Answered step by step

Verified Expert Solution

Question

1 Approved Answer

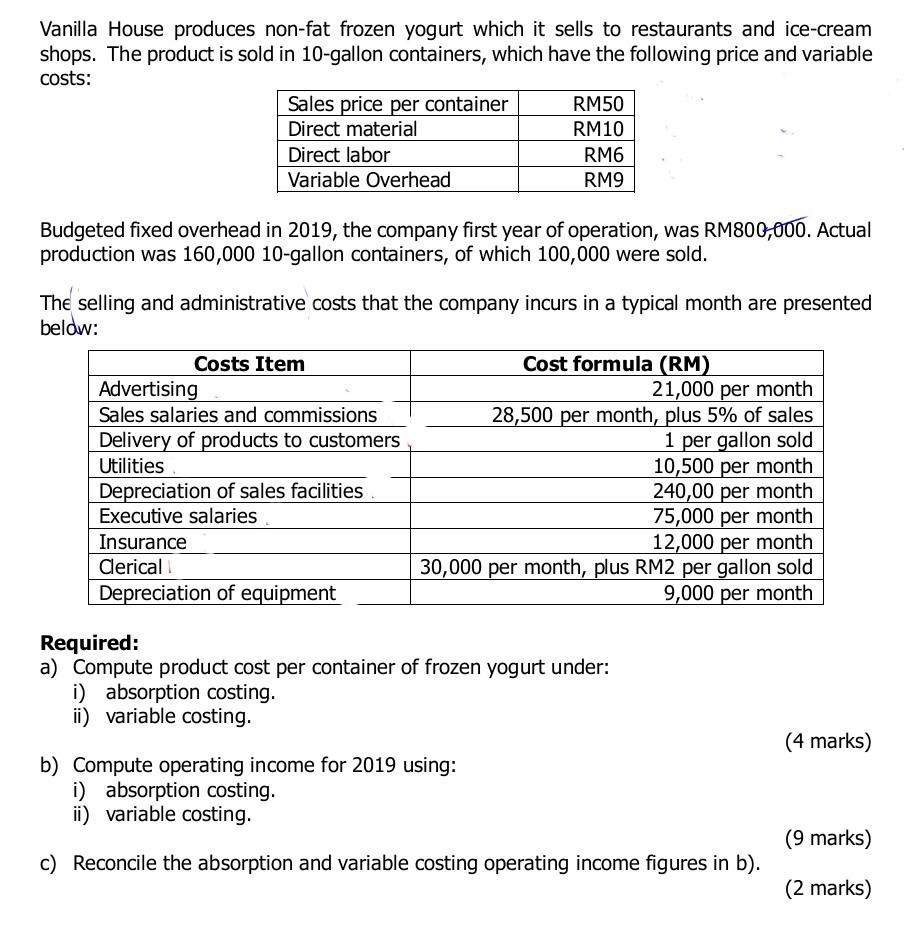

Vanilla House produces non-fat frozen yogurt which it sells to restaurants and ice-cream shops. The product is sold in 10-gallon containers, which have the following

Vanilla House produces non-fat frozen yogurt which it sells to restaurants and ice-cream shops. The product is sold in 10-gallon containers, which have the following price and variable costs: Sales price per container RM50 Direct material RM10 Direct labor RM6 Variable Overhead RM9 Budgeted fixed overhead in 2019, the company first year of operation, was RM800,000. Actual production was 160,000 10-gallon containers, of which 100,000 were sold. The selling and administrative costs that the company incurs in a typical month are presented below: Costs Item Cost formula (RM) Advertising 21,000 per month Sales salaries and commissions 28,500 per month, plus 5% of sales Delivery of products to customers 1 per gallon sold Utilities 10,500 per month Depreciation of sales facilities 240,00 per month Executive salaries 75,000 per month Insurance 12,000 per month Clerical 30,000 per month, plus RM2 per gallon sold Depreciation of equipment 9,000 per month Required: a) Compute product cost per container of frozen yogurt under: i) absorption costing. ii) variable costing. (4 marks) b) Compute operating income for 2019 using: i) absorption costing. ii) variable costing. (9 marks) c) Reconcile the absorption and variable costing operating income figures in b). (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started