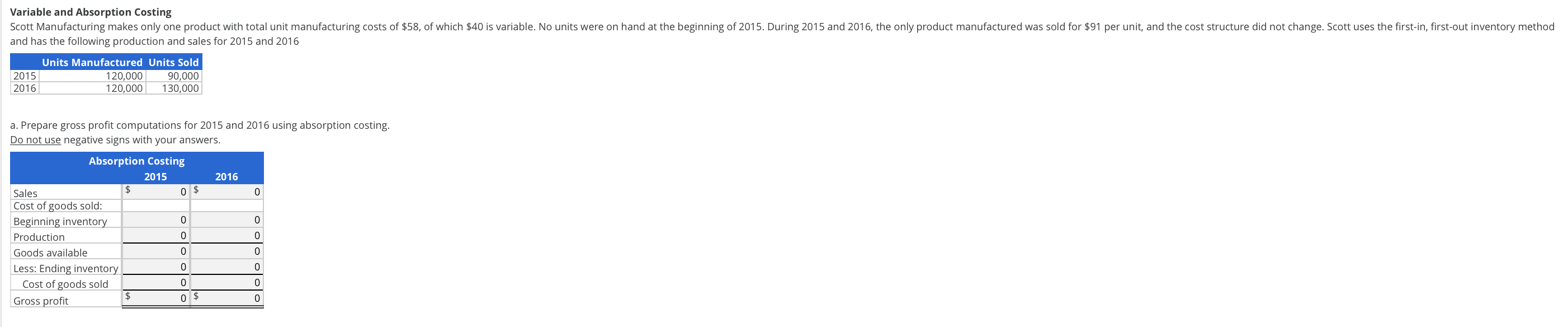

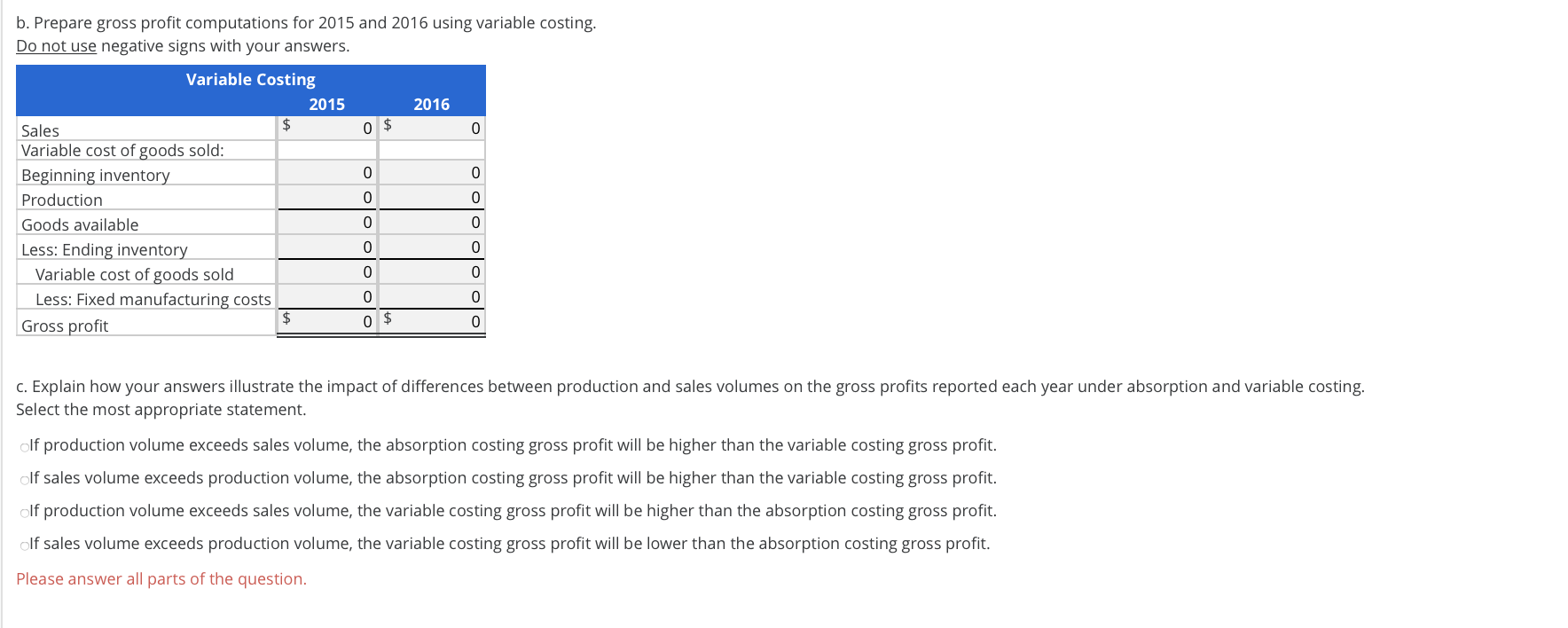

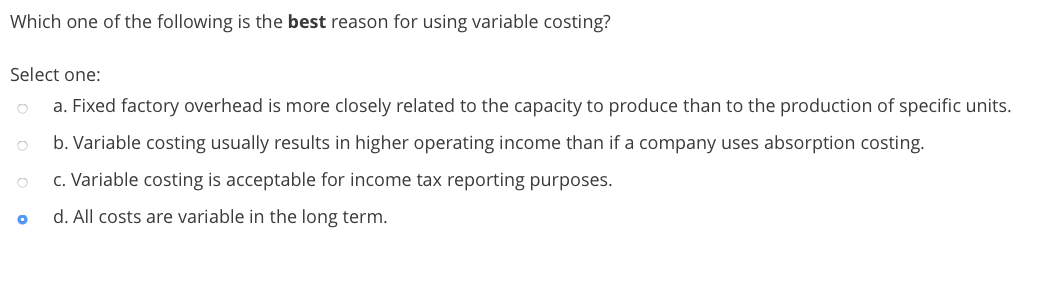

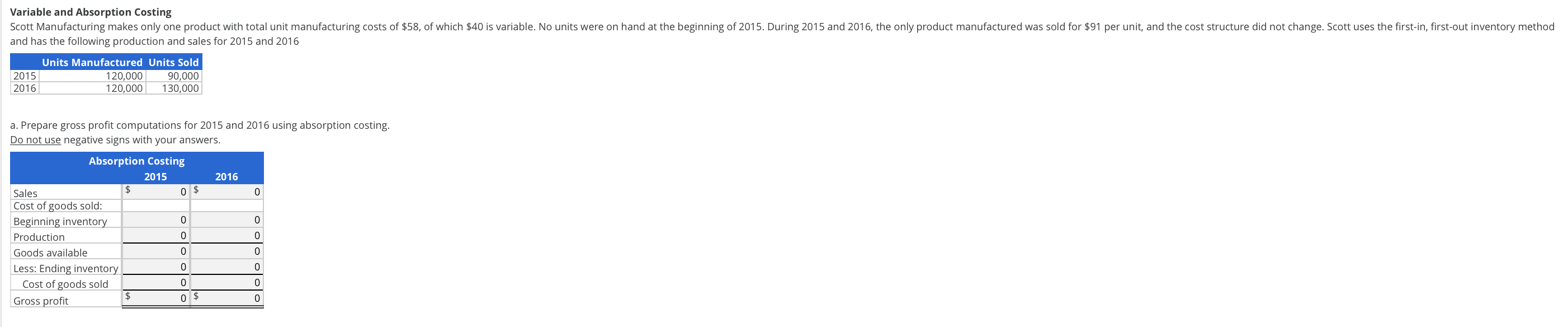

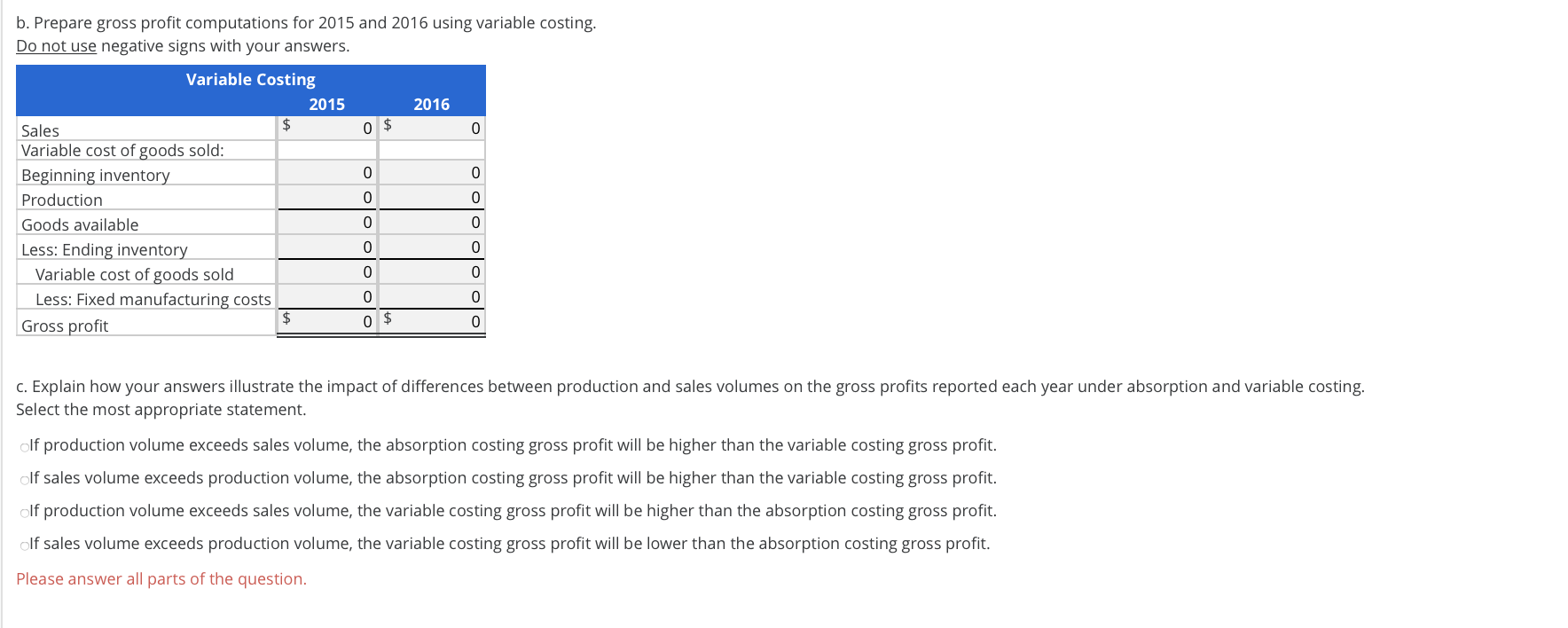

Variable and Absorption Costing Scott Manufacturing makes only one product with total unit manufacturing costs of $58, of which $40 is variable. No units were on hand at the beginning of 2015. During 2015 and 2016, the only product manufactured was sold for $91 per unit, and the cost structure did not change. Scott uses the first-in, first-out inventory method and has the following production and sales for 2015 and 2016 2015 2016 Units Manufactured Units Sold 120,000 90,000 120,000 130,000 a. Prepare gross profit computations for 2015 and 2016 using absorption costing. Do not use negative signs with your answers. 2016 0 $ Absorption Costing 2015 Sales Cost of goods sold: Beginning inventory Production Goods available Less: Ending inventory Cost of goods sold 0 Gross profit $ b. Prepare gross profit computations for 2015 and 2016 using variable costing. Do not use negative signs with your answers. 2016 0 $ Variable Costing 2015 Sales Variable cost of goods sold: Beginning inventory Production Goods available Less: Ending inventory Variable cost of goods sold Less: Fixed manufacturing costs Gross profit c. Explain how your answers illustrate the impact of differences between production and sales volumes on the gross profits reported each year under absorption and variable costing. Select the most appropriate statement. olf production volume exceeds sales volume, the absorption costing gross profit will be higher than the variable costing gross profit. olf sales volume exceeds production volume, the absorption costing gross profit will be higher than the variable costing gross profit. olf production volume exceeds sales volume, the variable costing gross profit will be higher than the absorption costing gross profit. olf sales volume exceeds production volume, the variable costing gross profit will be lower than the absorption costing gross profit. Please answer all parts of the question. Which one of the following is the best reason for using variable costing? Select one: a. Fixed factory overhead is more closely related to the capacity to produce than to the production of specific units. O b. Variable costing usually results in higher operating income than if a company uses absorption costing. O C. Variable costing is acceptable for income tax reporting purposes. O d. All costs are variable in the long term