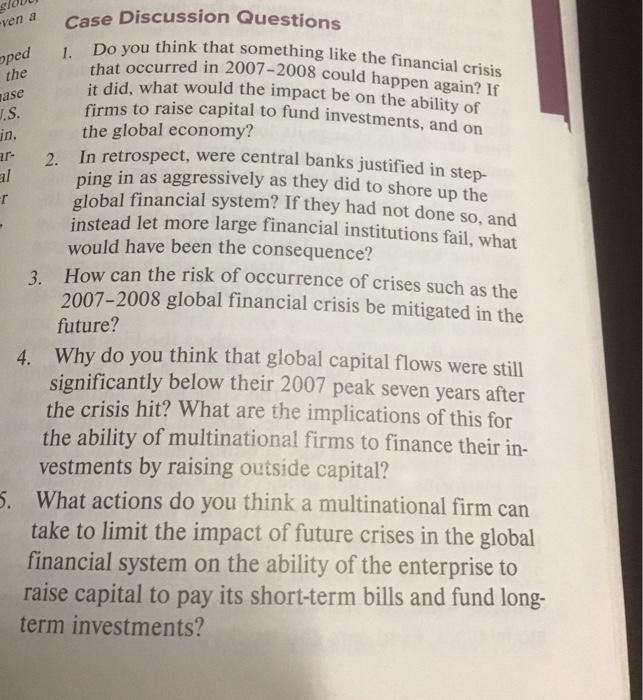

ven a 1. oped the nase J.S. in. Do you think that something like the financial crisis Case Discussion Questions that occurred in 2007-2008 could happen again? If it did, what would the impact be on the ability of firms to raise capital to fund investments, and on the global economy? ar- 2. In retrospect, were central banks justified in step- al ping in as aggressively as they did to shore up the r global financial system? If they had not done so, and instead let more large financial institutions fail, what would have been the consequence? 3. How can the risk of occurrence of crises such as the 2007-2008 global financial crisis be mitigated in the future? 4. Why do you think that global capital flows were still significantly below their 2007 peak seven years after the crisis hit? What are the implications of this for the ability of multinational firms to finance their in- vestments by raising outside capital? 5. What actions do you think a multinational firm can take to limit the impact of future crises in the global financial system on the ability of the enterprise to raise capital to pay its short-term bills and fund long- term investments? why we tes back to 2005 He company . The dollar For decades-beder capital film-cloting lead many to be complex derivatives, the value ing, foreign direct investment flow and purchases of of which was tied to the underlying value of mortgage apie med hondenced elentlessly wefecting the backed securities. Now these inicia were facing neming integration of capital markets in a writes the port of sertpage-backed single massive global system. Cross-border capital for securities and the sociale derivatives. One of these surped from $0 trik in 1980 to a peak of Sulton. Lehman Brothers, halten aggrele po son in 2007 and then the collapsed By 2012 in the market for mortgage backed securities. In border capitales de billion per September 2005 the firm collapsed to be rupy of wimpal. The global capital mare, US US permet decided not to me in and we it seemed was intrat To understand The funksupy of Lehen et abeck waves through where e major crisis epe three slobal capital the richel financial mula dict, the US govem market that we way for the financial institut had stated it was opened to let large filin bricate the wheels of the global economy Financial itution ullamedinely, bunki noduced their lendast borrow risions of dollars between themselves they fell a need to bud cash because they no longer Moud banks and corporation we und not know the value of the mortgage backed securities they ween 1 and 210 days. This is a way for the first afraid to lead to the banks became these funksmight al meeting payroll und paying suppliers. Because the wets, only bank and corporation with excellent credit the month US Tramy bills in 2007 which is ratings are able to sell their commercial per ata normal speed. However, the spread increased to sonable price. This price is set with reference to the percent by late 2006 talsing the cost of short-term Leader offered Rate LIBOR) The LIBOR bring some 16-fd. Many options found that is the rate at which banks lead to each other. In normal they could not raise capital taastable price times, the LIBOR ste is very close to the rite charged Money market funds which is normal times we large by national central Parks, has the US Federal Rebuyers of commercial pred trade wire forte della Early in 2008 banks in countries and started the month Try Nils down to his low and torm in troubles it became clear that the value of led to use in the value of the US dollar, in the mortage-backed securities that wy held sow, the financial plumbing of the global economy lap thing default rates a mortapemes notably in the fire would be able to borre to service their hom United States and Great Britain, where leaders had term financing. They would rapidly become written creaningly risky mortgages over the preceding bestandene of bankruptcies could we and few years. These mortgages were handled into securithe globe, plunging the world into an mesin ties and then sold to other financial institution. Ale reven a depression At this point several nationalents stepped into the beach. The US Federal Reserse entered the commercial paper maritting pa fund to parchase commercial paper strate close to the rules fx US Team Control fons in Japat Great Britain the European Union took similation. Once partici pants in the global capital markets saw that national por ernment were willing to enter the commercial apet market. They are toate their ending ricco and LIBOK es wared to fall again. The US. ment established the Towed Art Relief Program TARP, alwing the US Trawy to purchase aris are up to $700 Win in ruble Under TARP the government began to capital led banksty purchasing from them that were difficult to value, such as more-backed securities. This si maled there would be no more kruptcies och L's. This too heed the form mercial paper. A major crida had been wertedbut cely just. Although the $700 price tag for TARP stunted people, most of the most to be TARP was quickly paid back with interest and by late 2012 estimate agent that the total cost to the taxpayer would be close to 24 billion Five years after the crisis hit, the global capital mar ket had still not fully recovered from its 2007 peak Drees this signal astral from the labelitation of tal, merely a rece? Most out believe the one in the Since 2005 the world economy has grown dowly and controles permanent particularly Europe who wantsalt mense burdened with high level of that is their ability to deal with ply growth and high unemployment. Notwithstanding this the world com continues to become more inte rated propelled by stronger growth in some develop ing nation, and this process unfolds, global capital markets will inevitably start to expand to support cross-border trade in pools and services, as well as cross-border investments