Answered step by step

Verified Expert Solution

Question

1 Approved Answer

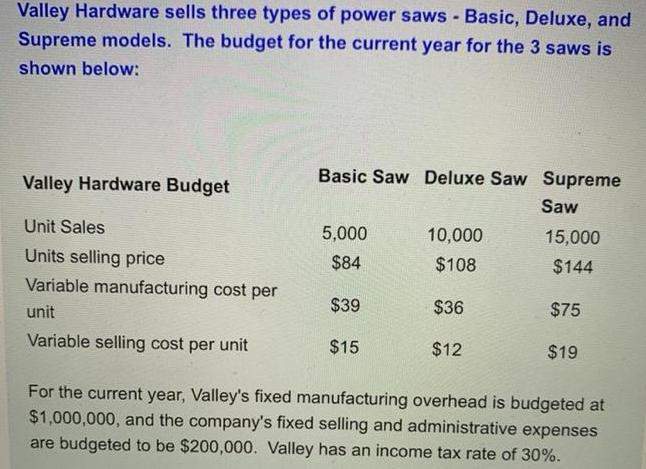

Valley Hardware sells three types of power saws - Basic, Deluxe, and Supreme models. The budget for the current year for the 3 saws

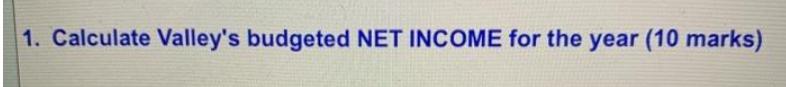

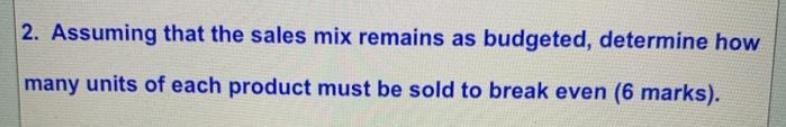

Valley Hardware sells three types of power saws - Basic, Deluxe, and Supreme models. The budget for the current year for the 3 saws is shown below: Valley Hardware Budget Unit Sales Units selling price Variable manufacturing cost per unit Variable selling cost per unit Basic Saw Deluxe Saw Supreme Saw 5,000 $84 $39 $15 10,000 $108 $36 $12 15,000 $144 $75 $19 For the current year, Valley's fixed manufacturing overhead is budgeted at $1,000,000, and the company's fixed selling and administrative expenses are budgeted to be $200,000. Valley has an income tax rate of 30%. 1. Calculate Valley's budgeted NET INCOME for the year (10 marks) 2. Assuming that the sales mix remains as budgeted, determine how many units of each product must be sold to break even (6 marks). Valley Hardware sells three types of power saws - Basic, Deluxe, and Supreme models. The budget for the current year for the 3 saws is shown below: Valley Hardware Budget Unit Sales Units selling price Variable manufacturing cost per unit Variable selling cost per unit Basic Saw Deluxe Saw Supreme Saw 5,000 $84 $39 $15 10,000 $108 $36 $12 15,000 $144 $75 $19 For the current year, Valley's fixed manufacturing overhead is budgeted at $1,000,000, and the company's fixed selling and administrative expenses are budgeted to be $200,000. Valley has an income tax rate of 30%. 1. Calculate Valley's budgeted NET INCOME for the year (10 marks) 2. Assuming that the sales mix remains as budgeted, determine how many units of each product must be sold to break even (6 marks).

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Statement showing Net Income Particulars Amount Sales 3660000 Less Variable Cost 2160000 Contributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started