Answered step by step

Verified Expert Solution

Question

1 Approved Answer

vh 45,00,000 72,00,000 8,00,000 12,50,000 5,00,000 7,50,000 20,00,000 8,00,000 12,00,000 24,75,000 10,00.000 15,00,000 Sales Revenue Variable Costs : Direct Materials @ Rs.5 Factory Labour @

vh

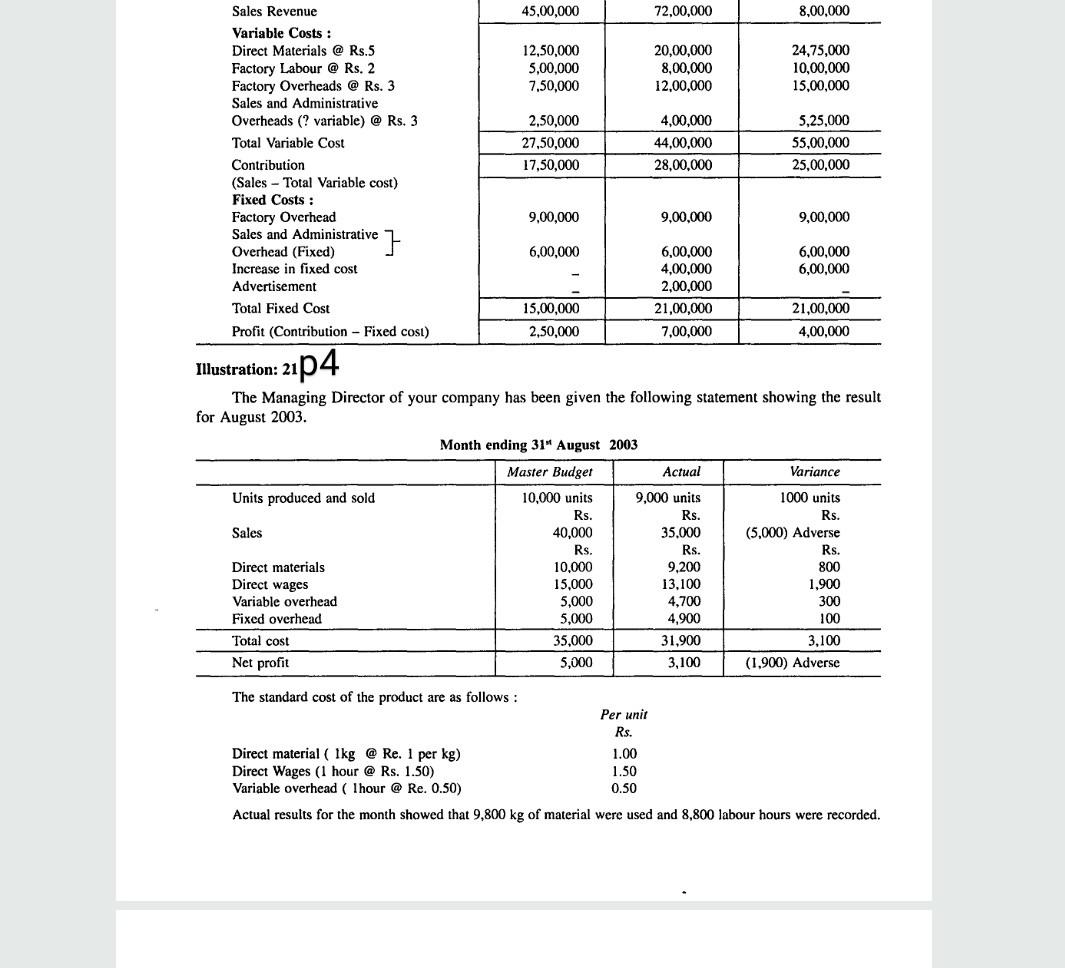

45,00,000 72,00,000 8,00,000 12,50,000 5,00,000 7,50,000 20,00,000 8,00,000 12,00,000 24,75,000 10,00.000 15,00,000 Sales Revenue Variable Costs : Direct Materials @ Rs.5 Factory Labour @ Rs. 2 Factory Overheads @ Rs. 3 Sales and Administrative Overheads (? variable) @ Rs. 3 Total Variable Cost Contribution (Sales - Total Variable cost) Fixed Costs : Factory Overhead 2,50,000 27,50,000 17,50,000 4,00,000 44,00,000 28,00,000 5,25,000 55,00,000 25,00,000 9,00,000 9,00,000 9,00,000 Sales and Administrative ] 6,00,000 6,00,000 6,00,000 Overhead (Fixed) Increase in fixed cost Advertisement Total Fixed Cost Profit (Contribution - Fixed cost) 6,00,000 4,00,000 2,00,000 21,00,000 7,00,000 15,00,000 21,00,000 4,00,000 2,50,000 :21P4 Illustration: 21 The Managing Director of your company has been given the following statement showing the result for August 2003. Month ending 31 August 2003 Master Budget Actual Variance Units produced and sold 10,000 units 9,000 units 1000 units Rs. Rs. Rs. Sales 40,000 35.000 (5,000) Adverse Rs. Rs. Rs. Direct materials 10,000 9,200 800 Direct wages 15,000 13.100 1,900 Variable overhead 5,000 4.700 300 Fixed overhead 5.000 4,900 100 Total cost 35.000 31,900 3,100 Net profit 5,000 3,100 (1,900) Adverse The standard cost of the product are as follows: Per unit Rs. Direct material ( 1kg @ Re. I per kg) 1.00 Direct Wages (1 hour @ Rs. 1.50) 1.50 Variable overhead ( 1hour @ Re. 0.50) 0.50 Actual results for the month showed that 9,800 kg of material were used and 8,800 labour hours were recordedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started