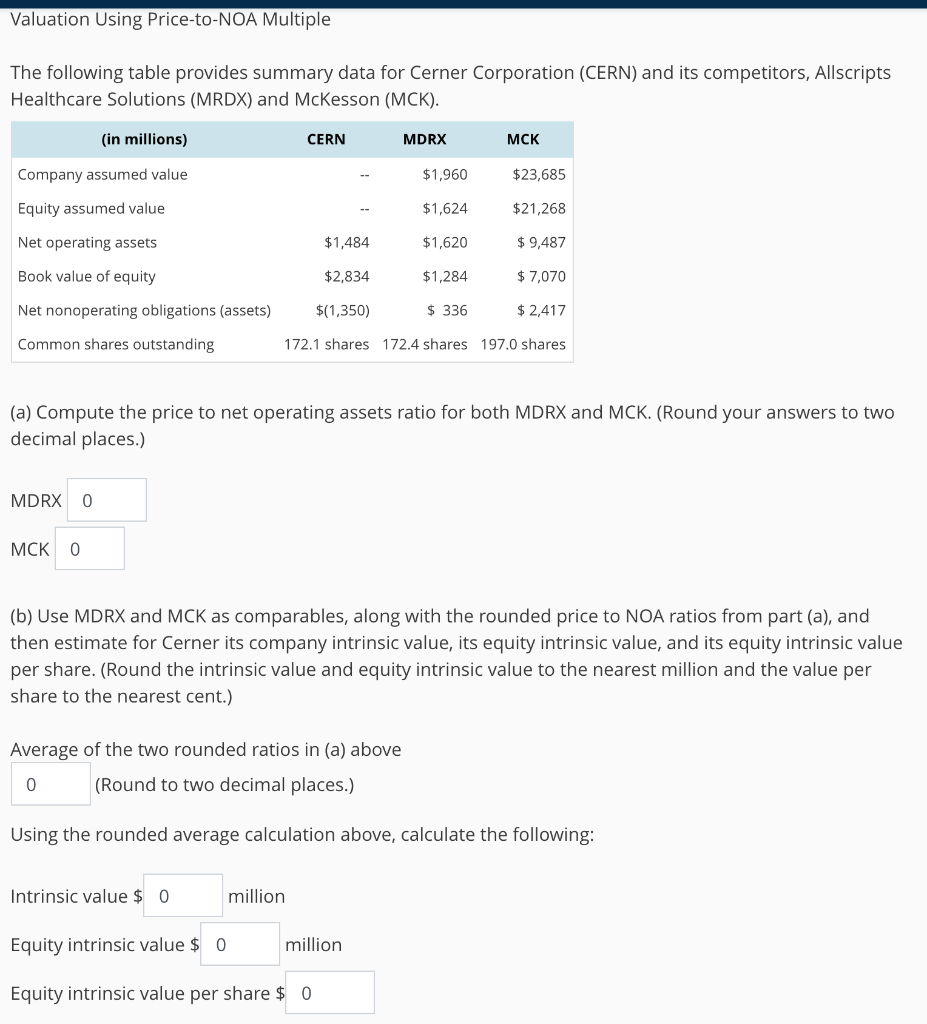

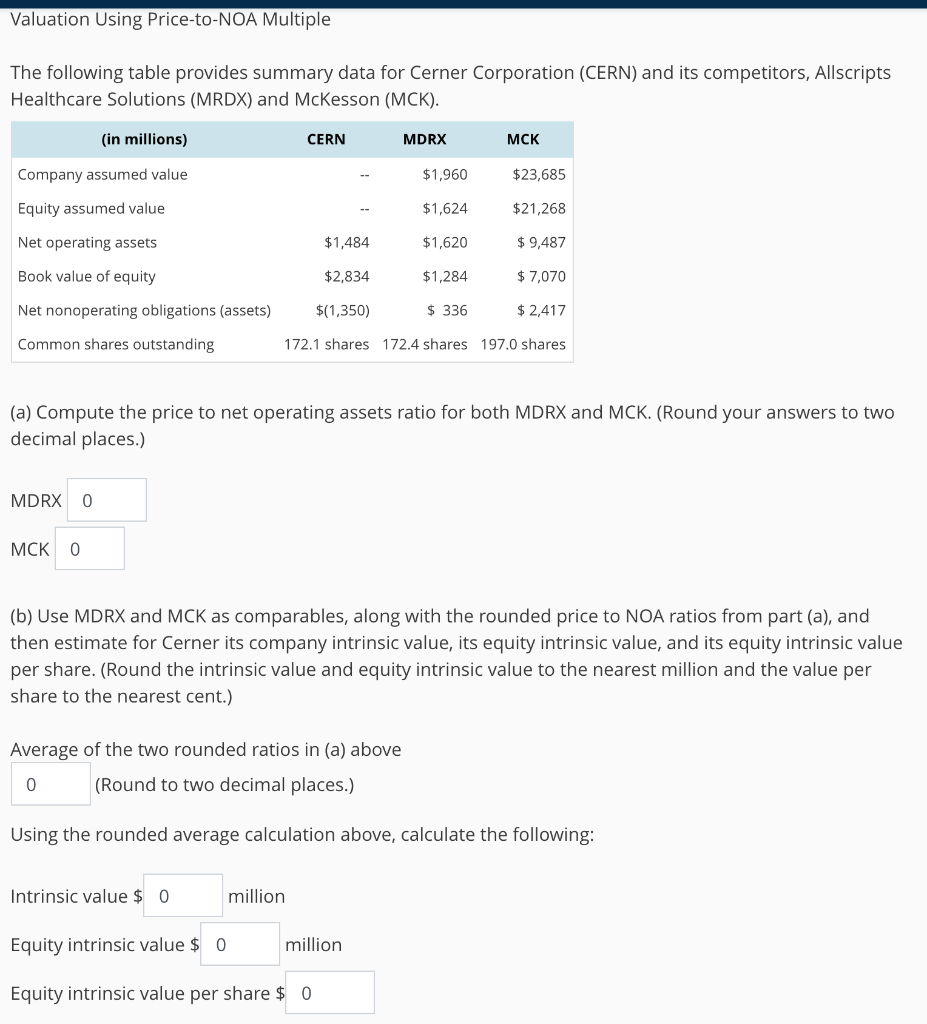

Valuation Using Price-to-NOA Multiple The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions (MRDX) and McKesson (MCK) (in millions) CERN MDRX $23,685 Company assumed value $1,960 Equity assumed value $1,624 $21,268 Net operating assets $1,484 $9,487 $1,620 Book value of equity $2,834 $1,284 $7,070 Net nonoperating obligations (assets) $(1,350) $2,417 336 Common shares outstanding 172.1 shares 172.4 shares 197.0 shares (a) Compute the price to net operating assets ratio for both MDRX and MCK. (Round your answers to two decimal places.) MDRX 0 (b) Use MDRX and MCK as comparables, along with the rounded price to NOA ratios from part (a), and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.) Average of the two rounded ratios in (a) above (Round to two decimal places.) 0 Using the rounded average calculation above, calculate the following: Intrinsic value $ 0 million million Equity intrinsic value $ 0 Equity intrinsic value per share $0 Valuation Using Price-to-NOA Multiple The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions (MRDX) and McKesson (MCK) (in millions) CERN MDRX $23,685 Company assumed value $1,960 Equity assumed value $1,624 $21,268 Net operating assets $1,484 $9,487 $1,620 Book value of equity $2,834 $1,284 $7,070 Net nonoperating obligations (assets) $(1,350) $2,417 336 Common shares outstanding 172.1 shares 172.4 shares 197.0 shares (a) Compute the price to net operating assets ratio for both MDRX and MCK. (Round your answers to two decimal places.) MDRX 0 (b) Use MDRX and MCK as comparables, along with the rounded price to NOA ratios from part (a), and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.) Average of the two rounded ratios in (a) above (Round to two decimal places.) 0 Using the rounded average calculation above, calculate the following: Intrinsic value $ 0 million million Equity intrinsic value $ 0 Equity intrinsic value per share $0