Answered step by step

Verified Expert Solution

Question

1 Approved Answer

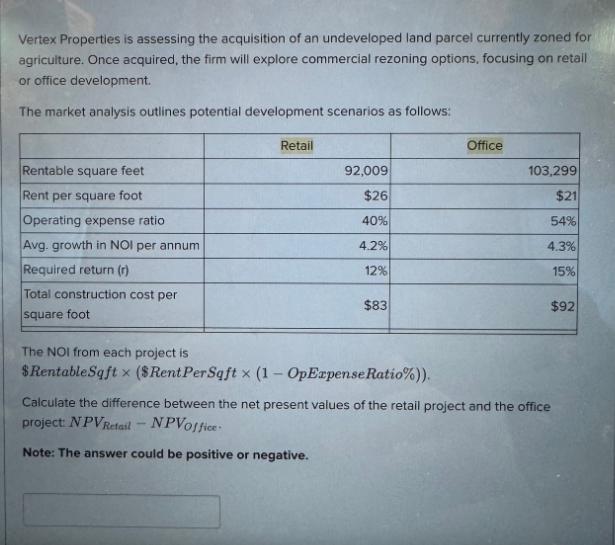

Vertex Properties is assessing the acquisition of an undeveloped land parcel currently zoned for agriculture. Once acquired, the firm will explore commercial rezoning options,

Vertex Properties is assessing the acquisition of an undeveloped land parcel currently zoned for agriculture. Once acquired, the firm will explore commercial rezoning options, focusing on retall or office development. The market analysis outlines potential development scenarios as follows: Rentable square feet Rent per square foot Operating expense ratio Avg. growth in NOI per annum Required return (r) Total construction cost per square foot Retail 92,009 $26 40% 4.2% 12% $83 The NOI from each project is $Rentable Sqft x ($Rent Per Sqft x (1 - OpExpense Ratio%)). Office 103,299 $21 54% 4.3% 15% $92 Calculate the difference between the net present values of the retail project and the office project: NPVRefail - NPVoffice- Note: The answer could be positive or negative.

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the NPVs and their difference ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started