Answered step by step

Verified Expert Solution

Question

1 Approved Answer

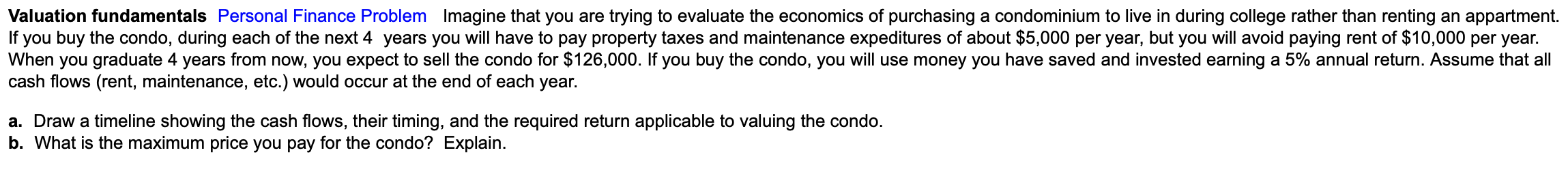

Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during college rather than

Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during college rather than renting Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during college rather than renting an appartment.

If you buy the condo, during each of the next years you will have to pay property taxes and maintenance expeditures of about $ per year, but you will avoid paying rent of $ per year.

When you graduate years from now, you expect to sell the condo for $ If you buy the condo, you will use money you have saved and invested earning a annual return. Assume that all

cash flows rent maintenance, etc. would occur at the end of each year.

a Draw a timeline showing the cash flows, their timing, and the required return applicable to valuing the condo.

b What is the maximum price you pay for the condo? Explain.an appartment. If you buy the condo, during each of the next years you will have to pay property taxes and maintenance expeditures of about $ per year, but you will avoid paying rent of $ per year. When you graduate years from now, you expect to sell the condo for $ If you buy the condo, you will use money you have saved and invested earning a annual return. Assume that all cash flows rent maintenance, etc. would occur at the end of each year. a Draw a timeline showing the cash flows, their timing, and the required return applicable to valuing the condo. b What is the maximum price you pay for the condo? Explain.Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during college rather than renting an appartment.

If you buy the condo, during each of the next years you will have to pay property taxes and maintenance expeditures of about $ per year, but you will avoid paying rent of $ per year.

When you graduate years from now, you expect to sell the condo for $ If you buy the condo, you will use money you have saved and invested earning a annual return. Assume that all

cash flows rent maintenance, etc. would occur at the end of each year.

a Draw a timeline showing the cash flows, their timing, and the required return applicable to valuing the condo.

b What is the maximum price you pay for the condo? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started