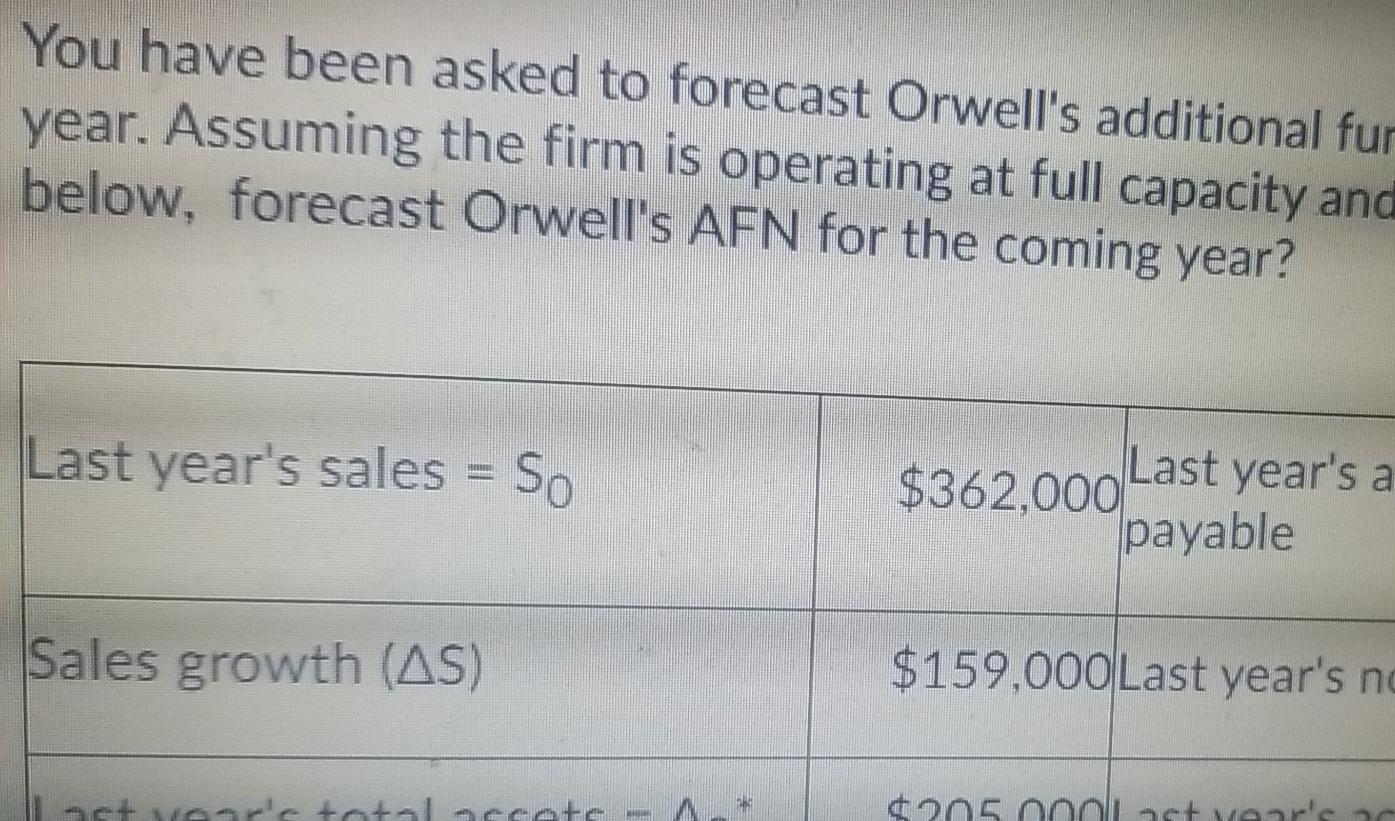

Uus eued (AFN) forn Sulug the firm is operating at full capacity and using the data in the t forecast Orwell's AFN for the coming

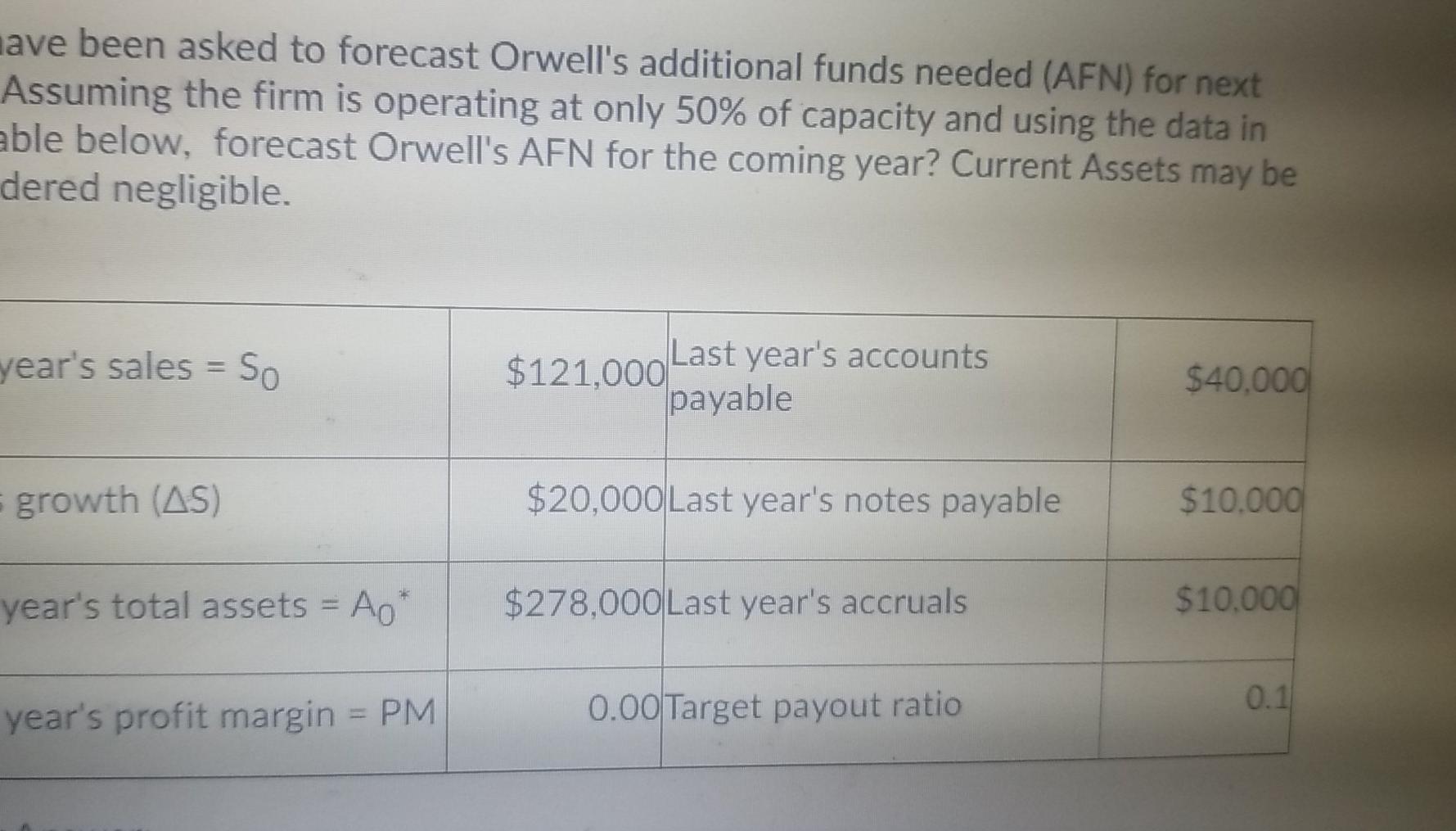

Uus eued (AFN) forn Sulug the firm is operating at full capacity and using the data in the t forecast Orwell's AFN for the coming year? ar's sales = So $362,000 Last year's accounts payable $4 Cowth (AS) $159,000 Last year's notes payable $1 ar's total assets = A* $205,000 Last year's accruals $1 ar's profit margin = PM 0.65 Target payout ratio You have been asked to forecast Orwell's additional fur year. Assuming the firm is operating at full capacity and below, forecast Orwell's AFN for the coming year? Last year's sales = So Last year's a $362,000 payable Sales growth (AS) $159,000 Last year's no $205 nollast year's have been asked to forecast Orwell's additional funds needed (AFN) for next Assuming the firm is operating at only 50% of capacity and using the data in able below, forecast Orwell's AFN for the coming year? Current Assets may be dered negligible. year's sales = So $121,000 Last year's accounts payable $40.000 growth (AS) $20,000 Last year's notes payable $10.000 year's total assets = Ao $278,000 Last year's accruals $10.000 0.1 year's profit margin = PM 0.00 Target payout ratio Uus eued (AFN) forn Sulug the firm is operating at full capacity and using the data in the t forecast Orwell's AFN for the coming year? ar's sales = So $362,000 Last year's accounts payable $4 Cowth (AS) $159,000 Last year's notes payable $1 ar's total assets = A* $205,000 Last year's accruals $1 ar's profit margin = PM 0.65 Target payout ratio You have been asked to forecast Orwell's additional fur year. Assuming the firm is operating at full capacity and below, forecast Orwell's AFN for the coming year? Last year's sales = So Last year's a $362,000 payable Sales growth (AS) $159,000 Last year's no $205 nollast year's have been asked to forecast Orwell's additional funds needed (AFN) for next Assuming the firm is operating at only 50% of capacity and using the data in able below, forecast Orwell's AFN for the coming year? Current Assets may be dered negligible. year's sales = So $121,000 Last year's accounts payable $40.000 growth (AS) $20,000 Last year's notes payable $10.000 year's total assets = Ao $278,000 Last year's accruals $10.000 0.1 year's profit margin = PM 0.00 Target payout ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started