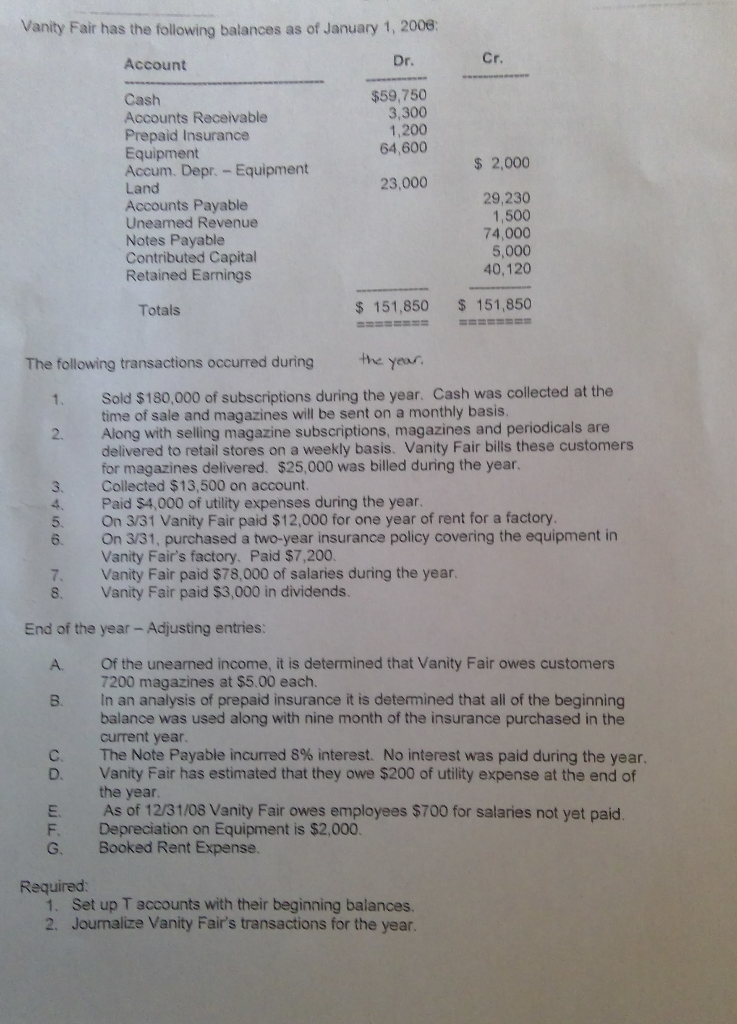

Vanity Fair has the following balances as of January 1, 2006: Cr. Dr. Account $59,750 3,300 1,200 64,600 Cash Accounts Receivable Prepaid Insurance Equipment Accum. Depr. -Equipment Land Accounts Payable Uneamed Revenue Notes Payable Contributed Capital Retained Earnings $ 2,000 23,000 29,230 1,500 74,000 5,000 40,120 $ 151,850 151,850 Totals the year The following transactions occurred during Sold $180,000 of subscriptions during the year. Cash was collected at the time of sale and magazines will be sent on a monthly basis. Along with selling magazine subscriptions, magazines and periodicals are delivered to retail stores on a weekly basis. Vanity Fair bills these customers for magazines delivered. $25,000 was billed during the year. Collected $13,500 on account. Paid $4,000 of utility expenses during the year. On 3/31 Vanity Fair paid $12,000 for one year of rent for a factory On 3/31, purchased a two-year insurance policy covering the equipment in Vanity Fair's factory. Paid $7,200. Vanity Fair paid $78,000 of salaries during the year. Vanity Fair paid $3,000 in dividends. 1. 2 3. 4. 5. 7 8. End of the year - Adjusting entries: Of the unearned income, it is determined that Vanity Fair owes customers 7200 magazines at $5.00 each. In an analysis of prepaid insurance it is determined that all of the beginning balance was used along with nine month of the insurance purchased in the current year. The Note Payable incurred 8% interest. No interest was paid during the year. Vanity Fair has estimated that they owe $200 of utility expense at the end of the year As of 12/31/08 Vanity Fair owes employees $700 for salaries not yet paid Depreciation on Equipment is $2,000. Booked Rent Expense. A. F G Required: 1. Set up T accounts with their beginning balances. 2. Journalize Vanity Fair's transactions for the year. CO uiw C 3. Post the journal entries into the T accounts. 4. Prepare a trial balance. 5. Journalize the adjusting entries. 6. Post the adjusting entries to the T accounts. 7. Prepare an Adjusted Trial Balance 8. Prepare the financial statements. 9. Journalize the closing entries. 10. Post the closing entries to the T accounts 11. Prepare a Post Closing Trial Balance