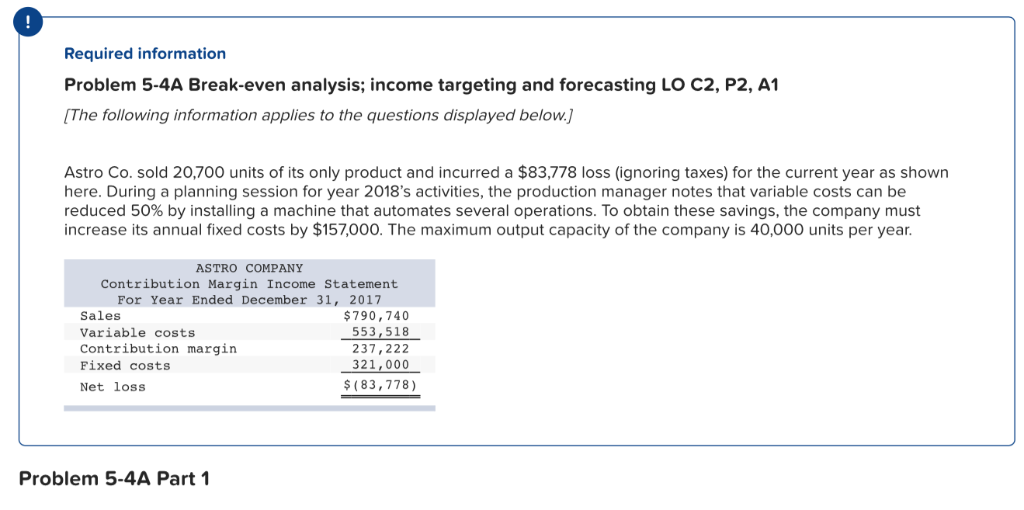

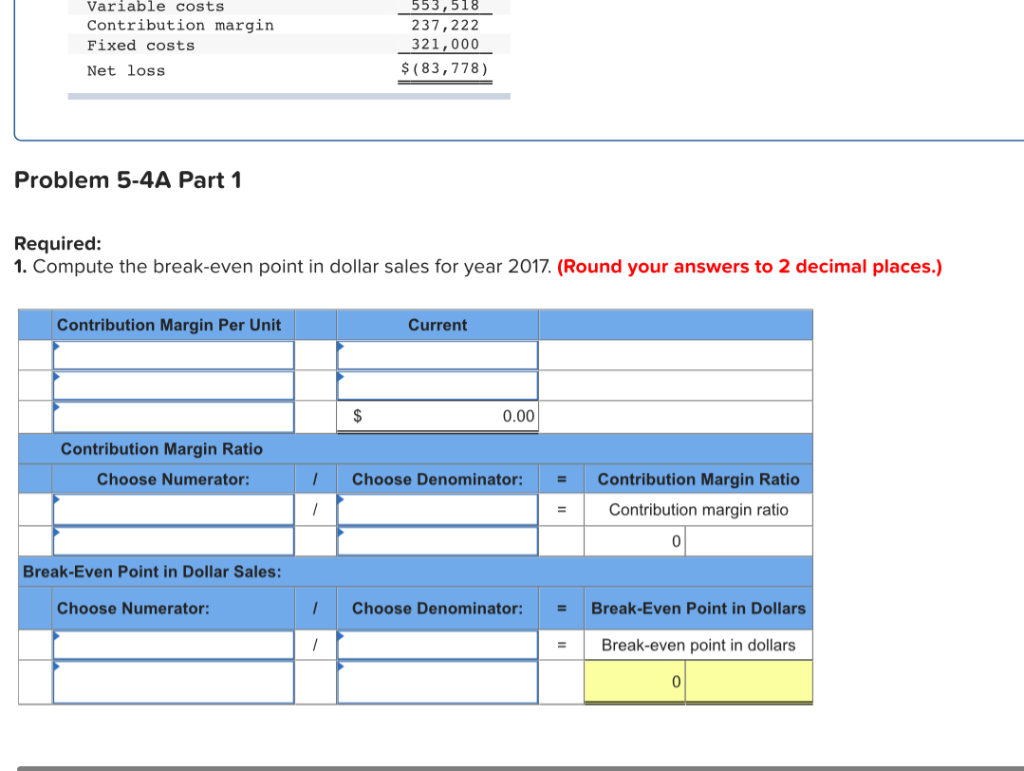

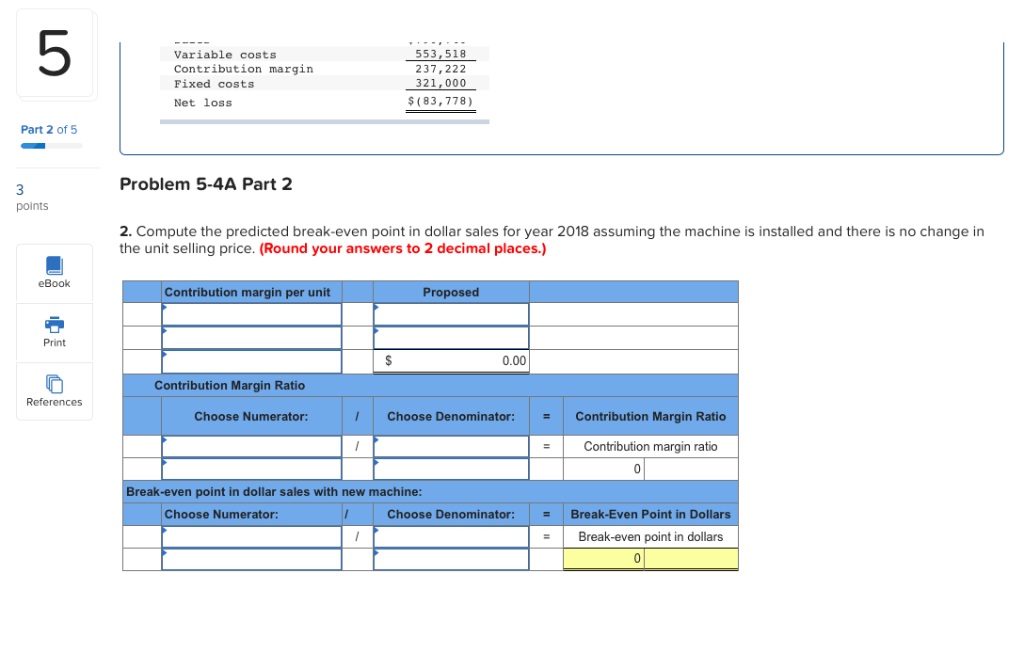

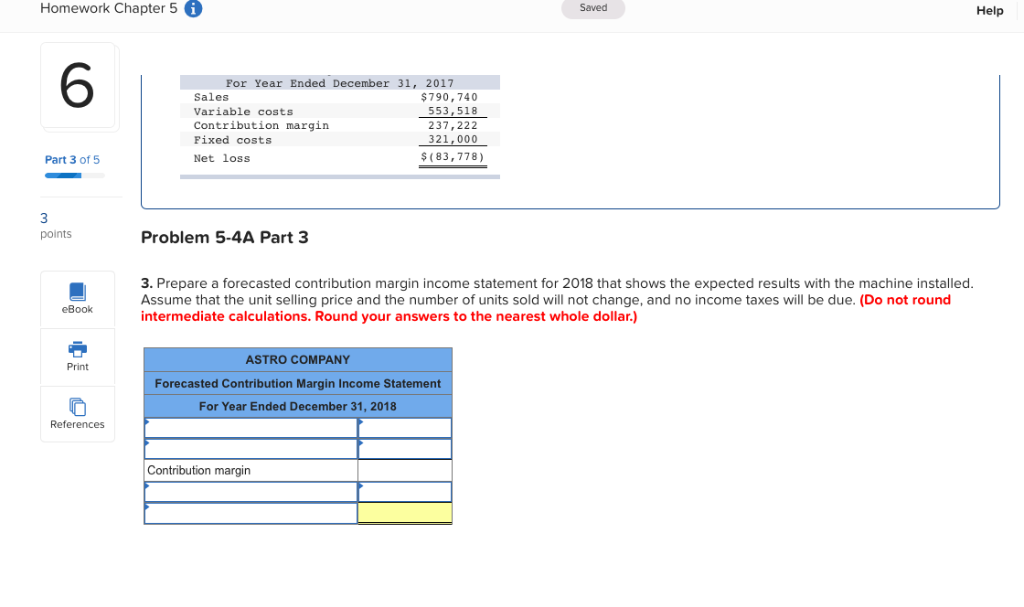

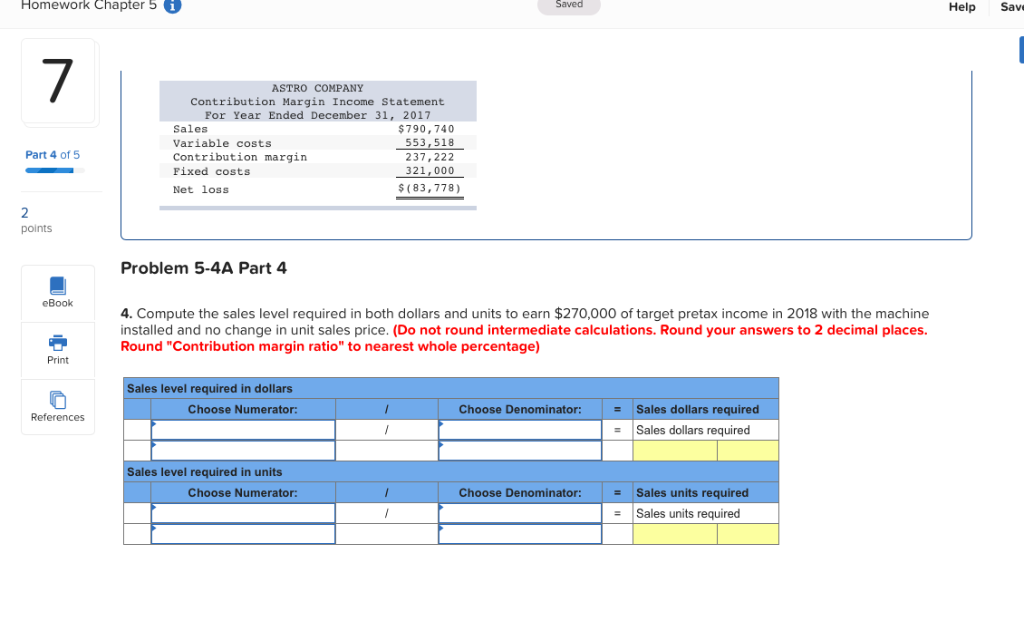

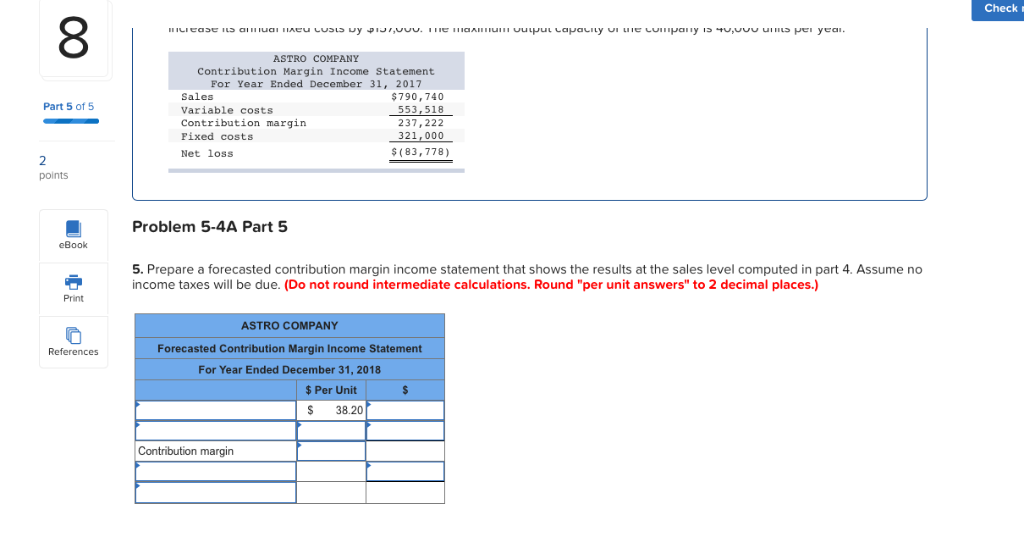

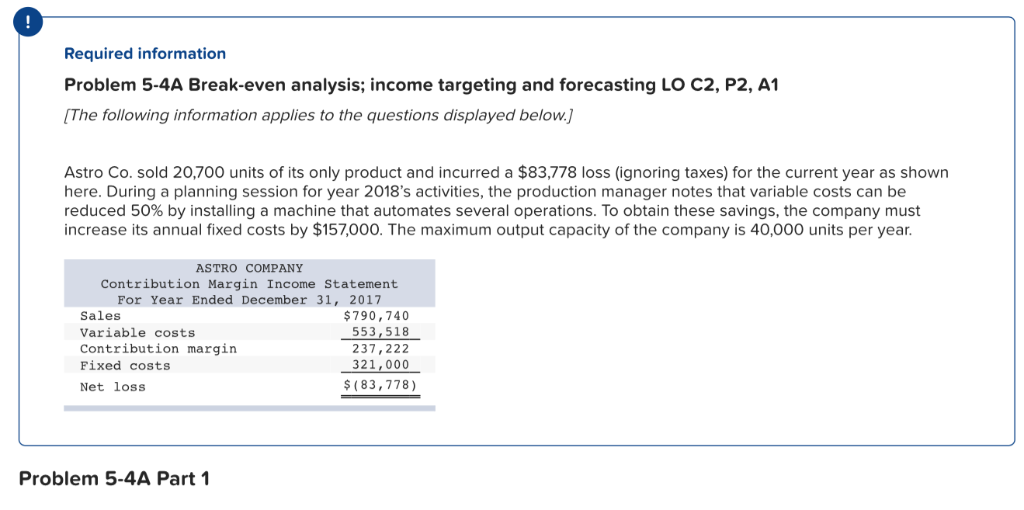

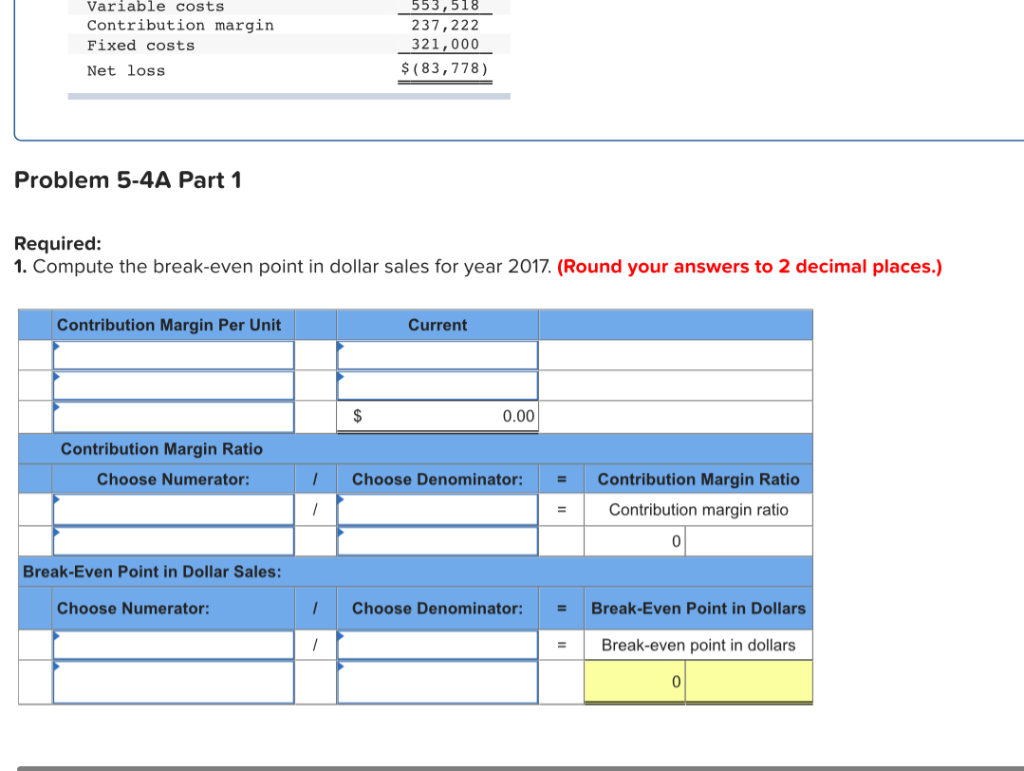

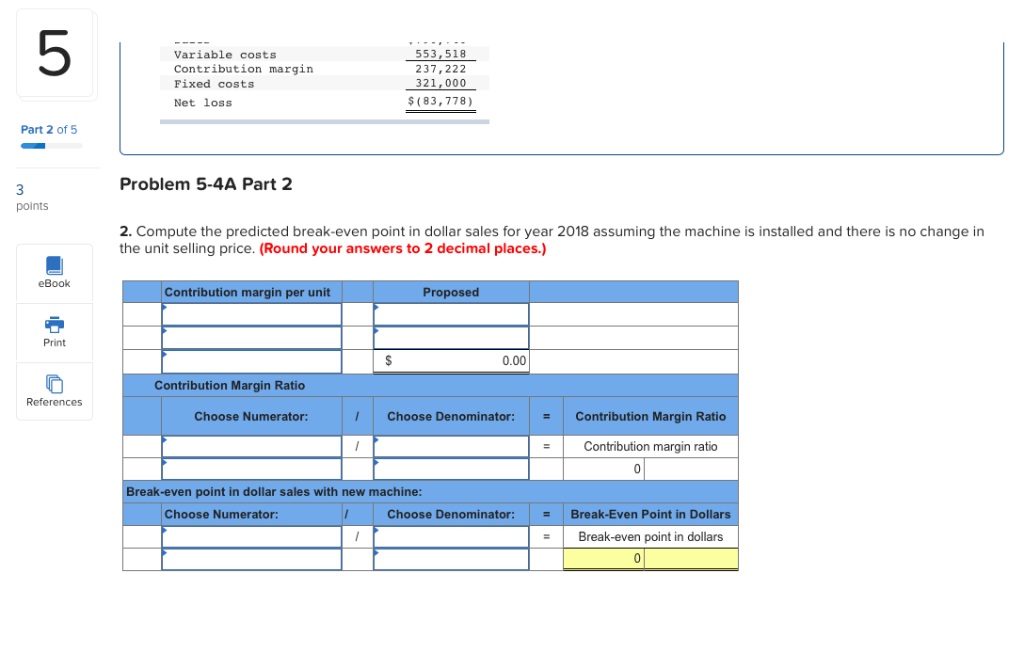

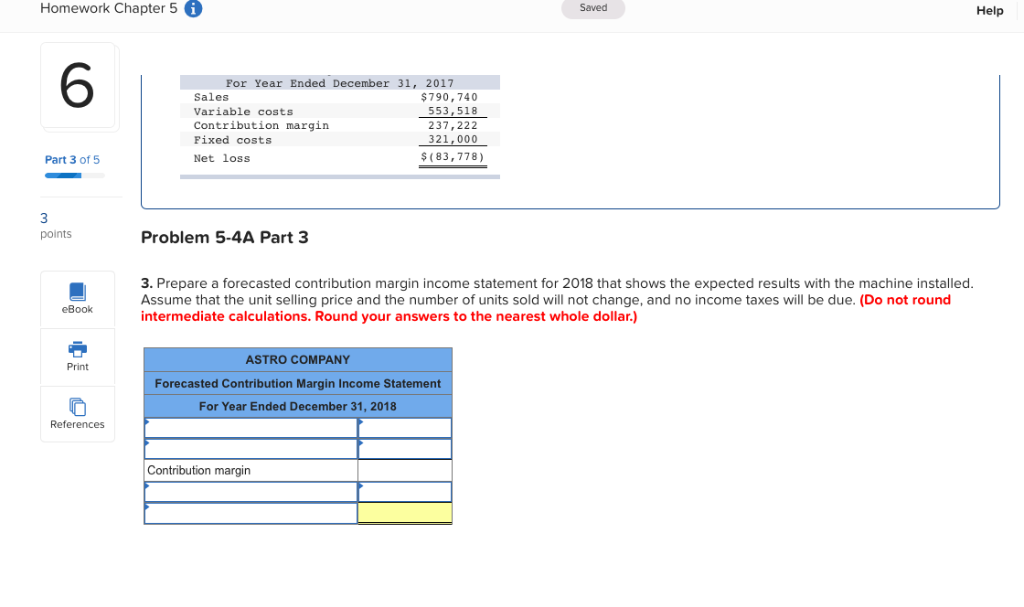

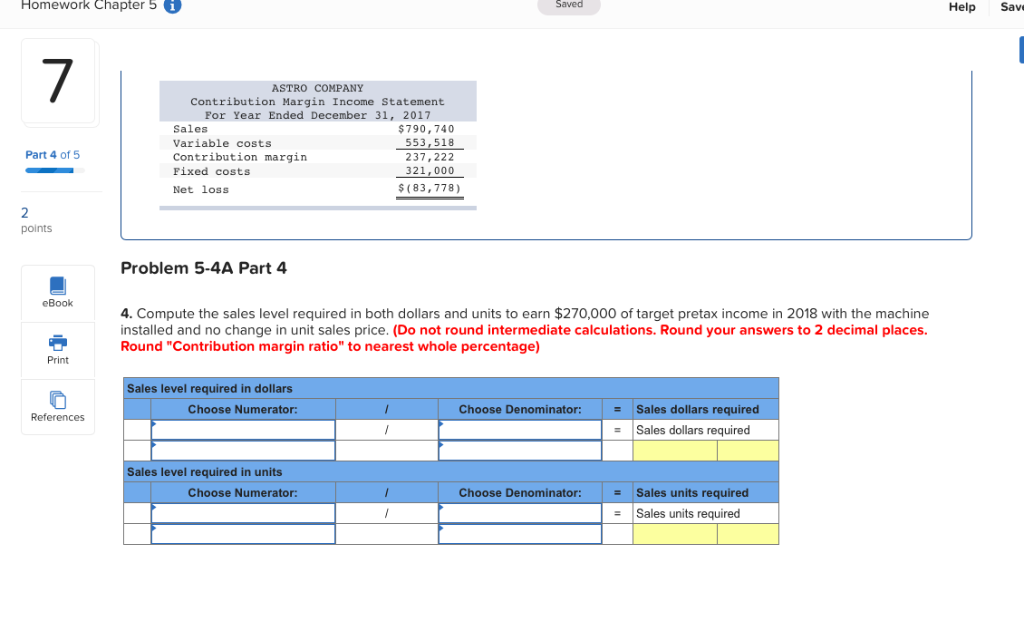

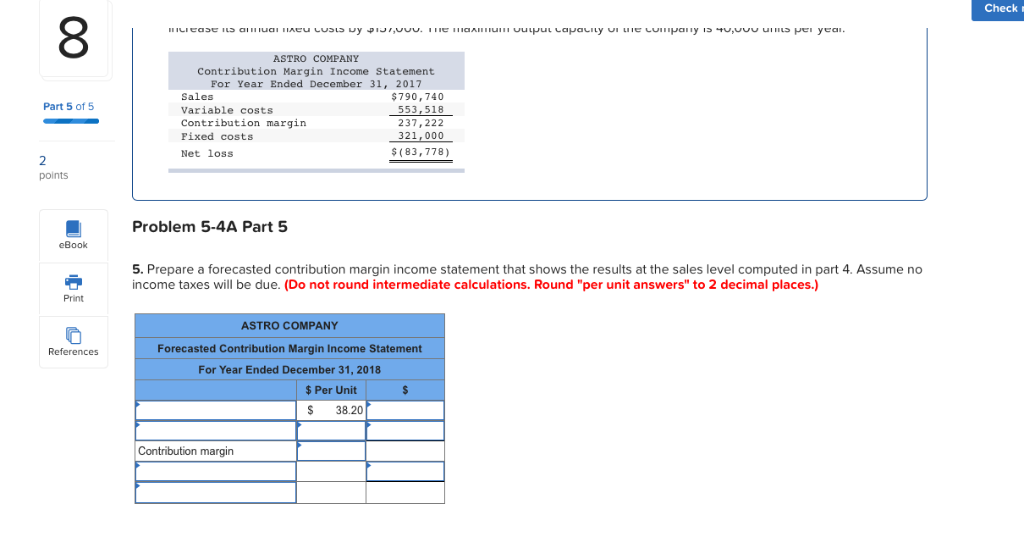

Variable costs Contribution margin Fixed costs Net loss 553,518 237,222 321,000 (83,778) Problem 5-4A Part 1 Required 1. Compute the break-even point in dollar sales for year 2017. (Round your answers to 2 decimal places.) Contribution Margin Per Unit Current 0.00 Contribution Margin Ratio Choose Numerator Choose Denominator:Contribution Margin Ratio Contribution margin ratio Break-Even Point in Dollar Sales Choose Numerator Choose Denominator:Break-Even Point in Dollars Break-even point in dollars Variable costs Contribution margin Fixed costs Net loss 553,518 237,222 321,000 (83,778) Part 2 of5 Problem 5-4A Part 2 points 2. Compute the predicted break-even point in dollar sales for year 2018 assuming the machine is installed and there is no change in the unit selling price. (Round your answers to 2 decimal places.) eBook Contribution margin per unit Proposed Print 0.00 Contribution Margin Ratio References Choose Numerator: Choose Denominator: Contribution Margin Ratio Contribution margin ratio Break-even point in dollar sales with new machine Choose Numerator: Choose Denominator: Break-Even Point in Dollars Break-even point in dollars Homework Chapter 5 Saved Help 6 For Year Ended December 31, 2017 Sales Variable costs Contribution margin Fixed costs Net loss 790,740 553,518 237,222 321.000 Part 3 of 5 (83,778) points Problem 5-4A Part 3 3. Prepare a forecasted contribution margin income statement for 2018 that shows the expected results with the machine installed Assume that the unit selling price and the number of units sold will not change, and no income taxes will be due. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) eBook ASTRO COMPANY Forecasted Contribution Margin Income Statement For Year Ended December 31, 2018 Print References Contribution margin Homework Chapter 5 Saved Help Save ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31, 2017 Sales Variable costs Contribution margin Fixed costs Net loss $790,740 553,518 237,222 321.000 $ (83,778) Part 4 of 5 points Problem 5-4A Part 4 eBook 4. Compute the sales level required in both dollars and units to earn $270,000 of target pretax income in 2018 with the machine installed and no change in unit sales price. (Do not round intermediate calculations. Round your answers to 2 decimal places Round "Contribution margin ratio" to nearest whole percentage) Print Sales level required in dollars Choose Numerator: Choose Denominator: - Sales dollars required -Sales dollars required References Sales level required in units Choose Numerator: Choose Denominator Sales units required Sales units required Check r ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31, 2017 Sales Variable costs Contribution margin Pixed costs Net loss $790,740 553,518 237,222 321,000 Part 5 of 5 (83,778) points Problem 5-4A Part 5 eBook 5. Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume no income taxes will be due. (Do not round intermediate calculations. Round "per unit answers" to 2 decimal places.) Print ASTRO COMPANY Forecasted Contribution Margin Income Statement For Year Ended December 31, 2018 References $Per Unit S 38.20 margin