Answered step by step

Verified Expert Solution

Question

1 Approved Answer

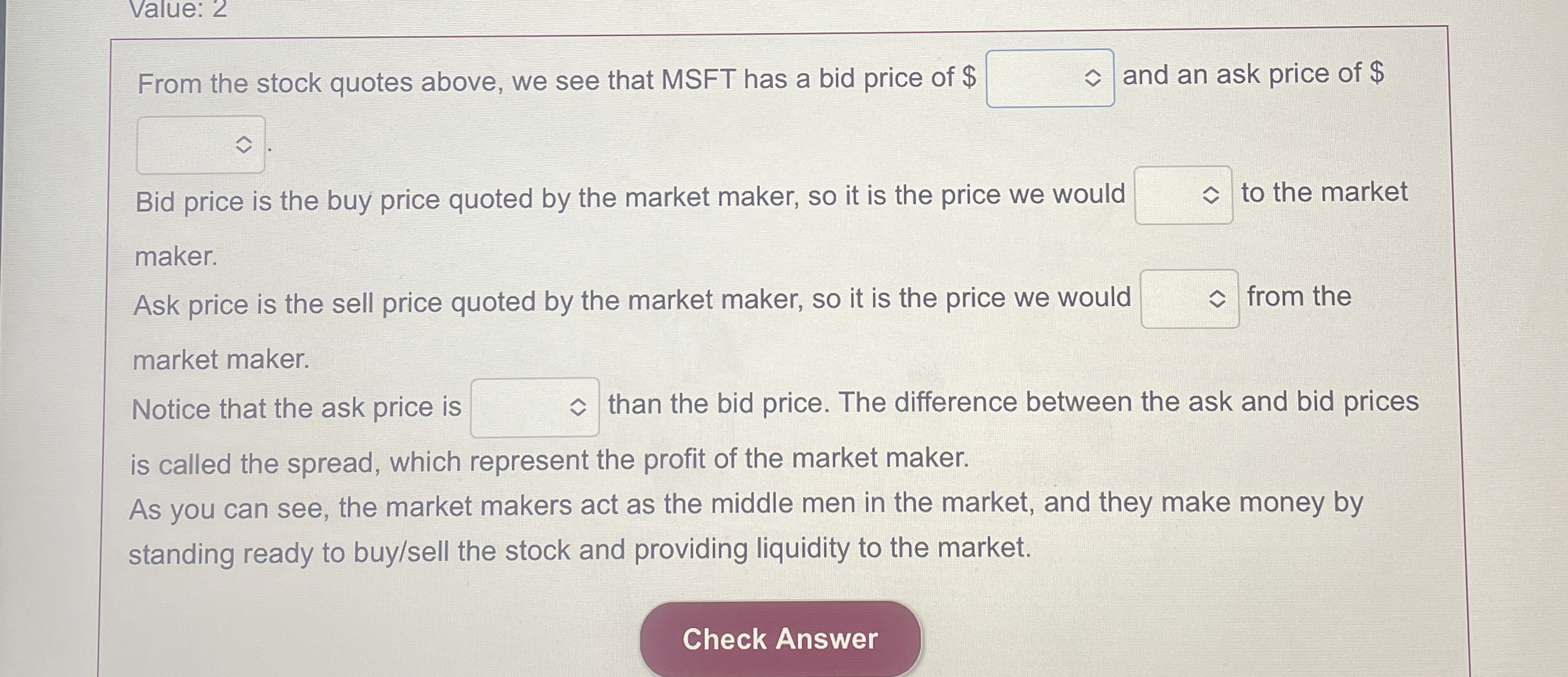

Value: 2 From the stock quotes above, we see that MSFT has a bid price of $ and an ask price of $ Bid price

Value:

From the stock quotes above, we see that MSFT has a bid price of $ and an ask price of $ Bid price is the buy price quoted by the market maker, so it is the price we would to the market maker.

Ask price is the sell price quoted by the market maker, so it is the price we would from the market maker.

Notice that the ask price is than the bid price. The difference between the ask and bid prices is called the spread, which represent the profit of the market maker.

As you can see, the market makers act as the middle men in the market, and they make money by standing ready to buysell the stock and providing liquidity to the market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started