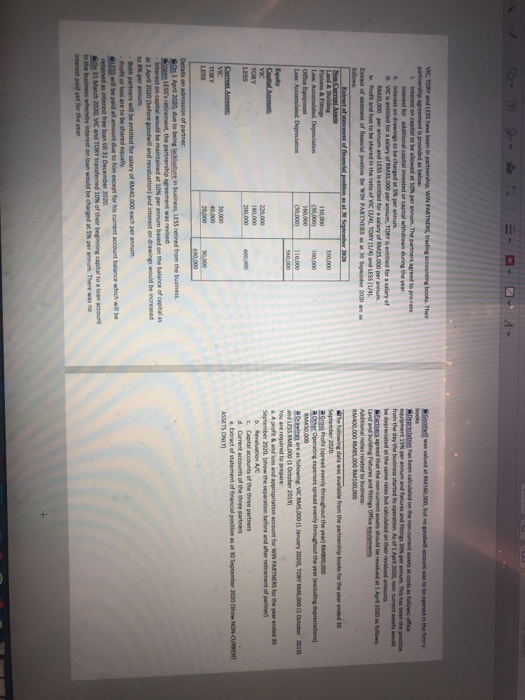

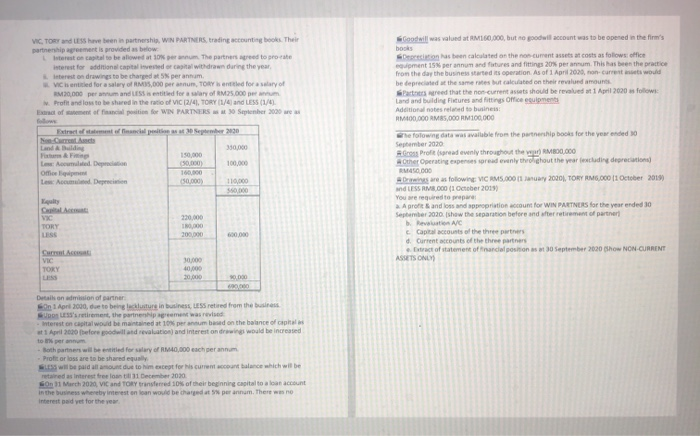

VICTORY and Les have been in partnershi WIN PARTNERS, trading accounting books. Their partnership agreement is provided as below: Linterest on capital to be allowed at 10% per annum. The partners agreed to probe Interest for additional capital invested or capital thdrawn during the year Interest on drawings to be charged per annum Ventitled for a story of RM35,000 per annum, TORY is entitled for a salary of RM20,000 per annum and LESS is led for a salary of RMOS.000 peran . Profit and loss to be shared in the ratio of VIC 2/4TORY 1/4 and LESS (1/41 Extract of women official position for WIN PARTNERS 3 September 2020 Wh Extract of statement of facilities September 3030 Nena Land Building 15000 150,00 Acested. Depreciation (50.000) 100 000 Office Equipment 160,000 Low: Accumulated. Depreciation (50,000 110,000 560.000 Equity Capital Account VIC 220.000 TORY 10.000 LESS 200.000 600,000 Site RM160,000, but no podia to be opened in the firm's books Depreciation has been calculated on the noncorrentes coses flow office equipment 15% per annum and futures and finger. This has been the practice from the day the business and is operation. As of 1 April 2000, no currenties be depreciated at the same rates buted on the revered mounts Partners agreed that the non-currents should be revalued 1 Apr 2000 as follow Land and building Futures and fittings Office Additional notes related to businew RM 400,000 RM85.000 RM500,000 the following data was available from the partnership boots for the year ended 10 September 2020 Grow Profit read evenly throughout the year M,000 Other Operating expenses spread evenly throughout the year excluding depreciation RM50,000 Bwire as following VIC RM5,00011 January 20201 TORY ME.001 October 2014 SS RM8,000(1 October 2010 You are required to prepare: a. A profit & and loss and appropriation count for WIN PARTNERS for the year ended 30 September 2000 (show the separation before and after retirement of partner Revelation A/C Capital accounts of the three partners d. Current accounts of the three partners . Extract of statement of financial position as at 30 September 2010 Show NON-CURRENT ASSETS ONLY) VIC TORY 30.000 20,000 90,000 Details on admission of partner son 1 Apr 2030, due to being back in business, LESS retired from the business Upon LESS's retirement, the partnership greement was revised Interest on capital would be maintained at 1o per annum based on the balance of capitals 1 April 2020 efore goodwill and evaluation and interest on drawings would be increased to per annum Both partners will be entitled for salary of RM10,000 each per annum -Profit or loss are to be shared equally, US will be paid al amount due to him except for his current account balance which will be retained as interest free loan 31 December 2020 Son 31 March 2020, VIC and TORY transferred 10% of their beginning capital to a loan account in the business whereby interest on loan would be charged ut per annum. There was no interest paid yet for the year VICTORY and have been in partners, WIN PARTNERS, trading accounting books. Their partnership agreement is provided as below Interest on capital to be allowed to the partnered to prostate interest for additional capital invested or capital withdrawn during the year interest on drawings to be charged at 5% per annum VIC entitled for a salary of AMOS,000 per annum, TORY entitled for a salary of RM20,000 per annum and LSS is entitled for a salary of RM25,000 per Profit and loss to be shared in the ratio of VC 12/4. TORY (1/4 and LESS (1/4) met of ement of financial position for WIN PARTNERS - September 2000 we Extract of statement facile 30 September 2000 Neueste Land Building 350,000 Low Accumulated. Depreciation 50.000 100.000 Office Les Accu Deprem 110.000 550.000 Equity Goodwill was valued at RM160,000, but to goodwill account was to be opened in the firm's books Sections been calculated on the non-current assets at costs as foliows office cuipment 15 per annum and futures and fittings 20% per annum. This has been the practice from the day the business started its operation. As of 1 April 2020, noncurrents would be depreciated the same rates but calculated on the evalued amounts Partners wreed that the non-current assets should be revalued at 1 April 2020 follow Land and building Fixtures and fittings Oficines Additional terelned to business RM10.000 RMSS.O00 RM100.000 refolown data was available from the partnership books for the year ended 30 September 2020 Gross Pro read evenly throughout the WROO,000 Other Operating perces read evenly the ghout the year excluding depreciations) RM40.000 Drws are as following VIC RM5.000 11 ay 2000, TORY RM6,000 11 October 2015) and LESS RIV.000(1 October 2015) You are required to prepare Aprofit & and loss and propriation account for WIN PARTNERS for the year ended 30 September 2020. show the separation before and after retirement of partner b. Revelation NC Capital accounts of the three partners d. Current accounts of the three partners tract of statement of Financial sonst 30 September 2020 (how NON CURRENT ASSETS ONLY TORY 200.000 0.000 Current VIC TOKY 40.000 30,000 0.000 Details on admission of partner On 1 April 2000, to being cluture in business, LESS retired from the business LESS's retirement, the partneringement was revised - Interest on capital would be maintained at 10% per annum based on the balance of capital 1 April 2010 Defore wild revolution and interest on drawings would be increased to per annum Both parties will be entitled for salary of RM40,000 each per annum Profit or loss are to be shared equally LSS will be paid all amount due to him except for his current account balance which will be retained as interest tree loan till 31 December 2010 On 31 March 2020, VI and TORY transferred 10% of the beginning capital to a loan account in the business whereby interest on an would be that per annum. There was no Interest and yet for the ye VICTORY and Les have been in partnershi WIN PARTNERS, trading accounting books. Their partnership agreement is provided as below: Linterest on capital to be allowed at 10% per annum. The partners agreed to probe Interest for additional capital invested or capital thdrawn during the year Interest on drawings to be charged per annum Ventitled for a story of RM35,000 per annum, TORY is entitled for a salary of RM20,000 per annum and LESS is led for a salary of RMOS.000 peran . Profit and loss to be shared in the ratio of VIC 2/4TORY 1/4 and LESS (1/41 Extract of women official position for WIN PARTNERS 3 September 2020 Wh Extract of statement of facilities September 3030 Nena Land Building 15000 150,00 Acested. Depreciation (50.000) 100 000 Office Equipment 160,000 Low: Accumulated. Depreciation (50,000 110,000 560.000 Equity Capital Account VIC 220.000 TORY 10.000 LESS 200.000 600,000 Site RM160,000, but no podia to be opened in the firm's books Depreciation has been calculated on the noncorrentes coses flow office equipment 15% per annum and futures and finger. This has been the practice from the day the business and is operation. As of 1 April 2000, no currenties be depreciated at the same rates buted on the revered mounts Partners agreed that the non-currents should be revalued 1 Apr 2000 as follow Land and building Futures and fittings Office Additional notes related to businew RM 400,000 RM85.000 RM500,000 the following data was available from the partnership boots for the year ended 10 September 2020 Grow Profit read evenly throughout the year M,000 Other Operating expenses spread evenly throughout the year excluding depreciation RM50,000 Bwire as following VIC RM5,00011 January 20201 TORY ME.001 October 2014 SS RM8,000(1 October 2010 You are required to prepare: a. A profit & and loss and appropriation count for WIN PARTNERS for the year ended 30 September 2000 (show the separation before and after retirement of partner Revelation A/C Capital accounts of the three partners d. Current accounts of the three partners . Extract of statement of financial position as at 30 September 2010 Show NON-CURRENT ASSETS ONLY) VIC TORY 30.000 20,000 90,000 Details on admission of partner son 1 Apr 2030, due to being back in business, LESS retired from the business Upon LESS's retirement, the partnership greement was revised Interest on capital would be maintained at 1o per annum based on the balance of capitals 1 April 2020 efore goodwill and evaluation and interest on drawings would be increased to per annum Both partners will be entitled for salary of RM10,000 each per annum -Profit or loss are to be shared equally, US will be paid al amount due to him except for his current account balance which will be retained as interest free loan 31 December 2020 Son 31 March 2020, VIC and TORY transferred 10% of their beginning capital to a loan account in the business whereby interest on loan would be charged ut per annum. There was no interest paid yet for the year VICTORY and have been in partners, WIN PARTNERS, trading accounting books. Their partnership agreement is provided as below Interest on capital to be allowed to the partnered to prostate interest for additional capital invested or capital withdrawn during the year interest on drawings to be charged at 5% per annum VIC entitled for a salary of AMOS,000 per annum, TORY entitled for a salary of RM20,000 per annum and LSS is entitled for a salary of RM25,000 per Profit and loss to be shared in the ratio of VC 12/4. TORY (1/4 and LESS (1/4) met of ement of financial position for WIN PARTNERS - September 2000 we Extract of statement facile 30 September 2000 Neueste Land Building 350,000 Low Accumulated. Depreciation 50.000 100.000 Office Les Accu Deprem 110.000 550.000 Equity Goodwill was valued at RM160,000, but to goodwill account was to be opened in the firm's books Sections been calculated on the non-current assets at costs as foliows office cuipment 15 per annum and futures and fittings 20% per annum. This has been the practice from the day the business started its operation. As of 1 April 2020, noncurrents would be depreciated the same rates but calculated on the evalued amounts Partners wreed that the non-current assets should be revalued at 1 April 2020 follow Land and building Fixtures and fittings Oficines Additional terelned to business RM10.000 RMSS.O00 RM100.000 refolown data was available from the partnership books for the year ended 30 September 2020 Gross Pro read evenly throughout the WROO,000 Other Operating perces read evenly the ghout the year excluding depreciations) RM40.000 Drws are as following VIC RM5.000 11 ay 2000, TORY RM6,000 11 October 2015) and LESS RIV.000(1 October 2015) You are required to prepare Aprofit & and loss and propriation account for WIN PARTNERS for the year ended 30 September 2020. show the separation before and after retirement of partner b. Revelation NC Capital accounts of the three partners d. Current accounts of the three partners tract of statement of Financial sonst 30 September 2020 (how NON CURRENT ASSETS ONLY TORY 200.000 0.000 Current VIC TOKY 40.000 30,000 0.000 Details on admission of partner On 1 April 2000, to being cluture in business, LESS retired from the business LESS's retirement, the partneringement was revised - Interest on capital would be maintained at 10% per annum based on the balance of capital 1 April 2010 Defore wild revolution and interest on drawings would be increased to per annum Both parties will be entitled for salary of RM40,000 each per annum Profit or loss are to be shared equally LSS will be paid all amount due to him except for his current account balance which will be retained as interest tree loan till 31 December 2010 On 31 March 2020, VI and TORY transferred 10% of the beginning capital to a loan account in the business whereby interest on an would be that per annum. There was no Interest and yet for the ye