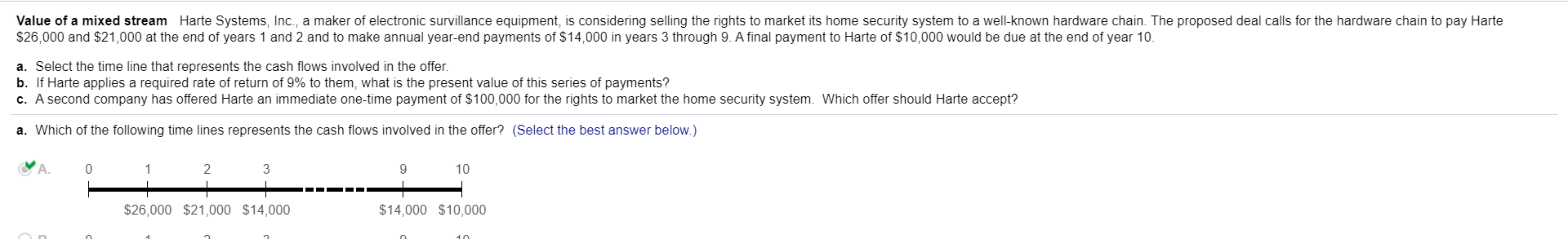

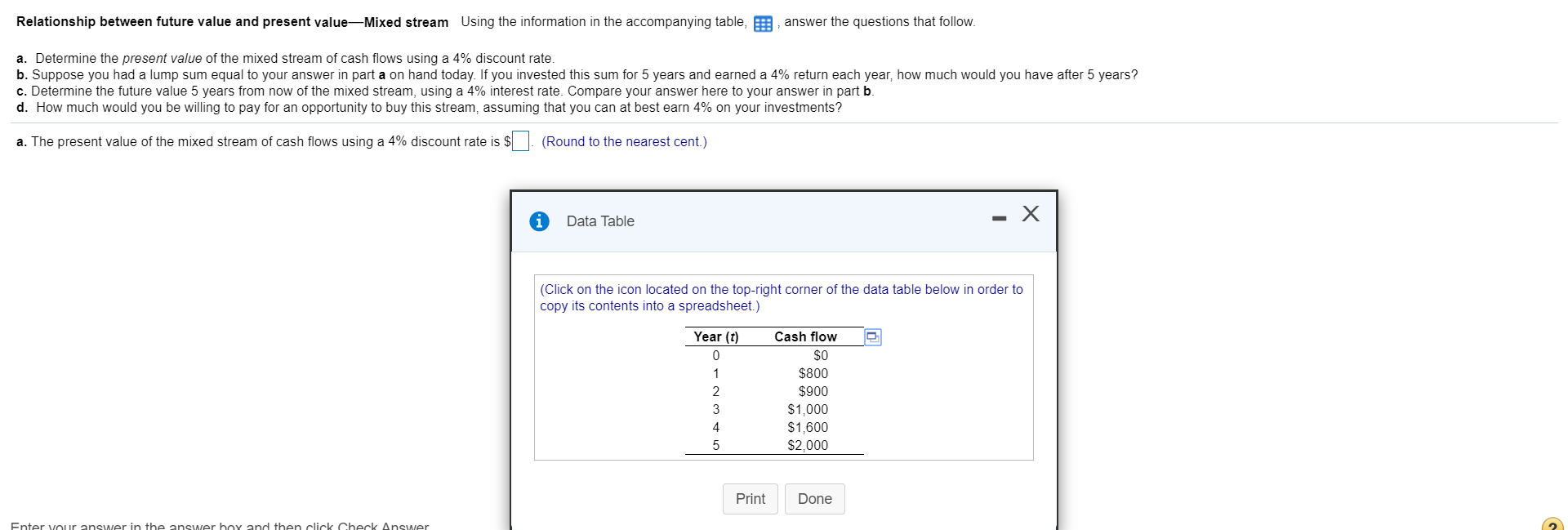

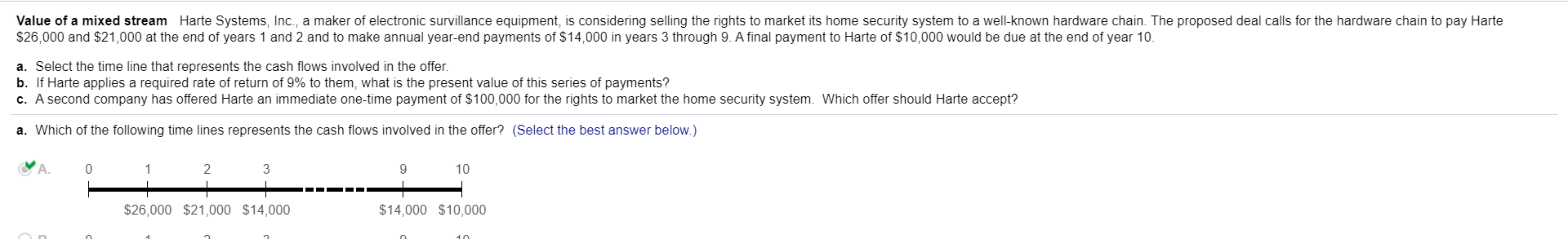

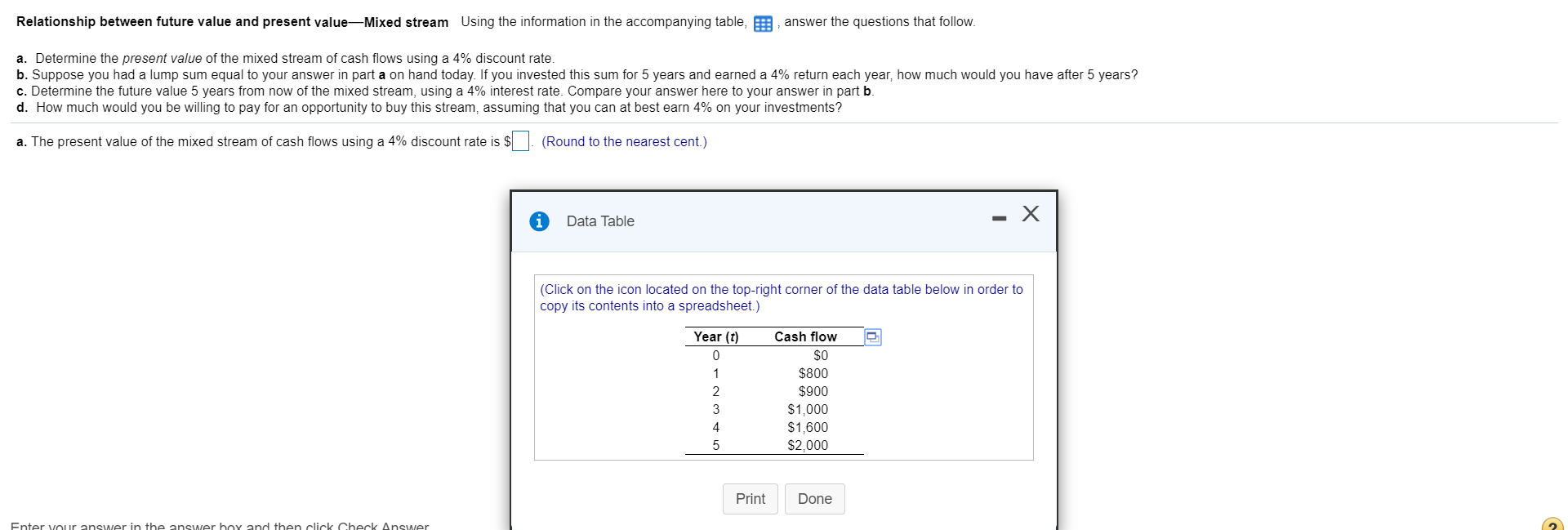

Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $26,000 and $21,000 at the end of years 1 and 2 and to make annual year-end payments of $14,000 in years 3 through 9. A final payment to Harte of $10,000 would be due at the end of year 10. a. Select the time line that represents the cash flows involved in the offer. b. If Harte applies a required rate of return of 9% to them, what is the present value of this series of payments? c. A second company has offered Harte an immediate one-time payment of $100,000 for the rights to market the home security system. Which offer should Harte accept? a. Which of the following time lines represents the cash flows involved in the offer? (Select the best answer below.) 1 A. 0 2 3 9 10 $26,000 $21,000 $14,000 $14,000 $10,000 Relationship between future value and present value-Mixed stream Using the information in the accompanying table, answer the questions that follow. a. Determine the present value of the mixed stream of cash flows using a 4% discount rate. b. Suppose you had a lump sum equal to your answer in part a on hand today. If you invested this sum for 5 years and earned a 4% return each year, how much would you have after 5 years? c. Determine the future value 5 years from now of the mixed stream, using a 4% interest rate. Compare your answer here to your answer in part b d. How much would you be willing to pay for an opportunity to buy this stream, assuming that you can at best earn 4% on your investments? a. The present value of the mixed stream of cash flows using a 4% discount rate is S (Round to the nearest cent.) X Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year (t) Cash flow $800 1 $900 2 $1,000 $1,600 $2,000 3 4 5 Print Done Enter vour answer in the anSwer box and then click Check Answer Compounding frequency, time value, and effective annual rates For each of the cases in the following table, a. Calculate the future value at the end of the specified deposit period. b. Determine the effective annual rate, EAR. c. Compare the nominal annual rate, r, to the effective annual rate, EAR. What relationship exists between compounding frequency and the nominal and effective annual rates? a. The future value of case A at the end of year 7 is $ (Round to the nearest cent.) Loan amortization schedule Personal Finance Problem Joan Messineo borrowed $48,000 at a 4% annual rate of interest to be repaid over 3 years. The loan is amortized into three equal, annual, end-of-year payments. a. Calculate the annual, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. c. Explain why the interest portion of each payment declines with the passage of time. a. The amount of the equal, annual, end-of-year loan payment is S (Round to the nearest cent.)