Answered step by step

Verified Expert Solution

Question

1 Approved Answer

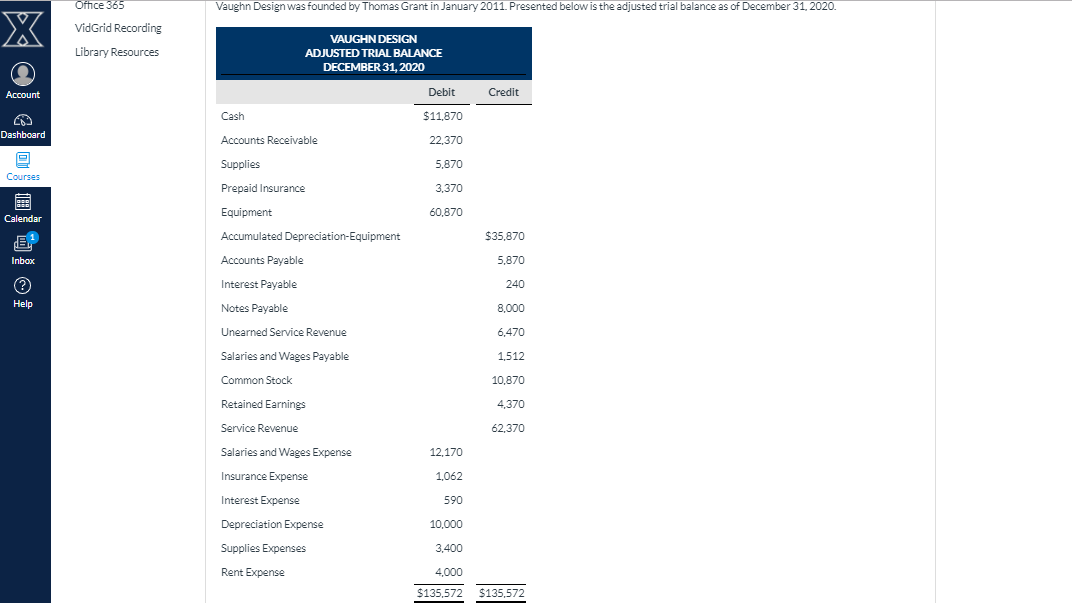

Vaughn Design was founded by Thomas Grant in January 2011. Presented below is the adjusted trial balance as of December 31, 2020. Please come back

Vaughn Design was founded by Thomas Grant in January 2011. Presented below is the adjusted trial balance as of December 31, 2020.

Please come back to the comments to check for the next part of the question.

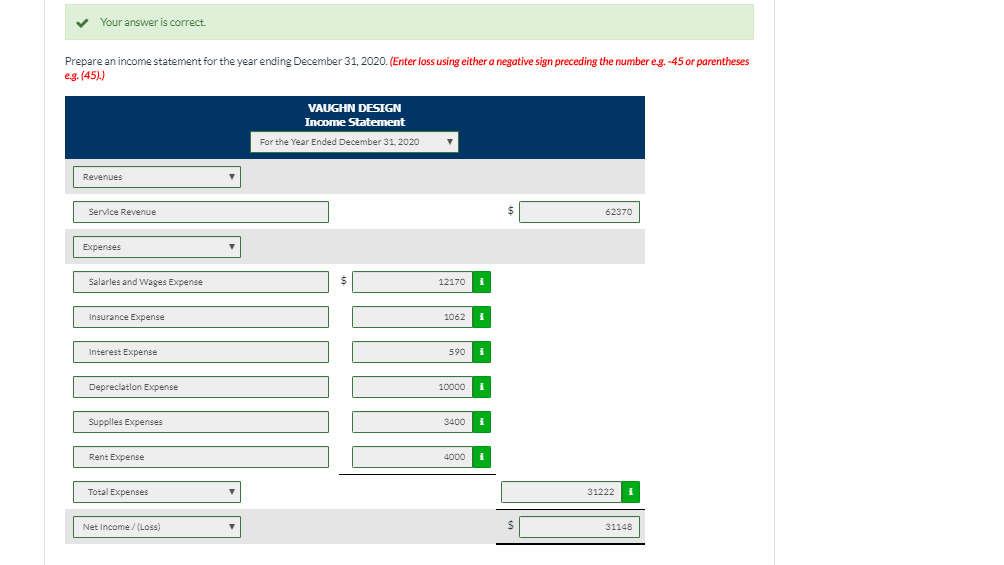

Office 365 Vaughn Design was founded by Thomas Grant in January 2011. Presented below is the adjusted trial balance as of December 31, 2020. X VidGrid Recording VAUGHN DESIGN Library Resources ADJUSTED TRIAL BALANCE DECEMBER 31,2020 Debit Credit Account $11,870 Cash Dashboard Accounts Receivable 22,370 Supplies 5,870 Courses Prepaid Insurance 3,370 Equipment 60,870 Calendar Accumulated Depreciation-Equipment $35,870 Accounts Payable 5,870 Inbox ? Interest Payable 240 Help Notes Payable 8,000 Unearned Service Revenue 6,470 Salaries and Wages Payable 1,512 Common Stock 10,870 Retained Earnings 4,370 Service Revenue 62,370 Salaries and Wages Expense 12,170 Insurance Expense 1,062 Interest Expense 590 Depreciation Expense 10,000 Supplies Expenses 3,400 Rent Expense 4,000 $135,572 $135,572 Your answer is correct. Prepare an income statement for the year ending December 31, 2020. (Enter loss using either a negative sign preceding the number eg. -45 or parentheses eg. (45)) VAUGHN DESIGN Income Statement For the Year Ended December 31, 2020 Revenues Service Revenue 62370 Expenses Salarles and Wages Expense 12170 1062 Insurance Expense Interest Expense 590 Depreclatlon Expense 10000 Supplles Expenses 3400 Rent Expense 4000 31222 Total Expenses $ Net Income/(Loss) 31148 (a2) Prepare a statement of retained earnings for the year ending December 31, 2020. VAUGHN DESIGN Statement of Retained Earnings eTextbook and Media List of Accounts Attempts: 0 of 2 usedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started