Answered step by step

Verified Expert Solution

Question

1 Approved Answer

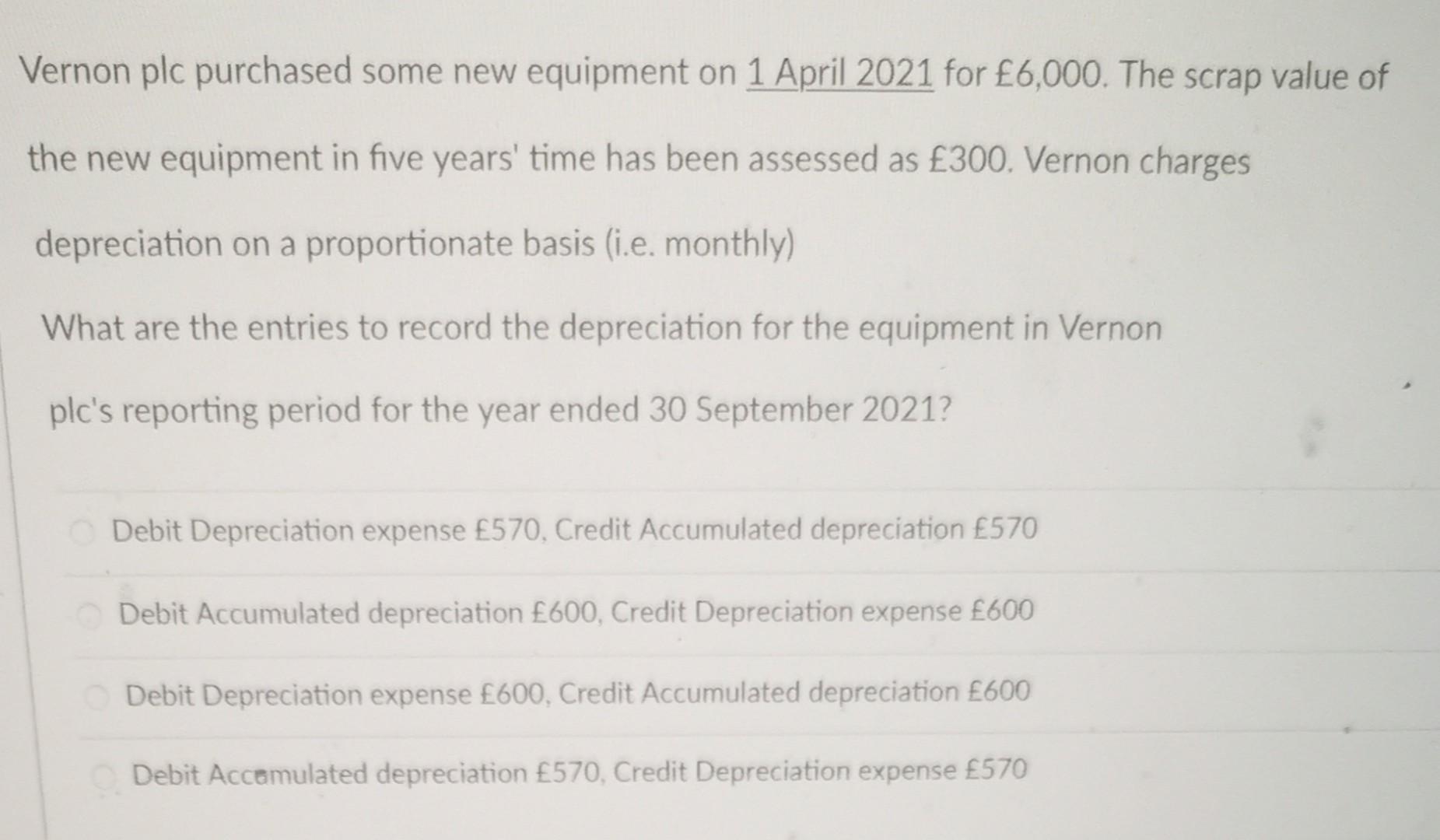

Vernon plc purchased some new equipment on 1 April 2021 for 6,000. The scrap value of the new equipment in five years' time has been

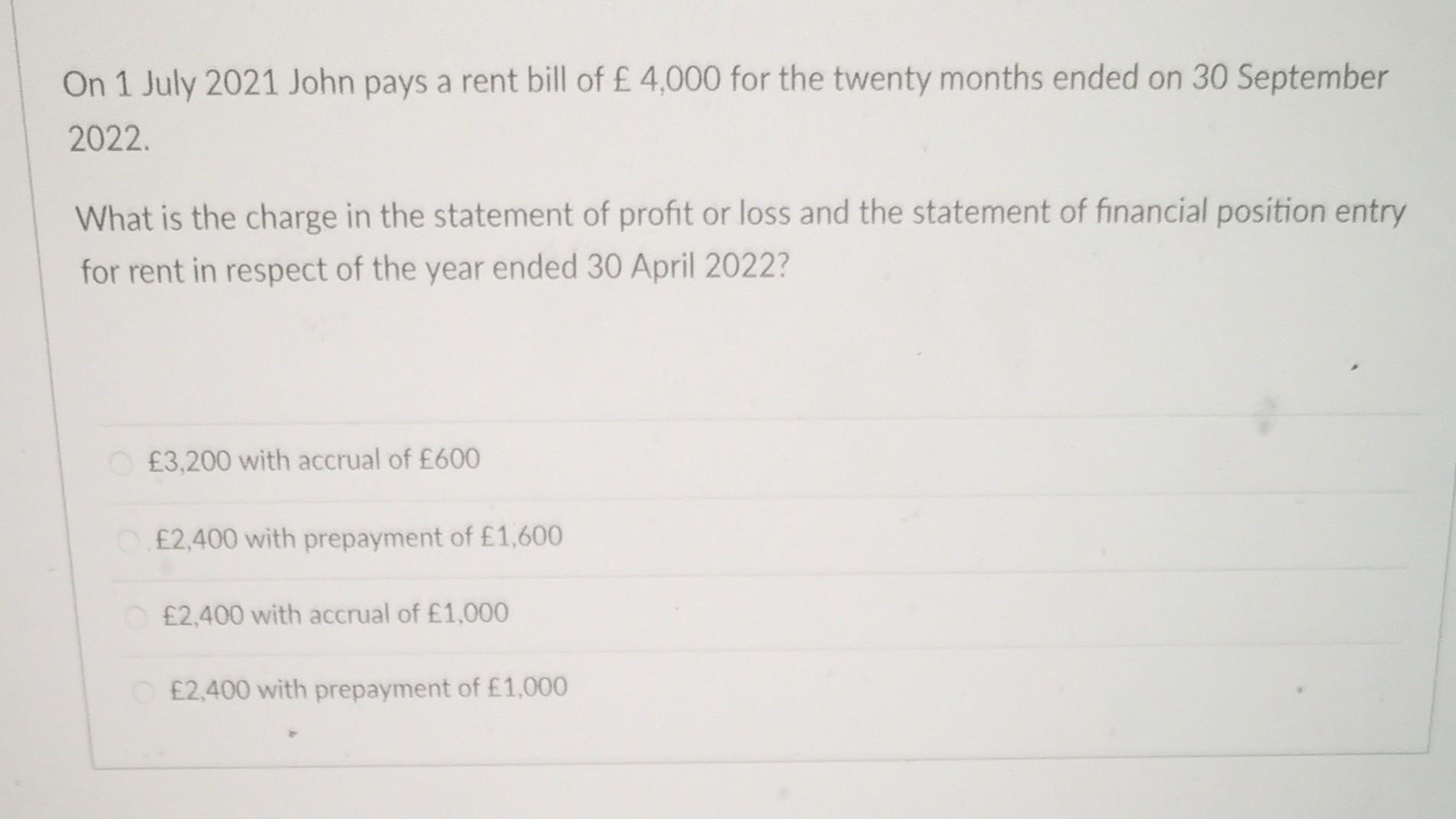

Vernon plc purchased some new equipment on 1 April 2021 for 6,000. The scrap value of the new equipment in five years' time has been assessed as 300. Vernon charges depreciation on a proportionate basis (i.e. monthly) What are the entries to record the depreciation for the equipment in Vernon plc's reporting period for the year ended 30 September 2021? Debit Depreciation expense 570, Credit Accumulated depreciation 570 Debit Accumulated depreciation 600, Credit Depreciation expense 600 Debit Depreciation expense 600, Credit Accumulated depreciation 600 Debit Accemulated depreciation 570, Credit Depreciation expense 570 On 1 July 2021 John pays a rent bill of 4,000 for the twenty months ended on 30 September 2022. What is the charge in the statement of profit or loss and the statement of financial position entry for rent in respect of the year ended 30 April 2022 ? 3,200 with accrual of 600 2,400 with prepayment of 1,600 2,400 with accrual of 1,000 2,400 with prepayment of 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started