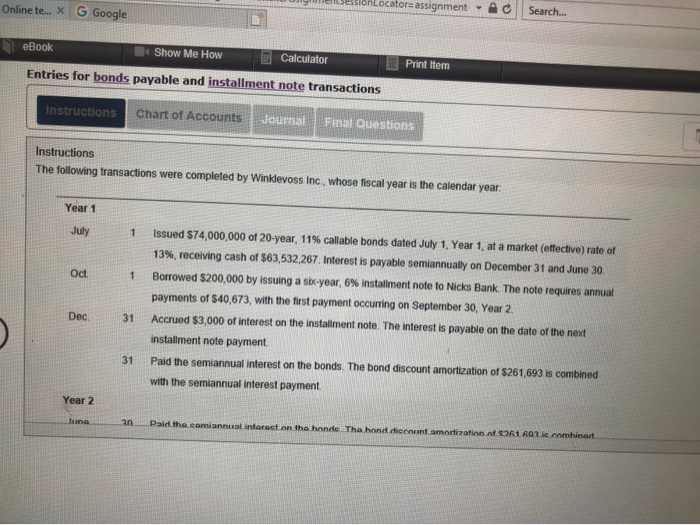

Uy en SessionLocator assignment - Online te... X G Google Search... El eBook Show Me How Calculator Entries for bonds payable and installment note transactions Print Item Instructions Chart of Accounts Journal Final Questions Instructions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year. Year 1 July 1 issued $74,000,000 of 20-year, 11% callable bonds dated July 1. Year 1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30 Oct 1 Borrowed $200,000 by issuing a sbc-year, 6% installment note to Nicks Bank. The note requires annual payments of $40,673, with the first payment occurring on September 30, Year 2 Dec 31 Accrued $3,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261.693 is combined with the semiannual interest payment. Year 2 June 20 Paid the comiannual interact on the honde Tha hond dicunt amortization of 261 601 e combinar Uy en SessionLocator assignment - Online te... X G Google Search... El eBook Show Me How Calculator Entries for bonds payable and installment note transactions Print Item Instructions Chart of Accounts Journal Final Questions Instructions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year. Year 1 July 1 issued $74,000,000 of 20-year, 11% callable bonds dated July 1. Year 1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30 Oct 1 Borrowed $200,000 by issuing a sbc-year, 6% installment note to Nicks Bank. The note requires annual payments of $40,673, with the first payment occurring on September 30, Year 2 Dec 31 Accrued $3,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261.693 is combined with the semiannual interest payment. Year 2 June 20 Paid the comiannual interact on the honde Tha hond dicunt amortization of 261 601 e combinar