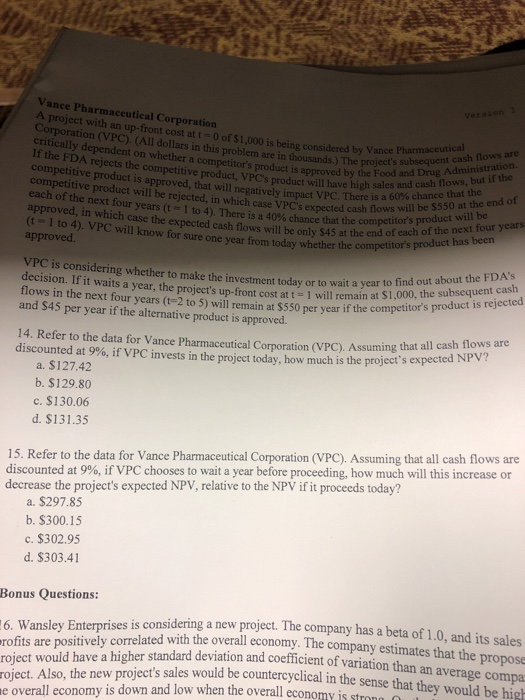

Vance Pharmaceutical Corporation A project with an up-front cost at t= 0 of $1,000 is being considered by Vance Corporation (VPC). (All dollars in this problem are in thousands.) The pr critically dependent on whether a competitor's product is approved by the If the FDA rejects the competitive product, VPC's product will have high sam competitive product is approved, that will negatively impact VPC. There is competitive product will be rejected, in which case VPC's expected cash flow each of the next four years (t = 1 to 4). There is a 40% chance that the compe approved, in which case the expected cash flows will be only sus (t = 1 to 4). VPC will know for sure one year from today whe approy the next duct will proved, th product, vp Productiousands.) Toby Vance Pharm (t I to in which Years ( t tled, in whickatively impl will have high food and Drug Ad Mousands. The proiectacouent cash flow y Vance Pharmaceutical the Food and Drug Administration high sales and cash flows, but if the PC There is a 60% chance that the d cash flows will be $550 at the end of . VPC will be the expected there is a 40% chs expected cash flows will besse will be only $45 at the end of each of the next four years It the competitor's product will be approved one year from today whether the competitor's product has been VPC is considering whether to make the investment today or decision. If it waits a year, the project's unfront pastattel will remain at 1,000, flows in the next four years (t-2 to 5) will remain at $550 per year if the competitor and $45 per year if the alternative product is approved. he investment today or to wait a year to find out about the FDA'S remain at $1,000, the subsequent cash ar if the competitor's product is rejected 14. Refer to the data for Vance Pharmaceutical Corporation (VPC). Assuming that all discounted at 9%, if VPC invests in the project today, how much is the project's expected orporation (VPC). Assuming that all cash flows are a. $127.42 b. $129.80 c. $130.06 d. $131.35 15. Refer to the data for Vance Pharmaceutical Corporation (VPC). Assuming that all cash flows are discounted at 9%, if VPC chooses to wait a year before proceeding, how much will this increase or decrease the project's expected NPV, relative to the NPV if it proceeds today? a. $297.85 b. $300.15 c. $302.95 d. $303.41 Bonus Questions: 16. Wansley Enterprises is considering a new project. The company has a beta ofi profits are positively correlated with the overall economy. The compa roject would have a higher standard deviation and coefficient of variat roject. Also, the new project's sales would be countercyclical in the se me overall economy is down and low when the overall economy is strong roject. The company has a beta of 1.0, and its sales verall economy. The company estimates that the propose on and coefficient of variation than an average compa would be countercyclical in the sense that they would be high