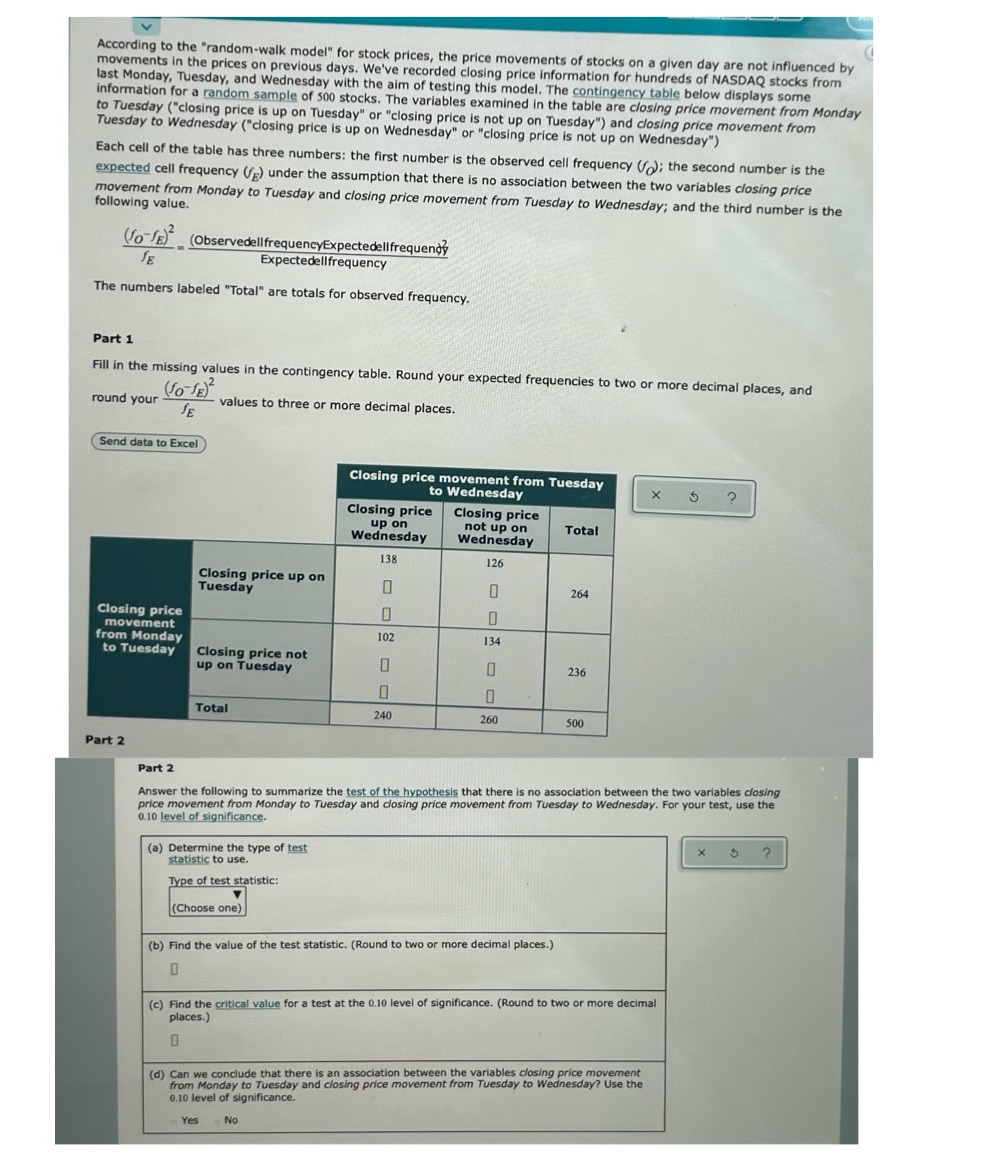

v According to the "random-walk model" for stock prices, the price movements of stocks on a given day are not influenced by movements in the prices on previous days. We've recorded closing price information for hundreds of NASDAQ stocks from last Monday, Tuesday, and Wednesday with the aim of testing this model. The contingency table below displays some information for a random sample of 500 stocks. The variables examined in the table are closing price movement from Monday to Tuesday ("closing price is up on Tuesday" or "closing price is not up on Tuesday") and closing price movement from Tuesday to Wednesday ("closing price is up on Wednesday" or "closing price is not up on Wednesday") Each cell of the table has three numbers: the first number is the observed cell frequency (); the second number is the expected cell frequency () under the assumption that there is no association between the two variables closing price movement from Monday to Tuesday and closing price movement from Tuesday to Wednesday; and the third number is the following value. (So E) (ObservedellfrequencyExpectedellfrequency JE Expectedellfrequency The numbers labeled "Total" are totals for observed frequency. Part 1 Fill in the missing values in the contingency table. Round your expected frequencies to two or more decimal places, and round your- (SO SE) JE values to three or more decimal places. Send data to Excel Closing price movement from Tuesday to Wednesday X 2 Closing price Closing price up on not up on Total Wednesday Wednesday 138 126 Closing price up on Tuesday 264 Closing price 0 movement 102 134 from Monday to Tuesday Closing price not up on Tuesday 0 236 0 Total 240 260 500 Part 2 Part 2 Answer the following to summarize the test of the hypothesis that there is no association between the two variables closing price movement from Monday to Tuesday and closing price movement from Tuesday to Wednesday. For your test, use the 0.10 level of significance. X ? (a) Determine the type of test statistic to use. Type of test statistic: (Choose one) (b) Find the value of the test statistic. (Round to two or more decimal places.) (c) Find the critical value for a test at the 0.10 level of significance. (Round to two or more decimal places.) (d) Can we conclude that there is an association between the variables closing price movement from Monday to Tuesday and closing price movement from Tuesday to Wednesday? Use the 0.10 level of significance. Yes No