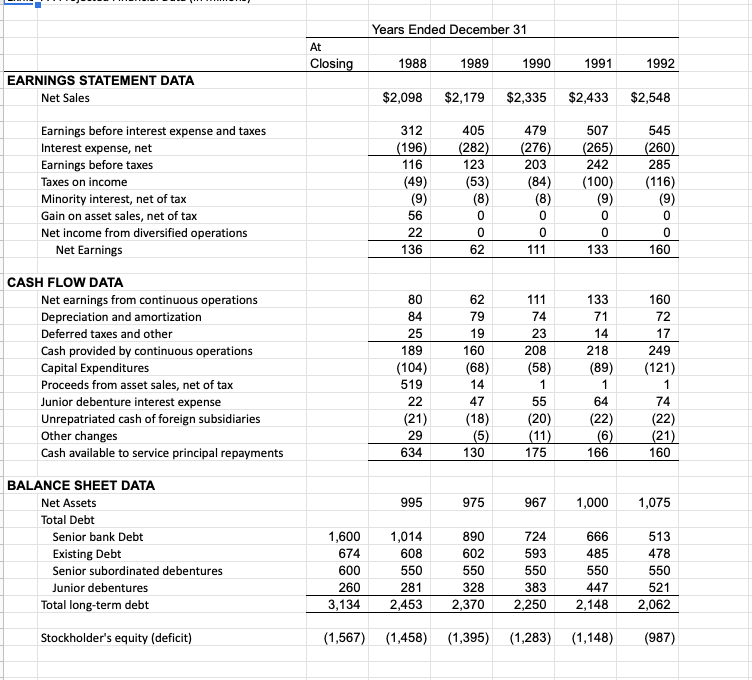

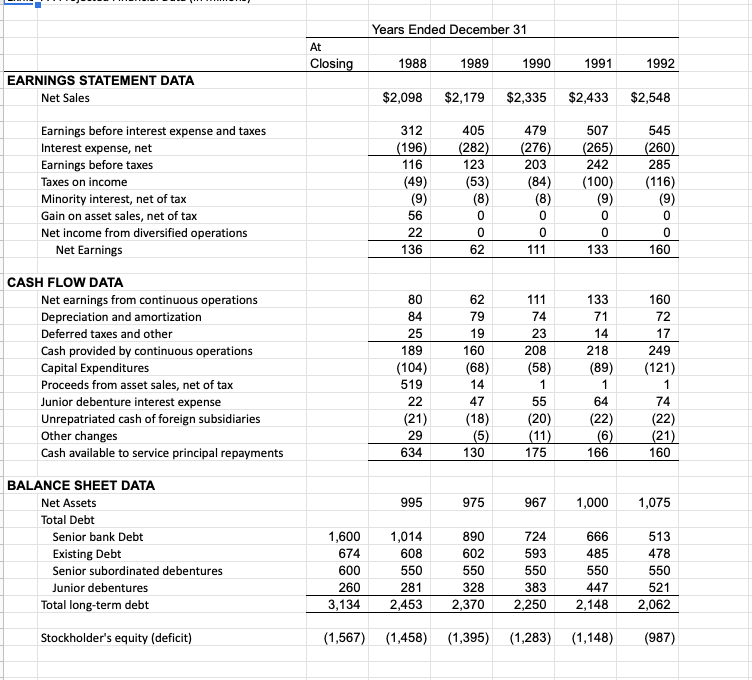

Value under the proposed restructuring plan (DCF)

Years Ended December 31 At Closing 1988 1989 1990 1991 1992 EARNINGS STATEMENT DATA Net Sales $2,098 $2,179 $2,335 $2,433 $2,548 Earnings before interest expense and taxes Interest expense, net Earnings before taxes Taxes on income Minority interest, net of tax Gain on asset sales, net of tax Net income from diversified operations Net Earnings 312 (196) 116 (49) (9) 56 22 136 405 (282) 123 (53) (8) 0 0 62 479 (276) 203 (84) (8) 0 0 111 507 (265) 242 (100) (9) 545 (260) 285 (116) (9) 0 0 160 0 133 CASH FLOW DATA Net earnings from continuous operations Depreciation and amortization Deferred taxes and other Cash provided by continuous operations Capital Expenditures Proceeds from asset sales, net of tax Junior debenture interest expense Unrepatriated cash of foreign subsidiaries Other changes Cash available to service principal repayments 80 84 25 189 (104) 519 22 (21) 29 634 62 79 19 160 (68) 14 47 (18) (5) 130 111 74 23 208 (58) 1 55 (20) (11) 175 133 71 14 218 (89) 1 64 (22) (6) 166 160 72 17 249 (121) 1 74 (22) (21) 160 995 975 967 1,000 1,075 BALANCE SHEET DATA Net Assets Total Debt Senior bank Debt Existing Debt Senior subordinated debentures Junior debentures Total long-term debt 1,600 674 600 260 3,134 1,014 608 550 281 2,453 890 602 550 328 2,370 724 593 550 383 2,250 666 485 550 447 2,148 513 478 550 521 2,062 Stockholder's equity (deficit) (1,567) (1,458) (1,395) (1,283) (1,148) (987) Years Ended December 31 At Closing 1988 1989 1990 1991 1992 EARNINGS STATEMENT DATA Net Sales $2,098 $2,179 $2,335 $2,433 $2,548 Earnings before interest expense and taxes Interest expense, net Earnings before taxes Taxes on income Minority interest, net of tax Gain on asset sales, net of tax Net income from diversified operations Net Earnings 312 (196) 116 (49) (9) 56 22 136 405 (282) 123 (53) (8) 0 0 62 479 (276) 203 (84) (8) 0 0 111 507 (265) 242 (100) (9) 545 (260) 285 (116) (9) 0 0 160 0 133 CASH FLOW DATA Net earnings from continuous operations Depreciation and amortization Deferred taxes and other Cash provided by continuous operations Capital Expenditures Proceeds from asset sales, net of tax Junior debenture interest expense Unrepatriated cash of foreign subsidiaries Other changes Cash available to service principal repayments 80 84 25 189 (104) 519 22 (21) 29 634 62 79 19 160 (68) 14 47 (18) (5) 130 111 74 23 208 (58) 1 55 (20) (11) 175 133 71 14 218 (89) 1 64 (22) (6) 166 160 72 17 249 (121) 1 74 (22) (21) 160 995 975 967 1,000 1,075 BALANCE SHEET DATA Net Assets Total Debt Senior bank Debt Existing Debt Senior subordinated debentures Junior debentures Total long-term debt 1,600 674 600 260 3,134 1,014 608 550 281 2,453 890 602 550 328 2,370 724 593 550 383 2,250 666 485 550 447 2,148 513 478 550 521 2,062 Stockholder's equity (deficit) (1,567) (1,458) (1,395) (1,283) (1,148) (987)