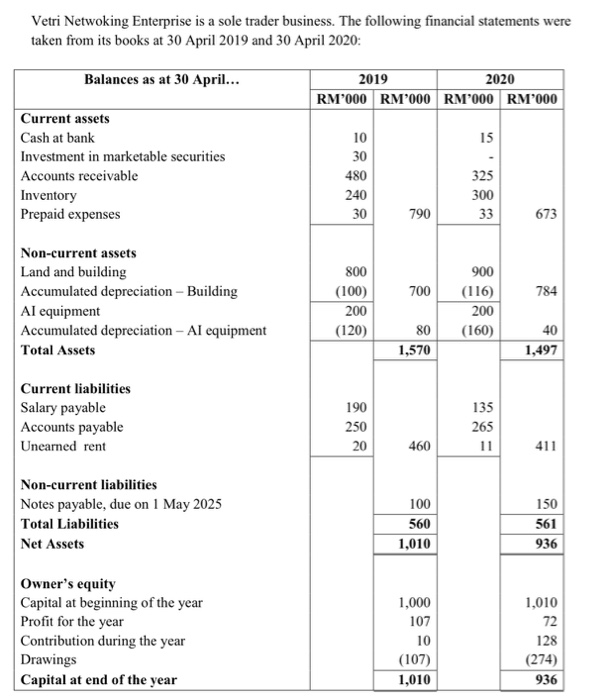

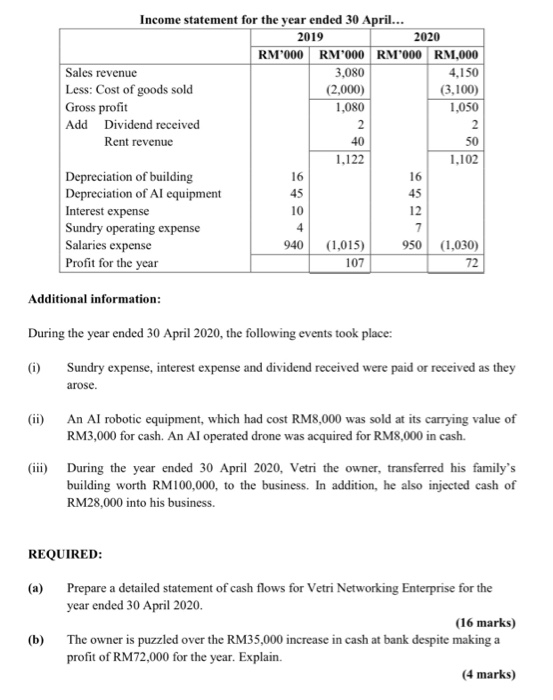

Vetri Netwoking Enterprise is a sole trader business. The following financial statements were taken from its books at 30 April 2019 and 30 April 2020: Balances as at 30 April... 2019 2020 RM'000 RM'000 RM'000 RM'000 15 30 Current assets Cash at bank Investment in marketable securities Accounts receivable Inventory Prepaid expenses 480 790 900 700 (116) 784 Non-current assets Land and building Accumulated depreciation - Building Al equipment Accumulated depreciation - Al equipment Total Assets 800 (100) 200 (120) 200 (160) 80 1,570 1,497 Current liabilities Salary payable Accounts payable Unearned rent 190 250 135 265 411 100 Non-current liabilities Notes payable, due on 1 May 2025 Total Liabilities Net Assets 560 1,010 1,010 1,000 107 Owner's equity Capital at beginning of the year Profit for the year Contribution during the year Drawings Capital at end of the year (107) 1,010 128 (274) 936 Income statement for the year ended 30 April... 2019 2020 RM9000 RM'000 RM000 RM,000 Sales revenue 3,080 4,150 Less: Cost of goods sold (2.000) (3,100) Gross profit 1,080 1,050 Add Dividend received Rent revenue 1.102 Depreciation of building Depreciation of Al equipment Interest expense Sundry operating expense Salaries expense 940 (1,01 950 (1.030) 107 72 1.122 Additional information: During the year ended 30 April 2020, the following events took place: (1) Sundry expense, interest expense and dividend received were paid or received as they arose. An Al robotic equipment, which had cost RM8,000 was sold at its carrying value of RM3,000 for cash. An Al operated drone was acquired for RM8,000 in cash. (iii) During the year ended 30 April 2020, Vetri the owner, transferred his family's building worth RM100,000, to the business. In addition, he also injected cash of RM28,000 into his business. REQUIRED: (a) Prepare a detailed statement of cash flows for Vetri Networking Enterprise for the year ended 30 April 2020. (16 marks) The owner is puzzled over the RM35,000 increase in cash at bank despite making a profit of RM72,000 for the year. Explain. (4 marks) (b) Vetri Netwoking Enterprise is a sole trader business. The following financial statements were taken from its books at 30 April 2019 and 30 April 2020: Balances as at 30 April... 2019 2020 RM'000 RM'000 RM'000 RM'000 15 30 Current assets Cash at bank Investment in marketable securities Accounts receivable Inventory Prepaid expenses 480 790 900 700 (116) 784 Non-current assets Land and building Accumulated depreciation - Building Al equipment Accumulated depreciation - Al equipment Total Assets 800 (100) 200 (120) 200 (160) 80 1,570 1,497 Current liabilities Salary payable Accounts payable Unearned rent 190 250 135 265 411 100 Non-current liabilities Notes payable, due on 1 May 2025 Total Liabilities Net Assets 560 1,010 1,010 1,000 107 Owner's equity Capital at beginning of the year Profit for the year Contribution during the year Drawings Capital at end of the year (107) 1,010 128 (274) 936 Income statement for the year ended 30 April... 2019 2020 RM9000 RM'000 RM000 RM,000 Sales revenue 3,080 4,150 Less: Cost of goods sold (2.000) (3,100) Gross profit 1,080 1,050 Add Dividend received Rent revenue 1.102 Depreciation of building Depreciation of Al equipment Interest expense Sundry operating expense Salaries expense 940 (1,01 950 (1.030) 107 72 1.122 Additional information: During the year ended 30 April 2020, the following events took place: (1) Sundry expense, interest expense and dividend received were paid or received as they arose. An Al robotic equipment, which had cost RM8,000 was sold at its carrying value of RM3,000 for cash. An Al operated drone was acquired for RM8,000 in cash. (iii) During the year ended 30 April 2020, Vetri the owner, transferred his family's building worth RM100,000, to the business. In addition, he also injected cash of RM28,000 into his business. REQUIRED: (a) Prepare a detailed statement of cash flows for Vetri Networking Enterprise for the year ended 30 April 2020. (16 marks) The owner is puzzled over the RM35,000 increase in cash at bank despite making a profit of RM72,000 for the year. Explain. (4 marks) (b)