Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Venu Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $ 915,000.

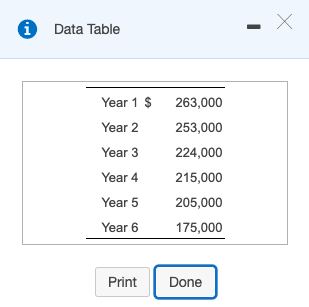

Venu Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $ 915,000. Projected net cash inflows are as follows.

Requirements.

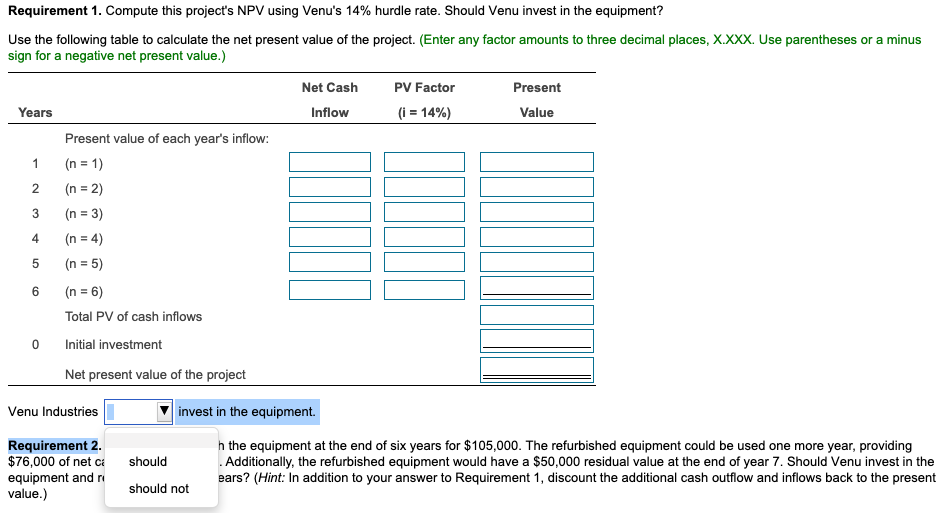

Requirement 1.

Requirement 1.

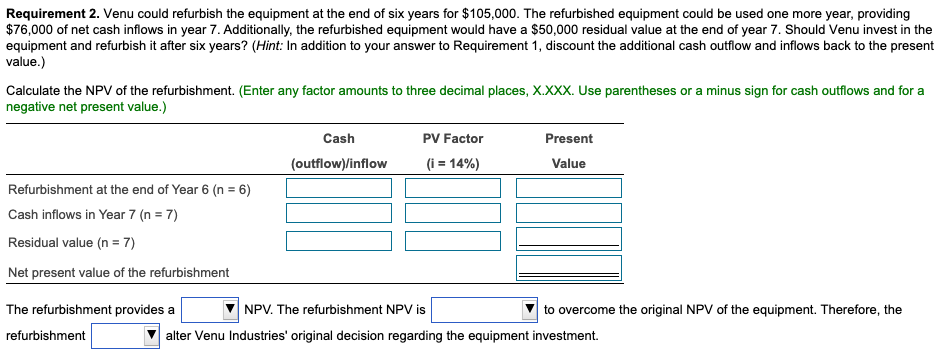

Requirement 2.

The refurbishment provides [negative/positive] NPV. The refurbishment NPV is [large enoughot large enough] to overcome the original NPV of the equipment. Therefore, the refurbishment [should/should not] alter Venus Industries' original decision regarding the equipment investment.

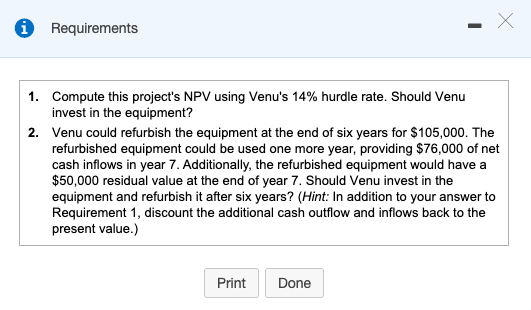

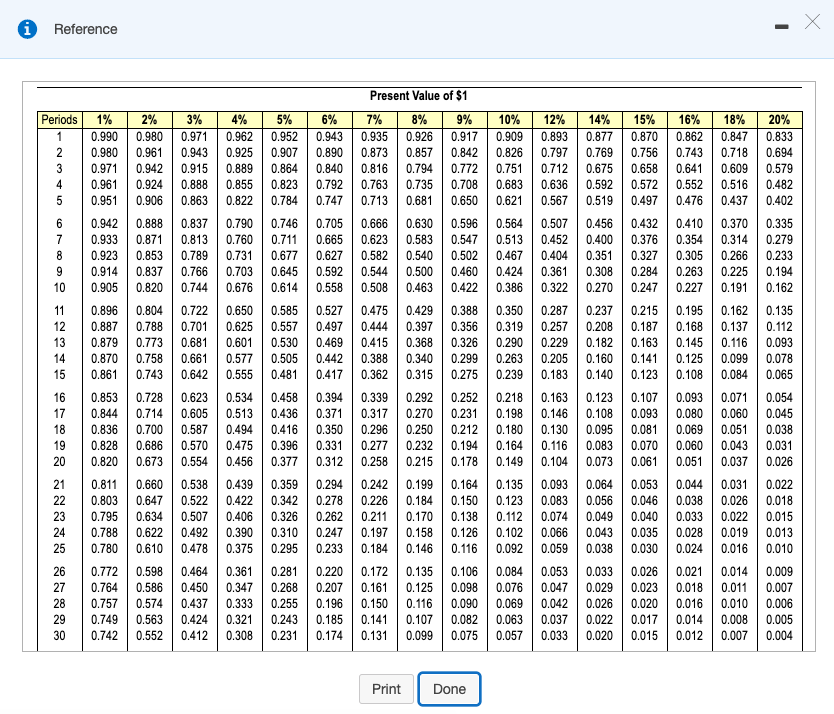

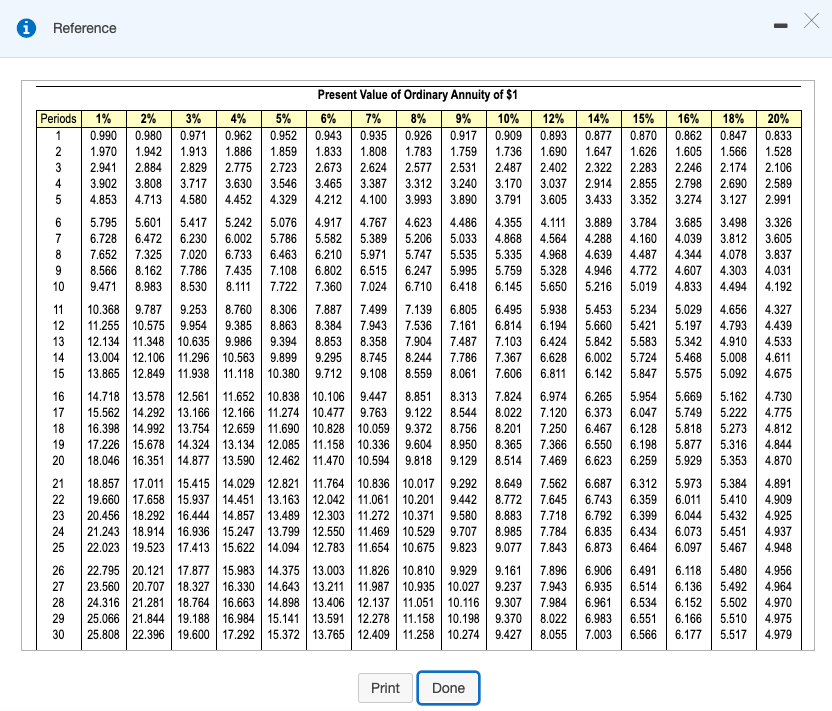

0 Requirements 1. Compute this project's NPV using Venu's 14% hurdle rate. Should Venu invest in the equipment? 2. Venu could refurbish the equipment at the end of six years for $105,000. The refurbished equipment could be used one more year, providing $76,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $50,000 residual value at the end of year 7. Should Venu invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Print Done i Data Table 263,000 253,000 Year 1 $ Year 2 Year 3 Year 4 Year 5 Year 6 224,000 215,000 205,000 175,000 Print Done i Reference Present Value of $1 Periods 1% 2% 0.990 0.980 0.980 0.961 0.971 0.942 0.961 0.924 0.951 0.906 0.942 0.888 0.933 0.871 0.923 0.853 0.914 0.837 0.905 0.820 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.743 0.853 0.728 0.844 0.714 0.836 0.700 0.828 0.686 0.820 0.673 0.811 0.660 0.803 0.647 0.795 0.634 0.788 0.622 0.780 0.610 0.772 0.598 0.764 0.586 0.757 0.574 0.7490.563 0.742 0.552 0.187 3% 4% 0.971 0.962 0.943 0.925 0.915 0.889 0.888 0.855 0.863 0.822 0.837 0.790 0.813 0.760 0.789 | 0.731 0.766 | 0.703 | 0.744 | 0.676 0.722 0.650 0.701 0.625 0.681 0.601 0.661 0.577 0.642 0.555 0.623 0.534 0.605 0.513 0.587 0.494 0.570 0.475 0.554 0.456 0.538 0.439 0.522 0.422 0.507 0.406 0.492 0.390 0.478 | 0.375 0.464 0.361 0.450 0.347 0.437 | 0.333 0.424 0.321 0.412 0.308 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.359 0.342 0.326 0.310 0.295 0.281 0.268 0.255 0.243 0.231 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.294 0.278 0.262 0.247 0.233 0.220 0.207 0.196 0.185 0.174 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.242 0.226 0.211 0.197 0.184 0.172 0.161 0.150 0.141 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 | 0.429 | 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.164 0.150 0.138 0.126 0.116 0.106 0.098 0.090 0.082 0.075 10% 12% 0.909 0.893 0.826 0.797 0.751 0.712 0.683 0.636 0.621 0.567 0.564 0.507 0.513 | 0.452 0.467 | 0.404 0.424 0.361 0.386 0.322 0.350 0.287 0.319 0.257 0.290 0.229 0.263 0.205 0.239 0.183 0.218 0.163 0.198 0.146 0.180 0.130 0.164 0.116 0.149 0.104 0.135 0.093 0.123 0.083 0.112 0.074 0.102 0.066 0.092 0.084 0.053 0.076 | 0.047 0.069 0.042 0.063 0.037 0.057 0.033 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.064 0.056 0.049 0.043 0.038 0.033 0.029 0.026 0.022 0.020 15% 16% 18% 20% 0.870 0.862 0.847 0.833 0.756 0.743 0.7180.694 0.658 0.641 0.609 0.579 0.572 | 0.552 0.516 0.482 0.497 | 0.476 0.437 0.402 0.432 0.410 0.370 0.335 0.376 0.354 0.314 0.279 0.327 0.305 0.266 0.233 0.284 0.263 | 0.225 0.194 0.247 0.227 0.191 0.162 0.215 0.195 0.162 0.135 0.168 0.137 0.112 0.163 0.145 0.116 0.093 0.141 0.125 0.099 0.078 0.123 0.108 0.084 0.065 0.107 0.093 0.071 0.054 0.093 0.080 0.060 0.045 0.081 0.069 0.038 0.070 0.060 0.043 0.031 0.061 0.051 0.037 0.026 0.053 | 0.044 0.031 0.022 0.046 0.038 0.026 0.018 0.040 | 0.033 0.022 0.015 0.035 | 0.028 0.019 0.013 0.030 0.024 0.016 0.010 0.026 0.021 | 0.014 0.009 0.023 0.018 | 0.011 0.007 0.020 0.016 0.010 0.006 0.017 0.014 0.008 0.005 0.015 0.012 0.007 0.004 0.051 0.199 0.184 0.170 0.158 0.146 0.059 0.135 0.125 0.116 0.107 0.099 0.131 Print Done i Reference Periods Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 1.970 1.942 1.913 1.886 1.859 1.8331.808 1.783 1.759 1.736 1.6901.647 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 3.902 3.808 3.717 3.630 3.546 3.465 3.387 | 3.312 3.240 3.170 3.037 2.914 4.853 4.713 4.580 | 4.452 4.329 4.212 | 4.100 3.993 | 3.890 3.791 3.605 3.433 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 8.566 8.162 7.786 | 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.6505.216 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.805 6.495 5.938 5.453 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 12.134 11.348 10.635 | 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 13.004 12.106 11.296 | 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.8246.9746.265 14.292 | 13.166 12.166 11.274 10.477 | 9.763 9.122 8.544 8.022 7.120 6.373 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 19.660 17.658 15.937 14.451 13.163 | 12.042 11.061 9.442 8.772 7.645 6.743 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 21.243 18.914 16.936 15.247 10.529 9.707 8.985 7.784 6.835 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.8436.873 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.906 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.961 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.1989.370 8.022 6.983 25.808 22.396 19.600 17.292 15.372 12.409 11.258 10.2749.427 8.055 7.003 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 7.499 16% 18% 0.862 0.847 1.605 1.566 2.246 2.174 2.798 2.690 3.274 3.127 3.685 3.498 4.039 3.812 4.344 4.078 4.607 4.303 4.833 4.494 5.029 4.656 5.197 | 4.793 5.3424.910 5.468 5.008 5.575 5.092 5.669 5.162 5.749 5.222 5.818 5.273 5.877 5.316 5.929 5.353 5.973 5.384 6.011 5.410 6.044 5.432 6.073 5.451 6.097 5.467 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.891 4.909 4.925 4.937 4.948 4.956 4.964 4.970 4.975 4.979 15.562 6.550 10.201 6.312 6.359 6.399 6.434 6.464 6.491 6.514 6.534 6.551 6.566 6.118 6.136 6.152 6.166 6.177 5.480 5.492 5.502 5.510 5.517 Print Done Requirement 1. Compute this project's NPV using Venu's 14% hurdle rate. Should Venu invest in the equipment? Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Present Net Cash Inflow PV Factor (i = 14%) Years Value Present value of each year's inflow: (n = 1) (n = 2) (n = 3) (n = 4) (n = 5) 4 (n = 6) Total PV of cash inflows Initial investment Net present value of the project Venu Industries invest in the equipment. should Requirement 2. $76,000 of net ci equipment and value.) h the equipment at the end of six years for $105,000. The refurbished equipment could be used one more year, providing Additionally, the refurbished equipment would have a $50,000 residual value at the end of year 7. Should Venu invest in the ears? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present should not Requirement 2. Venu could refurbish the equipment at the end of six years for $105,000. The refurbished equipment could be used one more year, providing $76,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $50,000 residual value at the end of year 7. Should Venu invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Calculate the NPV of the refurbishment. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for cash outflows and for a negative net present value.) Present Cash (outflow)/inflow PV Factor (i = 14%) Value Refurbishment at the end of Year 6 (n = 6) Cash inflows in Year 7 (n = 7) Residual value (n = 7) Net present value of the refurbishment The refurbishment provides a NPV. The refurbishment NPV is to overcome the original NPV of the equipment. Therefore, the refurbishment Valter Venu Industries' original decision regarding the equipment investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started