very long question

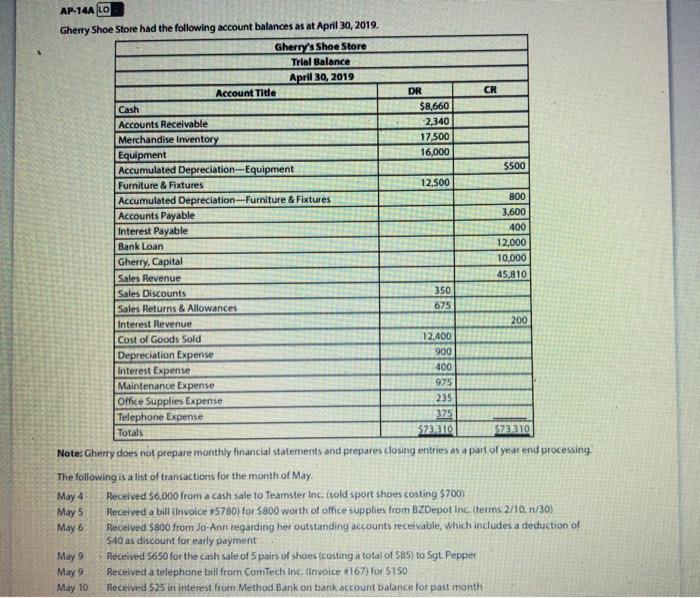

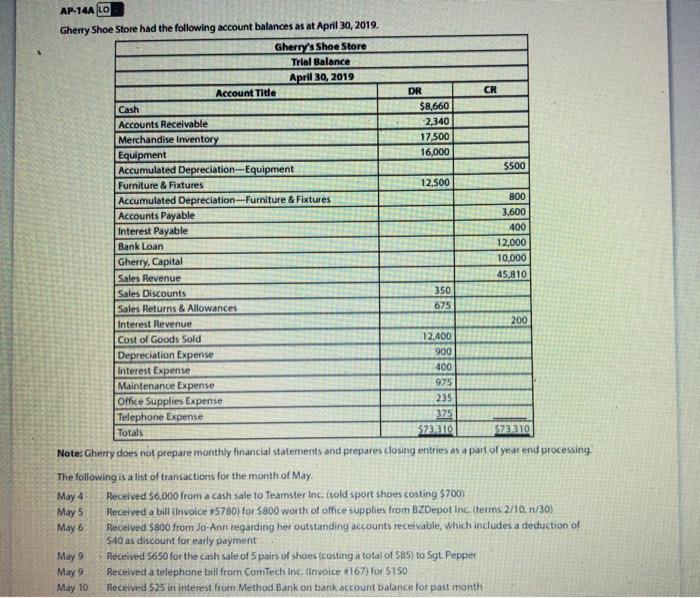

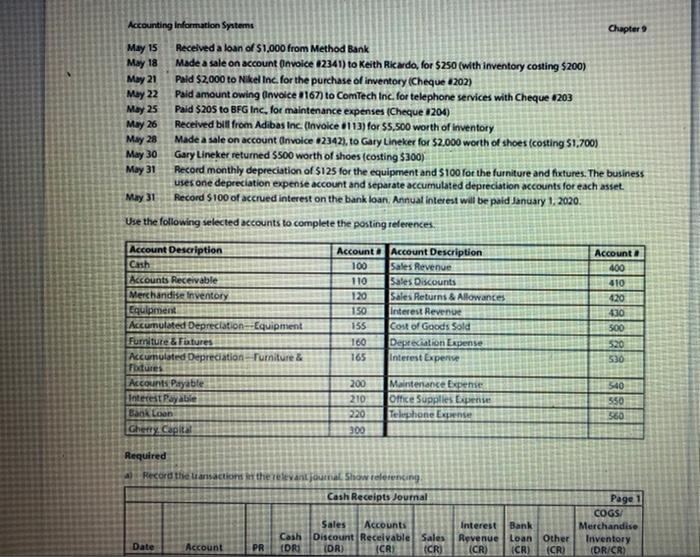

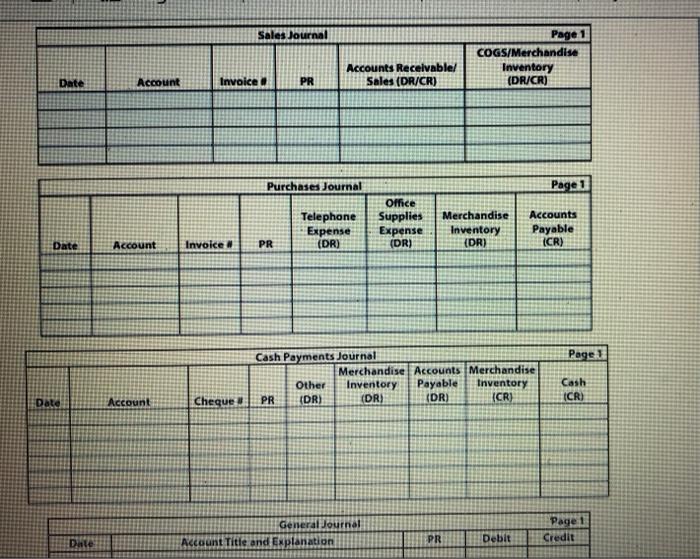

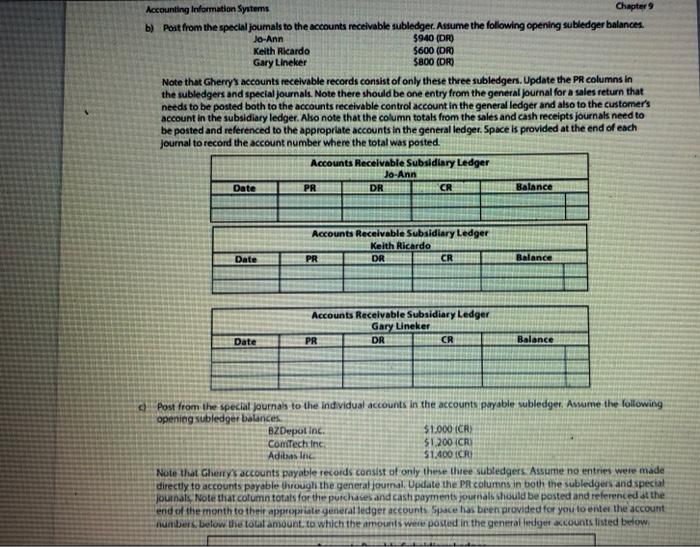

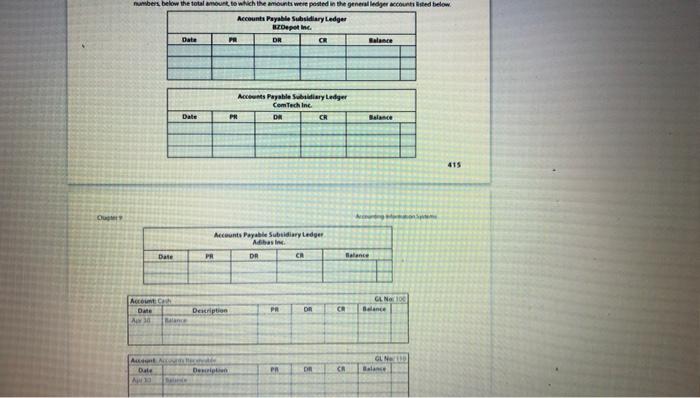

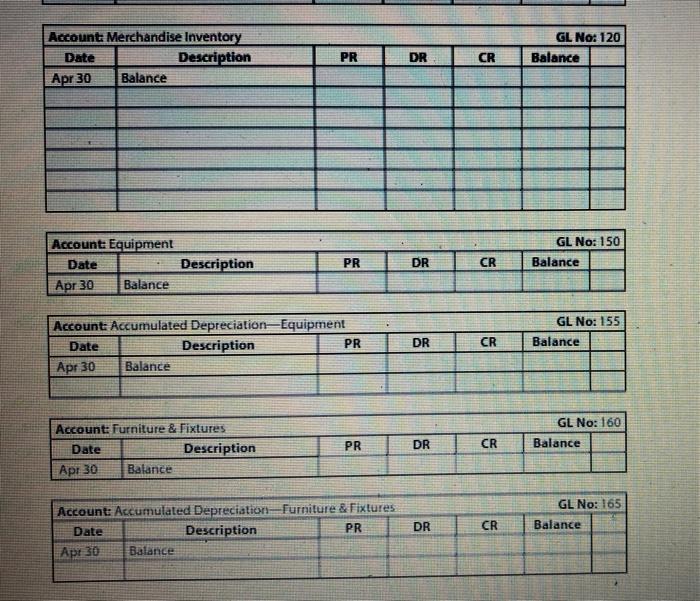

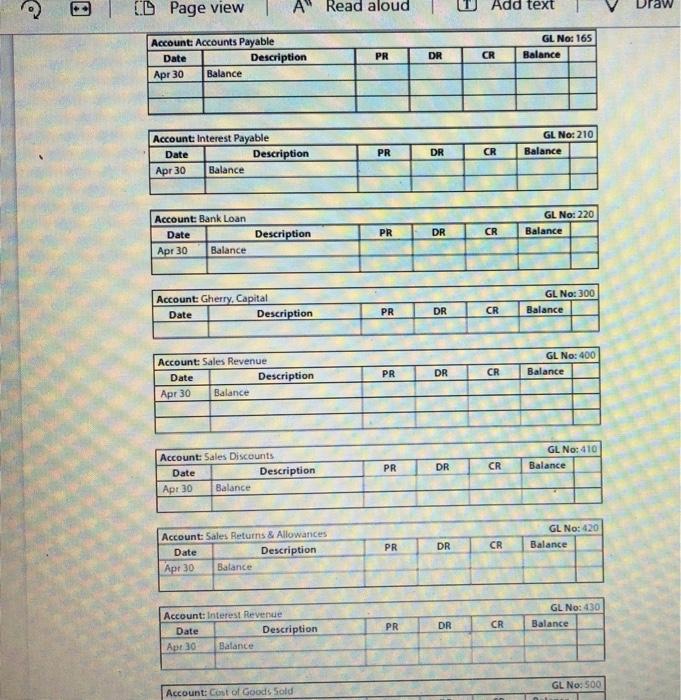

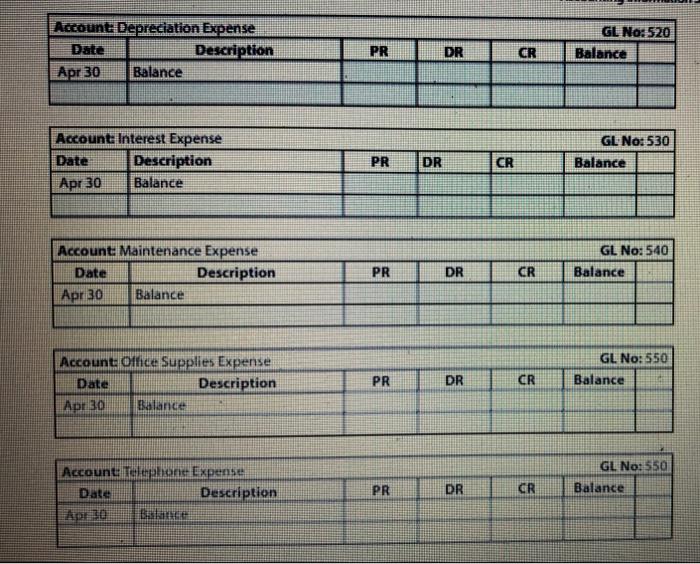

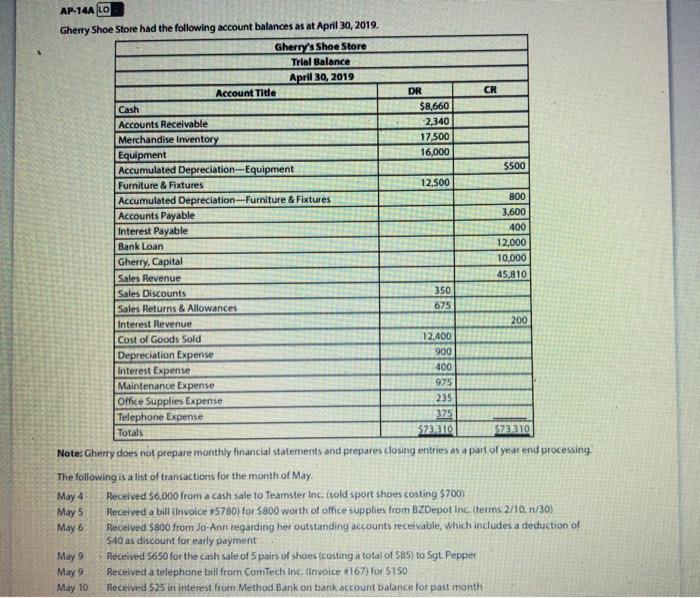

AP-14A LO Gherry Shoe Store had the following account balances as at April 30, 2019. Gherry's Shoe Store Trial Balance April 30, 2019 Account Title DR CR Cash $8,660 Accounts Receivable 2,340 Merchandise Inventory 17,500 Equipment 16,000 Accumulated Depreciation Equipment $500 Furniture & Fixtures 12,500 Accumulated Depreciation--- Furniture & Fixtures 800 Accounts Payable 3,600 Interest Payable 400 Bank Loan 12,000 Gherry, Capital 10,000 Sales Revenue 45,810 Sales Discounts 350 Sales Returns & Allowances 675 Interest Revenue 200 Cost of Goods Sold 12,400 Depreciation Expense 900 Interest Expense 400 Maintenance Expense 975 Office Supplies Expense 235 Telephone Expense 375 Totals 573310 573310 Note: Gherry does not prepare monthly financial statements and prepares closing entries as a part of year end processing. The following is a list of transactions for the month of May. May 4 Received 50,000 from a cash sale to Teamster Inc. (sold sport shoes costing $700) May 5 Received a bill invoice 15780) for $800 worth of office supplies from BZDepot Inc (terms 2/10, 1/30) May 6 Received Skoo from Jo-Ann regarding her outstanding accounts receivable, which includes a deduction of $40 as discount for early payment May 9 Received $650 for the cash sale of 5 pairs of shoes (custing a total of 585) to Sgt. Pepper May 9 Received a telephone bill from ComTech Inc. (Invoice #167) for $150 May 10 Received $25 in interest Iron Method Barik on bank account balance for past month Accounting Information Systems Chapter May 15 Received a loan of $1,000 from Method Bank May 18 Made a sale on account Onvoice 12341) to Keith Ricardo, for $250 (with inventory costing $200) May 21 Pald $2,000 to Nikel Inc. for the purchase of inventory (Cheque #202) May 22 Paid amount owing Invoice 1167) to ComTech Inc. for telephone services with Cheque 1203 May 25 Paid $205 to BFG Inc, for maintenance expenses (Cheque 1204) May 26 Received bill from Adibas Inc. (Invoice 1113) for $5.500 worth of inventory May 28 Made a sale on account (Involce 2342), to Gary Lineker for $2.000 worth of shoes (costing $1,700) May 30 Gary Lineker returned $500 worth of shoes (costing $300) May 31 Record monthly depreciation of $125 for the equipment and 5100 for the furniture and fixtures. The business uses one depreciation expense account and separate accumulated depreciation accounts for each asset May 31 Record S100 of accrued interest on the bank loan, Annual interest will be paid January 1, 2020. Use the following selected accounts to complete the posting references. Account Description Account Account Description Account Cash 100 Sales Revenue 400 Accounts Receivable 110 Sales Discounts 410 Merchandise Inventory 120 Sales Returns & Allowances 420 Equipmers 150 Interest Revenue 430 Accumulated Depreciation -Equipment 155 Cost of Goods Sold 500 Furniture & Fixtures 160 Depreciation Lepense 520 Accumulated Depreciation - Furniture & 165 Interest Expense 530 Fbdures Accounts Payable 200 Maintenance Expense 340 Interest Payable 210 Office Supplies Expense 550 Bank Loan 220 Telephone Expres 560 Ghetty Cat 300 Required Record the ansactions the releval journal Show Telering Cash Receipts Journal Sales Accounts Cash Discount Receivable Sales IDRI (DR) ICRI (CR) Interest Bank Revenue Loan Other (CR) (CR) (CR) Page 1 COGS Merchandise Inventory DR/CR) Date Account PR Sales Journal Page 1 COGS/Merchandise Inventory (DR/CR) Accounts Recelvable! Sales (DR/CR) Date Account Invoice PR Purchases Journal Page 1 Telephone Expense (DR) Office Supplies Expense (DR) Merchandise Inventory (DR) Accounts Payable (CR) Date Account Invoice PR Page 3 Cash Payments Journal Merchandise Accounts Merchandise Other Inventory Payable Inventory PR IDR) (DR) (DR) (CR) Cash (CR) Date Account Cheque General Journal Account Title and explanation Page 1 Credit PR Date Debit Accounting Information Systems Chapter 9 b) Post from the special journals to the accounts receivable subledger. Assume the following opening subledger balances. Jo-Ann $940 (DRO Keith Ricardo $600 (DRO Gary Lineker $800 (DR) Note that Gherrys accounts receivable records consist of only these three subledgers. Update the PR columns in the subledgers and special journals. Note there should be one entry from the general Journal for a sales return that needs to be posted both to the accounts receivable control account in the general ledger and also to the customer's account in the subsidiary ledger. Also note that the column totals from the sales and cash receipts journals need to be posted and referenced to the appropriate accounts in the general ledger. Space is provided at the end of each Journal to record the account number where the total was posted. Accounts Receivable Subsidiary Ledger Jo-Ann Date PR DR CR Balance Accounts Receivable Subsidiary Ledger Keith Ricardo PR DR CR Date Balance Accounts Receivable Subsidiary Ledger Gary Lineker PR DR CR Date Balance Post from the special journals to the individual accounts in the accounts payable subledger. Assume the following opening subledger balances BZDepot Inc. $1.000 (CR) Comitech Inc 51.200 (CR) Adibas Inc 51.400 ICR Note that Ghenry's accounts payable records consist of only these three subledgers. Assume no entries were made directly to accounts payable through the general journal Update the PR columns in both the subledgers and special journals. Note that column totals for the purchases and cash payments journals should be posted and referenced at the end of the month to their appropriate general ledger accounts Space has been provided for you to enter the account numbers below the total amount to which the amounts were posted in the general ledger accounts listed below numbers below the total amount to which the amounts were posted in the general ledger accounts listed below. Accounts PayableSubsidiary Ledger Depot Inc. Date PR DR CR Balance Acts PayableSubsidiary Ledger ComTech Inc. PR DA CR Date state 415 Accounts PayableSubsidiary Ledger Abbasing Date PR DR CA Balance Account Date A GLN 100 Balance Description PR CR CE Auch Dale Design GL NA Balance PR CA Account Merchandise Inventory Date Description Balance GL No: 120 Balance PR DR CR Apr 30 GL No: 150 Account Equipment Date Description Balance PR DR CR Balance Apr 30 Account Accumulated Depreciation Equipment Date Description PR Balance GL No: 155 Balance DR CR Apr 30 GL No: 160 PR DR CR Balance Account: Furniture & Fixtures Date Description Apr 30 Balance Account: Accumulated Depreciation Furniture & Fixtures Date Description PR Balance GL No: 165 Balance DR CR Apr 30 (D Page view A Read aloud Add text Draw Account Accounts Payable Date Description Balance GL No: 165 Balance PR DR CR Apr 30 Account Interest Payable Date Description Balance GL No: 210 Balance PR DR CR Apr 30 Account Bank Loan Date Description Apr 30 Balance GL No: 220 Balance PR DR CR Account: Gherry, Capital Date Description GL No: 300 Balance PR DR CR GL NO: 400 Balance PR DR CR Account Sales Revenue Date Description Apr 30 Balance GL No: 410 Balance PR DR CR Account: Sales Discounts Date Description Balance Apr 30 GL No: 420 Balance PR DR CR Account Sales Returns & Allowances Date Description Apr 30 Balance GL No: 430 Balance PR DR CR Account: Interest Revenue Date Description Apr 30 Balance GL No: 500 Account: Cost of Goods Sold Account Depreciation Expense Date Description Apr 30 Balance GL No:520 Balance PR DR CR Account Interest Expense Date Description Balance GL No: 530 Balance PR DR CR Apr 30 Account Maintenance Expense Date Description Balance GL No: 540 Balance PR DR CR Apr 30 Account Office Supplies Expense Date Description Balance GL No: 550 Balance PR DR CR Apr 30 GL No: 550 Balance Account consExpense Date Description Apr 10 Balance PR DR CR AP-14A LO Gherry Shoe Store had the following account balances as at April 30, 2019. Gherry's Shoe Store Trial Balance April 30, 2019 Account Title DR CR Cash $8,660 Accounts Receivable 2,340 Merchandise Inventory 17,500 Equipment 16,000 Accumulated Depreciation Equipment $500 Furniture & Fixtures 12,500 Accumulated Depreciation--- Furniture & Fixtures 800 Accounts Payable 3,600 Interest Payable 400 Bank Loan 12,000 Gherry, Capital 10,000 Sales Revenue 45,810 Sales Discounts 350 Sales Returns & Allowances 675 Interest Revenue 200 Cost of Goods Sold 12,400 Depreciation Expense 900 Interest Expense 400 Maintenance Expense 975 Office Supplies Expense 235 Telephone Expense 375 Totals 573310 573310 Note: Gherry does not prepare monthly financial statements and prepares closing entries as a part of year end processing. The following is a list of transactions for the month of May. May 4 Received 50,000 from a cash sale to Teamster Inc. (sold sport shoes costing $700) May 5 Received a bill invoice 15780) for $800 worth of office supplies from BZDepot Inc (terms 2/10, 1/30) May 6 Received Skoo from Jo-Ann regarding her outstanding accounts receivable, which includes a deduction of $40 as discount for early payment May 9 Received $650 for the cash sale of 5 pairs of shoes (custing a total of 585) to Sgt. Pepper May 9 Received a telephone bill from ComTech Inc. (Invoice #167) for $150 May 10 Received $25 in interest Iron Method Barik on bank account balance for past month Accounting Information Systems Chapter May 15 Received a loan of $1,000 from Method Bank May 18 Made a sale on account Onvoice 12341) to Keith Ricardo, for $250 (with inventory costing $200) May 21 Pald $2,000 to Nikel Inc. for the purchase of inventory (Cheque #202) May 22 Paid amount owing Invoice 1167) to ComTech Inc. for telephone services with Cheque 1203 May 25 Paid $205 to BFG Inc, for maintenance expenses (Cheque 1204) May 26 Received bill from Adibas Inc. (Invoice 1113) for $5.500 worth of inventory May 28 Made a sale on account (Involce 2342), to Gary Lineker for $2.000 worth of shoes (costing $1,700) May 30 Gary Lineker returned $500 worth of shoes (costing $300) May 31 Record monthly depreciation of $125 for the equipment and 5100 for the furniture and fixtures. The business uses one depreciation expense account and separate accumulated depreciation accounts for each asset May 31 Record S100 of accrued interest on the bank loan, Annual interest will be paid January 1, 2020. Use the following selected accounts to complete the posting references. Account Description Account Account Description Account Cash 100 Sales Revenue 400 Accounts Receivable 110 Sales Discounts 410 Merchandise Inventory 120 Sales Returns & Allowances 420 Equipmers 150 Interest Revenue 430 Accumulated Depreciation -Equipment 155 Cost of Goods Sold 500 Furniture & Fixtures 160 Depreciation Lepense 520 Accumulated Depreciation - Furniture & 165 Interest Expense 530 Fbdures Accounts Payable 200 Maintenance Expense 340 Interest Payable 210 Office Supplies Expense 550 Bank Loan 220 Telephone Expres 560 Ghetty Cat 300 Required Record the ansactions the releval journal Show Telering Cash Receipts Journal Sales Accounts Cash Discount Receivable Sales IDRI (DR) ICRI (CR) Interest Bank Revenue Loan Other (CR) (CR) (CR) Page 1 COGS Merchandise Inventory DR/CR) Date Account PR Sales Journal Page 1 COGS/Merchandise Inventory (DR/CR) Accounts Recelvable! Sales (DR/CR) Date Account Invoice PR Purchases Journal Page 1 Telephone Expense (DR) Office Supplies Expense (DR) Merchandise Inventory (DR) Accounts Payable (CR) Date Account Invoice PR Page 3 Cash Payments Journal Merchandise Accounts Merchandise Other Inventory Payable Inventory PR IDR) (DR) (DR) (CR) Cash (CR) Date Account Cheque General Journal Account Title and explanation Page 1 Credit PR Date Debit Accounting Information Systems Chapter 9 b) Post from the special journals to the accounts receivable subledger. Assume the following opening subledger balances. Jo-Ann $940 (DRO Keith Ricardo $600 (DRO Gary Lineker $800 (DR) Note that Gherrys accounts receivable records consist of only these three subledgers. Update the PR columns in the subledgers and special journals. Note there should be one entry from the general Journal for a sales return that needs to be posted both to the accounts receivable control account in the general ledger and also to the customer's account in the subsidiary ledger. Also note that the column totals from the sales and cash receipts journals need to be posted and referenced to the appropriate accounts in the general ledger. Space is provided at the end of each Journal to record the account number where the total was posted. Accounts Receivable Subsidiary Ledger Jo-Ann Date PR DR CR Balance Accounts Receivable Subsidiary Ledger Keith Ricardo PR DR CR Date Balance Accounts Receivable Subsidiary Ledger Gary Lineker PR DR CR Date Balance Post from the special journals to the individual accounts in the accounts payable subledger. Assume the following opening subledger balances BZDepot Inc. $1.000 (CR) Comitech Inc 51.200 (CR) Adibas Inc 51.400 ICR Note that Ghenry's accounts payable records consist of only these three subledgers. Assume no entries were made directly to accounts payable through the general journal Update the PR columns in both the subledgers and special journals. Note that column totals for the purchases and cash payments journals should be posted and referenced at the end of the month to their appropriate general ledger accounts Space has been provided for you to enter the account numbers below the total amount to which the amounts were posted in the general ledger accounts listed below numbers below the total amount to which the amounts were posted in the general ledger accounts listed below. Accounts PayableSubsidiary Ledger Depot Inc. Date PR DR CR Balance Acts PayableSubsidiary Ledger ComTech Inc. PR DA CR Date state 415 Accounts PayableSubsidiary Ledger Abbasing Date PR DR CA Balance Account Date A GLN 100 Balance Description PR CR CE Auch Dale Design GL NA Balance PR CA Account Merchandise Inventory Date Description Balance GL No: 120 Balance PR DR CR Apr 30 GL No: 150 Account Equipment Date Description Balance PR DR CR Balance Apr 30 Account Accumulated Depreciation Equipment Date Description PR Balance GL No: 155 Balance DR CR Apr 30 GL No: 160 PR DR CR Balance Account: Furniture & Fixtures Date Description Apr 30 Balance Account: Accumulated Depreciation Furniture & Fixtures Date Description PR Balance GL No: 165 Balance DR CR Apr 30 (D Page view A Read aloud Add text Draw Account Accounts Payable Date Description Balance GL No: 165 Balance PR DR CR Apr 30 Account Interest Payable Date Description Balance GL No: 210 Balance PR DR CR Apr 30 Account Bank Loan Date Description Apr 30 Balance GL No: 220 Balance PR DR CR Account: Gherry, Capital Date Description GL No: 300 Balance PR DR CR GL NO: 400 Balance PR DR CR Account Sales Revenue Date Description Apr 30 Balance GL No: 410 Balance PR DR CR Account: Sales Discounts Date Description Balance Apr 30 GL No: 420 Balance PR DR CR Account Sales Returns & Allowances Date Description Apr 30 Balance GL No: 430 Balance PR DR CR Account: Interest Revenue Date Description Apr 30 Balance GL No: 500 Account: Cost of Goods Sold Account Depreciation Expense Date Description Apr 30 Balance GL No:520 Balance PR DR CR Account Interest Expense Date Description Balance GL No: 530 Balance PR DR CR Apr 30 Account Maintenance Expense Date Description Balance GL No: 540 Balance PR DR CR Apr 30 Account Office Supplies Expense Date Description Balance GL No: 550 Balance PR DR CR Apr 30 GL No: 550 Balance Account consExpense Date Description Apr 10 Balance PR DR CR