Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vat and personal income tax is 21% and social security tax is 19.5% PRACTICAL. TASK Sun Ldd is VAT payer. The main activity is wholesale

Vat and personal income tax is 21% and social security tax is 19.5%

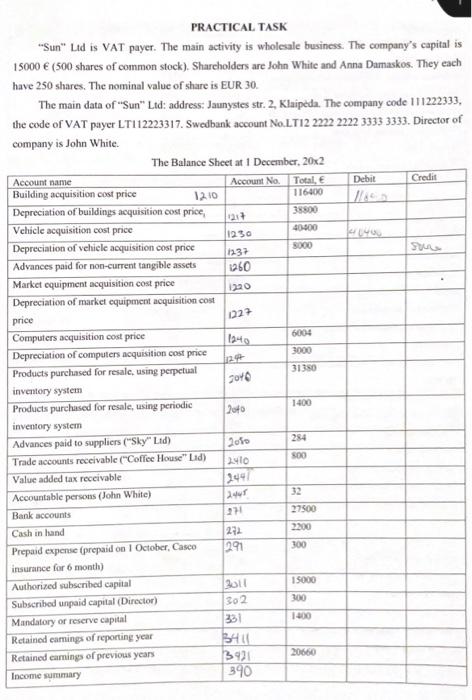

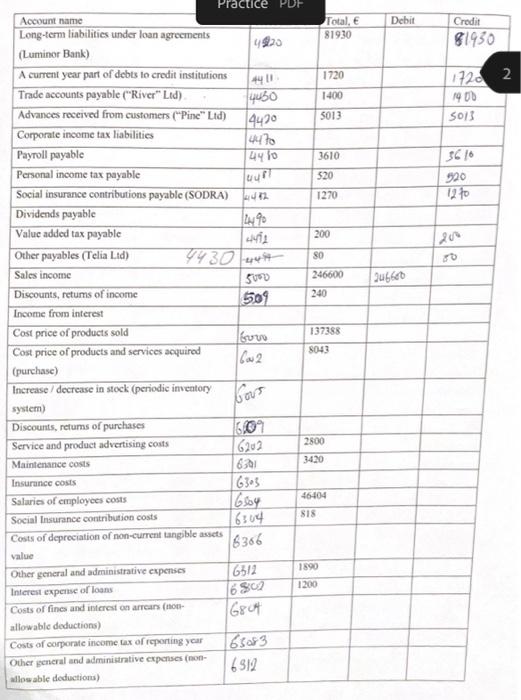

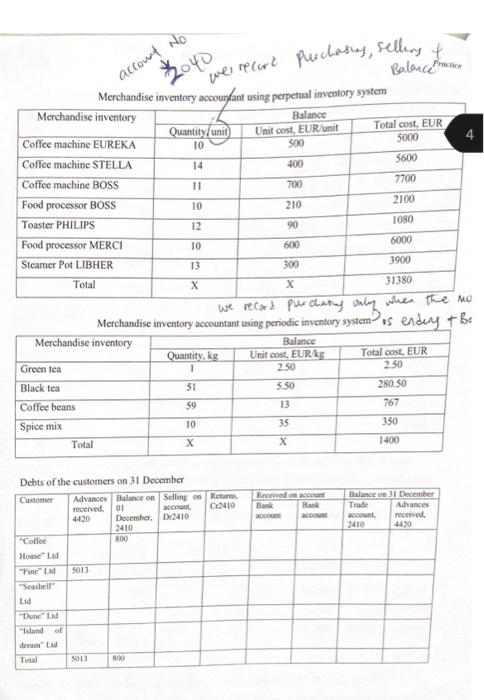

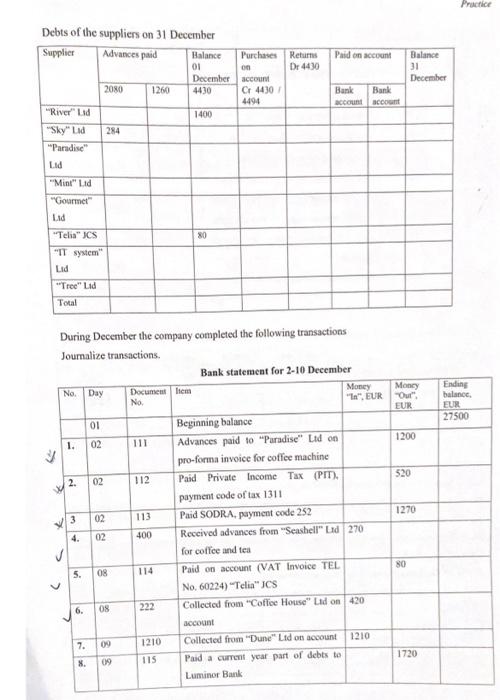

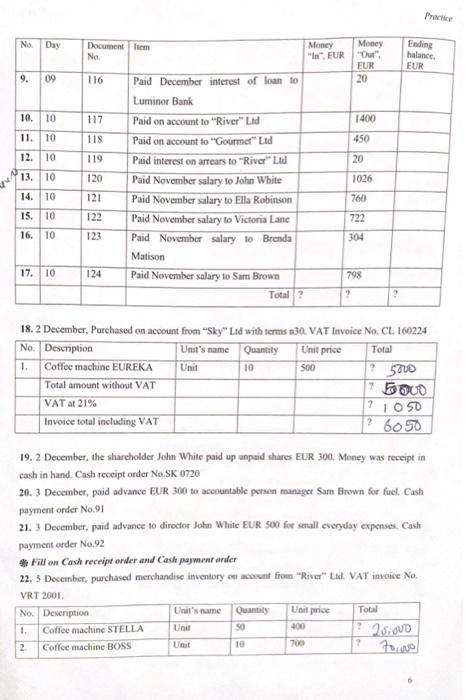

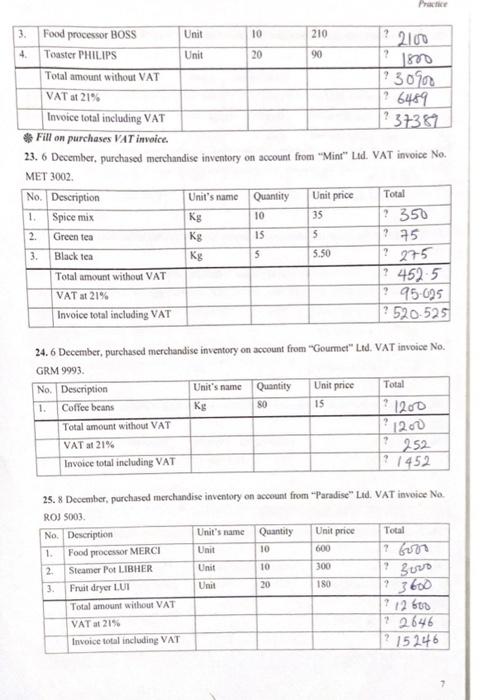

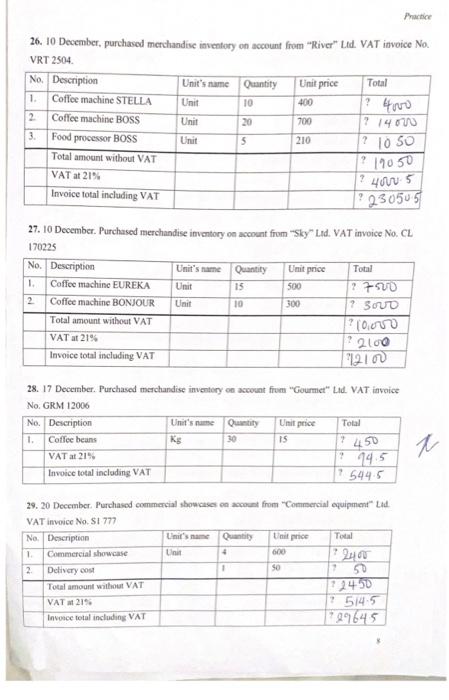

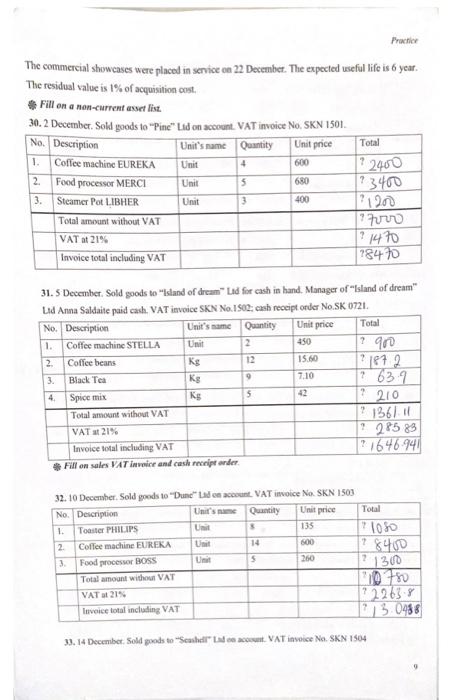

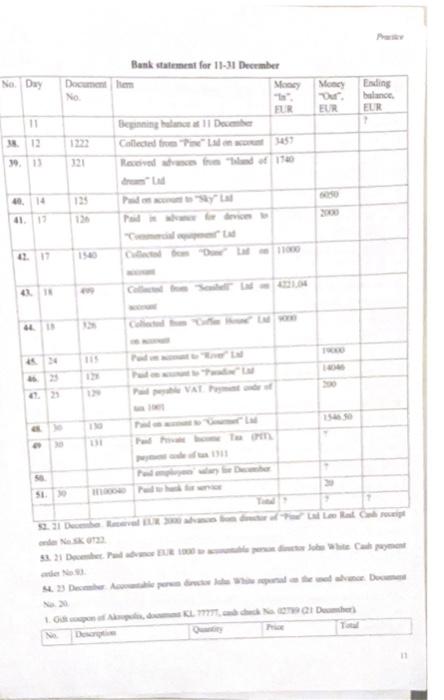

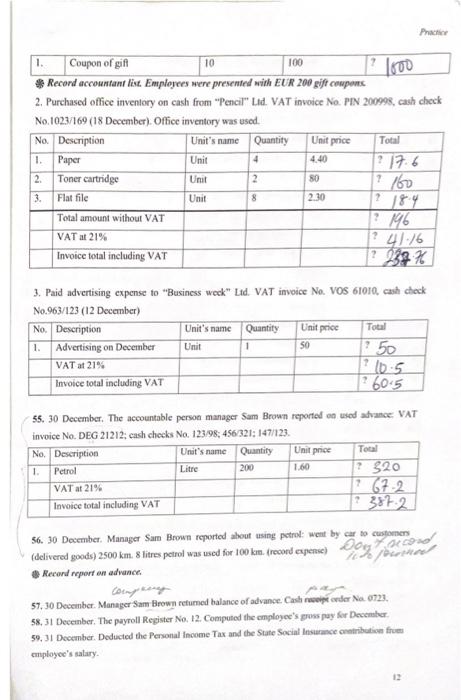

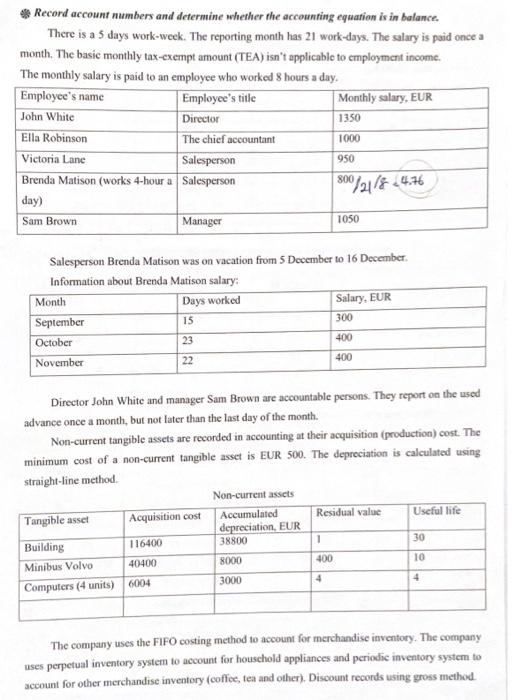

PRACTICAL. TASK "Sun" Ldd is VAT payer. The main activity is wholesale business. The company's capital is 15000 (500 shares of common stock). Sharcholders are John White and Anna Damaskos. They each have 250 shares. The nominal value of share is EUR 30. The main data of "Sun" Ltd: address: Jaunystes str. 2, Klaipeda. The company code 111222333, the code of VAT paycr LT112223317. Swedbank account No.LT12 2222222233333333 . Director of company is John White. 7o werrecor Merchandise inventorv accoundant using perpetual inventory system Merchandise inventory accountant using periodic inventory system is endery + Be Dehts of the customers on 31 December Debts of the suppliers on 31 December During December the company completed the following transactions Joumalize transactions. Bank statement for 2-10 December 18. 2 December, Purchased on account from "Sky" Ltd with terms n30. VAT Invoice No. CL. 160224 19. 2 December, the sharcholder John White paid up unpaid shares EUR 300. Money was receipt in cash in hand. Cash reccipt order No.SK 0720 20. 3 December, paid advance EUR 300 to accountable persen manager Sam Brown for fuel. Cash payment order No.91 21. 3 December, paid advance to diroctor John White EUR 500 for senall everyday expenses. Cash payment order No.92 Fill on Cash receipt onder and Cadh paynent arder 22. 5 December, purchased menchandise inventory en acount from "Rive" Lad. VAT invoice No. VRT 200I 23. 6 December, purchased merchandise inventory on account from "Mint" Ltd. VAT invoice No. MET 3002. 24. 6 December, purchased merchandise inventory on account from "Gournet" Ltd. VAT invoice No. GRM 9993. 25. 8 December, purchased merchandise inventory on account from "Paradise" Lid. VAT invoice No. R0] 5003. 26. 10 December, purchased merchandise inventory on account from "River" Ld. VAT invoice No. VRT 2504. 27. 10 December. Purchased merchandise inventory on accoont from "Sky" Lnd. VAT invoice No. CL 170225 28. 17 December. Purchased merchandise inventory on acoonat frum "Gourmet" LU. VAT invice No. GRM 12006 29. 20 December. Purchased commencial showceses en ascount from "Commservial equipment" Lid. VAT invoice No. SI 777 The commercial showcases were placed in service on 22 December. The expected useful life is 6 year. The residual value is 1% of acquisition onst. Fill on a non-current asset list. 30. 2 December. Sold goods to "Pine" Lid on acoount. VAT invoice No. SKN 1501. 31. 5 December. Sold goods to "Island of dream" Lad fir cash ia hand. Manager of "Island of dream" Ld Anna Saldaite paid cash. VAT imvoice SKN No.I S02; cash reccipt order No.SK 0721. Fill on sales VAT inwire and cast recrige waver. 13 in Nowemher. Sold monds wo "Duac" LM en acoount. VAT invoice No. SKN I503 34. 17 December. Sold soods to "Coffee House" Lud on acoount. VAT invoice Na. SKN 1505. 35. 21 December. Received goods back from "Coffee House" Lad. Debit VAT invoice No. KAV ?ans1 The reason for return: faulty goods. Sales VAT iavoice No. SKN 1505 36. 21 December. Updated the merchandisc inventary acoount for the cost of the retumed menchandise iaventory. Acoountant list No.12. 37. 22 Decomber, Retumed goods to "River" LA. Debit VAT imvice No. SKN 056. Goods were murchased an nurchave VAT invoice No, VRT 2004. Bank staterment for 11-31 Decraber cries Nask orzz. andent the 1.1. Wein 30 II 2. Purchased office inventory on cash from "Pencil" Ld. VAT invoice No. PNN 200998 , cash check No.1023/169 (18 December). Offiec inventory was used. 3. Paid advertising expense to "Business weck" Lid. VAT invoice No. VOS 61010 , eah check No.963/123 (12 Deember) 55. 30 December. The accountable person manager Sam Brown reportel en used advance. VAT invoice No. DEG 21212; each checks No. 123/98; 456321: 147/123. 56. 30 December. Manager Sarn Brown reported about using petrol: went by car to costonen Recond report en advance. 57, 30 December. Manager Sam Brown retumed balance of advance. Castin newipr arder Ne. 0123. 58. 31 Decenber. The payroll Register No, 12. Computed the cmployec's guss pay for December. 59, 31 December. Deducted the Pensonal Income Tax and the State Social Inswance onatribution fruen cmployee's salary. Record account numbers and determine whether the accounting equation is in balance. There is a 5 days work-week. The reporting month has 21 work-days. The salary is paid once a month. The basic monthly tax-exempt amount (TEA) isn't applicable to cmployment income. The monthly salary is paid to an employee who worked 8 hours a day. Salesperson Brenda Matison was on vacation from 5 December to 16 December. Information about Brenda Matison salary: Director John White and manager Sam Brown are accountable persons. They report on the used advance once a month, but not later than the last day of the month. Non-current tangible assets are recorded in accounting at their acquisition (production) cost. The minimum cost of a non-current tangible asset is EUR 500 . The depreciation is calculated using straight-line method. Non-current assets The company uses the FIFO costing method to account for merchandise inventory. The company uses perpetual inventory system to account for houschold appliances and periodic inventory system to account for other merchandise inventory (coffee, tea and other). Discount records using gross method. 60. 31 December. Calculated the employer's State Social Insurance contribution for December. Complete the Working Schedule Time Sheet and the Payroll Register for December. Fill on cash book on December and calculate cash ending balance 61. 31 December. Received a telephone bill from "Telia" JCS. VAT invoice No.777777. 1. Record transactions in the specific journals the Purchoses on accouat journal, the Sales on account journal, the Cash receipt journal, the Cavh payment journal, the General journal. 2. Post journal entries to the arcounts. 3. Compute the unadjusted balance in each acceunt and propare the unadjuated trial balance. 63.31 December. Journalize and post adjusting entries: prepuid suppliers and debts of supplien. 64. 31 December. Journalize and post adjusting entries debes of customers and advances received. Compute the balance of debis of customen and the Balance of deber of suppliers 65. Determine the cost of goods sold and she ending merchandive inventary by using a periodic inventory system. Physical count of inventory showed: 95kg cotfee beans, 12kg Green tea, 20kg Black tea, 15kg spice mix. Determine the ending merchandise inventary and the cast of goods sold by using a perpetual inventory system. Fill on the inventary curd. 66. 31 December. Correct the cost of goods sold. 10% of cost of the goods sold (determine by using periodic inventory system) are allocated to cost of representation. 67. 31 December. Determine the depreciation expense. 68. 31 December. Calculate balance the VAT account. 69.31 December. The adjusting entry: advance payment of future expenses adjusted for amount used. 70. 31 December. Transfer EUR 20640debt from long-term liabilities under loan agreements to current year part of debts to credit institutions 71. 31 December. Calculate the Corporate Income Tax using The Law on Corporate Income Tax. 72.31 December. Close the income accounts. Close the expenses accounts. 73. 31 December. Calculate and record the financial result of business. Prepare the adjusted trial balance. Prepare the post-closing trial balance. Prepare the financial statement: the Balance Sheet; the Statement of Profit or Loss. PRACTICAL. TASK "Sun" Ldd is VAT payer. The main activity is wholesale business. The company's capital is 15000 (500 shares of common stock). Sharcholders are John White and Anna Damaskos. They each have 250 shares. The nominal value of share is EUR 30. The main data of "Sun" Ltd: address: Jaunystes str. 2, Klaipeda. The company code 111222333, the code of VAT paycr LT112223317. Swedbank account No.LT12 2222222233333333 . Director of company is John White. 7o werrecor Merchandise inventorv accoundant using perpetual inventory system Merchandise inventory accountant using periodic inventory system is endery + Be Dehts of the customers on 31 December Debts of the suppliers on 31 December During December the company completed the following transactions Joumalize transactions. Bank statement for 2-10 December 18. 2 December, Purchased on account from "Sky" Ltd with terms n30. VAT Invoice No. CL. 160224 19. 2 December, the sharcholder John White paid up unpaid shares EUR 300. Money was receipt in cash in hand. Cash reccipt order No.SK 0720 20. 3 December, paid advance EUR 300 to accountable persen manager Sam Brown for fuel. Cash payment order No.91 21. 3 December, paid advance to diroctor John White EUR 500 for senall everyday expenses. Cash payment order No.92 Fill on Cash receipt onder and Cadh paynent arder 22. 5 December, purchased menchandise inventory en acount from "Rive" Lad. VAT invoice No. VRT 200I 23. 6 December, purchased merchandise inventory on account from "Mint" Ltd. VAT invoice No. MET 3002. 24. 6 December, purchased merchandise inventory on account from "Gournet" Ltd. VAT invoice No. GRM 9993. 25. 8 December, purchased merchandise inventory on account from "Paradise" Lid. VAT invoice No. R0] 5003. 26. 10 December, purchased merchandise inventory on account from "River" Ld. VAT invoice No. VRT 2504. 27. 10 December. Purchased merchandise inventory on accoont from "Sky" Lnd. VAT invoice No. CL 170225 28. 17 December. Purchased merchandise inventory on acoonat frum "Gourmet" LU. VAT invice No. GRM 12006 29. 20 December. Purchased commencial showceses en ascount from "Commservial equipment" Lid. VAT invoice No. SI 777 The commercial showcases were placed in service on 22 December. The expected useful life is 6 year. The residual value is 1% of acquisition onst. Fill on a non-current asset list. 30. 2 December. Sold goods to "Pine" Lid on acoount. VAT invoice No. SKN 1501. 31. 5 December. Sold goods to "Island of dream" Lad fir cash ia hand. Manager of "Island of dream" Ld Anna Saldaite paid cash. VAT imvoice SKN No.I S02; cash reccipt order No.SK 0721. Fill on sales VAT inwire and cast recrige waver. 13 in Nowemher. Sold monds wo "Duac" LM en acoount. VAT invoice No. SKN I503 34. 17 December. Sold soods to "Coffee House" Lud on acoount. VAT invoice Na. SKN 1505. 35. 21 December. Received goods back from "Coffee House" Lad. Debit VAT invoice No. KAV ?ans1 The reason for return: faulty goods. Sales VAT iavoice No. SKN 1505 36. 21 December. Updated the merchandisc inventary acoount for the cost of the retumed menchandise iaventory. Acoountant list No.12. 37. 22 Decomber, Retumed goods to "River" LA. Debit VAT imvice No. SKN 056. Goods were murchased an nurchave VAT invoice No, VRT 2004. Bank staterment for 11-31 Decraber cries Nask orzz. andent the 1.1. Wein 30 II 2. Purchased office inventory on cash from "Pencil" Ld. VAT invoice No. PNN 200998 , cash check No.1023/169 (18 December). Offiec inventory was used. 3. Paid advertising expense to "Business weck" Lid. VAT invoice No. VOS 61010 , eah check No.963/123 (12 Deember) 55. 30 December. The accountable person manager Sam Brown reportel en used advance. VAT invoice No. DEG 21212; each checks No. 123/98; 456321: 147/123. 56. 30 December. Manager Sarn Brown reported about using petrol: went by car to costonen Recond report en advance. 57, 30 December. Manager Sam Brown retumed balance of advance. Castin newipr arder Ne. 0123. 58. 31 Decenber. The payroll Register No, 12. Computed the cmployec's guss pay for December. 59, 31 December. Deducted the Pensonal Income Tax and the State Social Inswance onatribution fruen cmployee's salary. Record account numbers and determine whether the accounting equation is in balance. There is a 5 days work-week. The reporting month has 21 work-days. The salary is paid once a month. The basic monthly tax-exempt amount (TEA) isn't applicable to cmployment income. The monthly salary is paid to an employee who worked 8 hours a day. Salesperson Brenda Matison was on vacation from 5 December to 16 December. Information about Brenda Matison salary: Director John White and manager Sam Brown are accountable persons. They report on the used advance once a month, but not later than the last day of the month. Non-current tangible assets are recorded in accounting at their acquisition (production) cost. The minimum cost of a non-current tangible asset is EUR 500 . The depreciation is calculated using straight-line method. Non-current assets The company uses the FIFO costing method to account for merchandise inventory. The company uses perpetual inventory system to account for houschold appliances and periodic inventory system to account for other merchandise inventory (coffee, tea and other). Discount records using gross method. 60. 31 December. Calculated the employer's State Social Insurance contribution for December. Complete the Working Schedule Time Sheet and the Payroll Register for December. Fill on cash book on December and calculate cash ending balance 61. 31 December. Received a telephone bill from "Telia" JCS. VAT invoice No.777777. 1. Record transactions in the specific journals the Purchoses on accouat journal, the Sales on account journal, the Cash receipt journal, the Cavh payment journal, the General journal. 2. Post journal entries to the arcounts. 3. Compute the unadjusted balance in each acceunt and propare the unadjuated trial balance. 63.31 December. Journalize and post adjusting entries: prepuid suppliers and debts of supplien. 64. 31 December. Journalize and post adjusting entries debes of customers and advances received. Compute the balance of debis of customen and the Balance of deber of suppliers 65. Determine the cost of goods sold and she ending merchandive inventary by using a periodic inventory system. Physical count of inventory showed: 95kg cotfee beans, 12kg Green tea, 20kg Black tea, 15kg spice mix. Determine the ending merchandise inventary and the cast of goods sold by using a perpetual inventory system. Fill on the inventary curd. 66. 31 December. Correct the cost of goods sold. 10% of cost of the goods sold (determine by using periodic inventory system) are allocated to cost of representation. 67. 31 December. Determine the depreciation expense. 68. 31 December. Calculate balance the VAT account. 69.31 December. The adjusting entry: advance payment of future expenses adjusted for amount used. 70. 31 December. Transfer EUR 20640debt from long-term liabilities under loan agreements to current year part of debts to credit institutions 71. 31 December. Calculate the Corporate Income Tax using The Law on Corporate Income Tax. 72.31 December. Close the income accounts. Close the expenses accounts. 73. 31 December. Calculate and record the financial result of business. Prepare the adjusted trial balance. Prepare the post-closing trial balance. Prepare the financial statement: the Balance Sheet; the Statement of Profit or Loss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

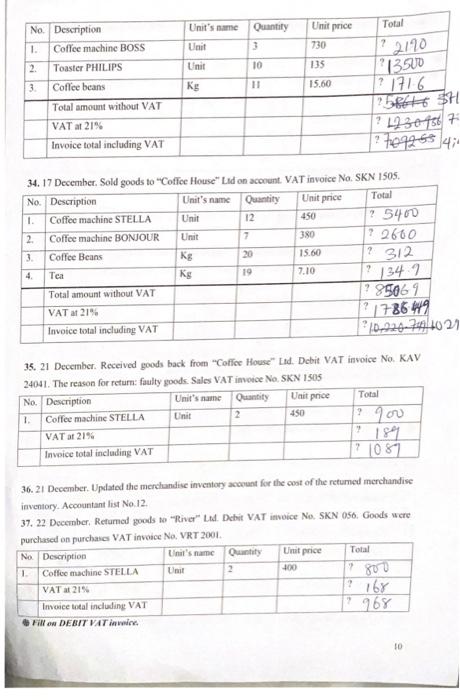

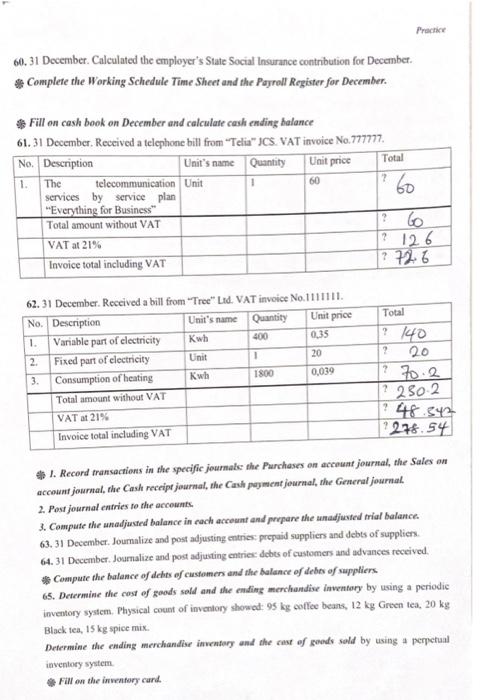

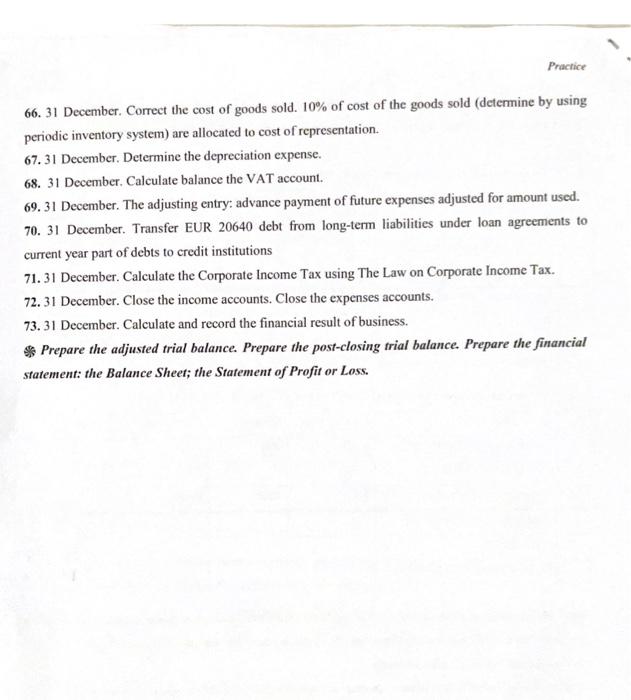

Get Started