Answered step by step

Verified Expert Solution

Question

1 Approved Answer

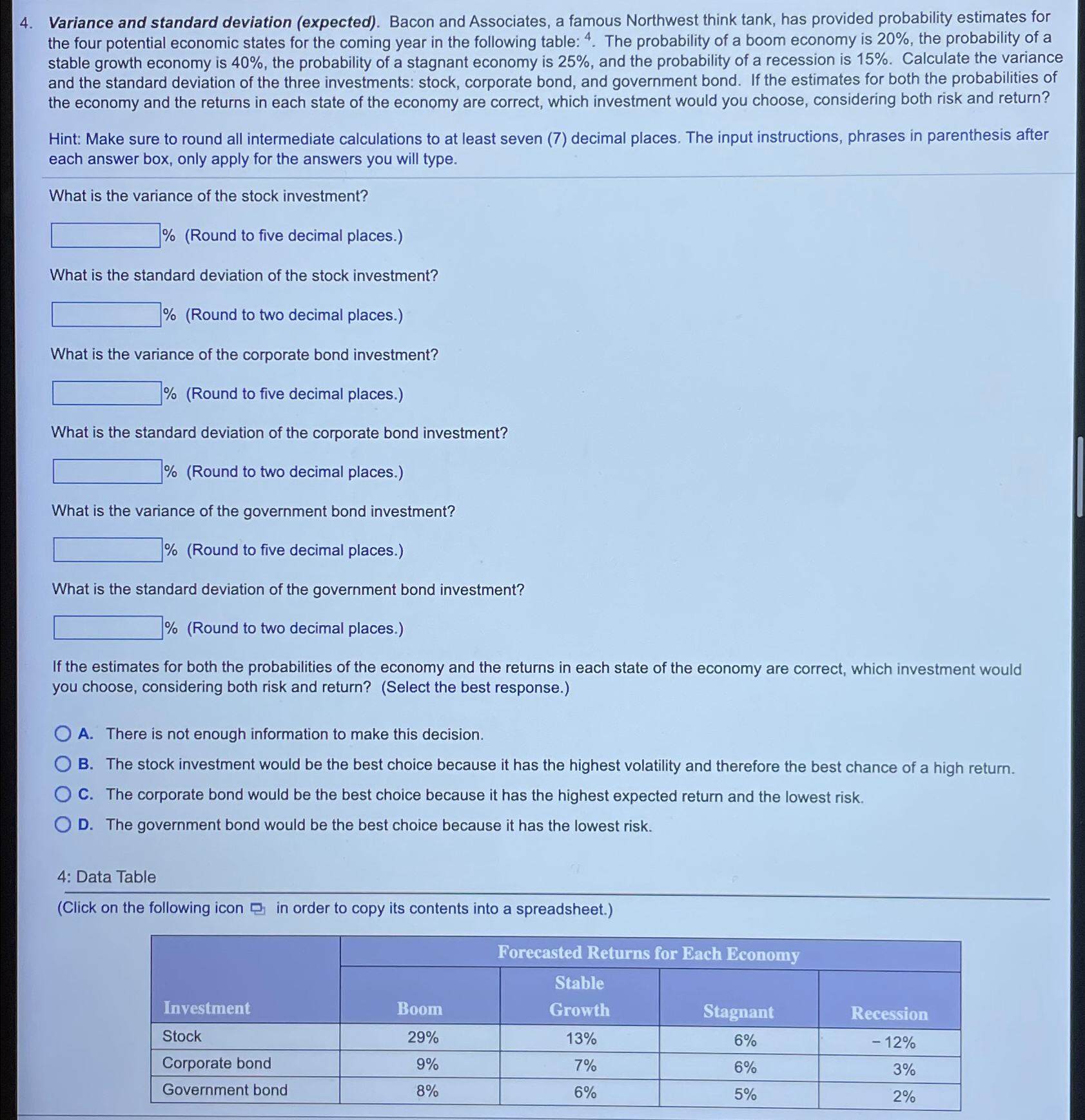

Variance and standard deviation ( expected ) . Bacon and Associates, a famous Northwest think tank, has provided probability estimates for the four potential economic

Variance and standard deviation expected Bacon and Associates, a famous Northwest think tank, has provided probability estimates for the four potential economic states for the coming year in the following table: The probability of a boom economy is the probability of a stable growth economy is the probability of a stagnant economy is and the probability of a recession is Calculate the variance and the standard deviation of the three investments: stock, corporate bond, and government bond. If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which investment would you choose, considering both risk and return?

Hint: Make sure to round all intermediate calculations to at least seven decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type.

What is the variance of the stock investment?

Round to five decimal places.

What is the standard deviation of the stock investment?

Round to two decimal places.

What is the variance of the corporate bond investment?

Round to five decimal places.

What is the standard deviation of the corporate bond investment?

Round to two decimal places.

What is the variance of the government bond investment?

Round to five decimal places.

What is the standard deviation of the government bond investment?

Round to two decimal places.

If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which investment would you choose, considering both risk and return? Select the best response.

A There is not enough information to make this decision.

B The stock investment would be the best choice because it has the highest volatility and therefore the best chance of a high return.

C The corporate bond would be the best choice because it has the highest expected return and the lowest risk.

D The government bond would be the best choice because it has the lowest risk.

: Data Table

Click on the following icon in order to copy its contents into a spreadsheet.

tableInvestmentForecasted Returns for Dach Economy,BoomtableStableGrowthStagnant,RecessionStock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started