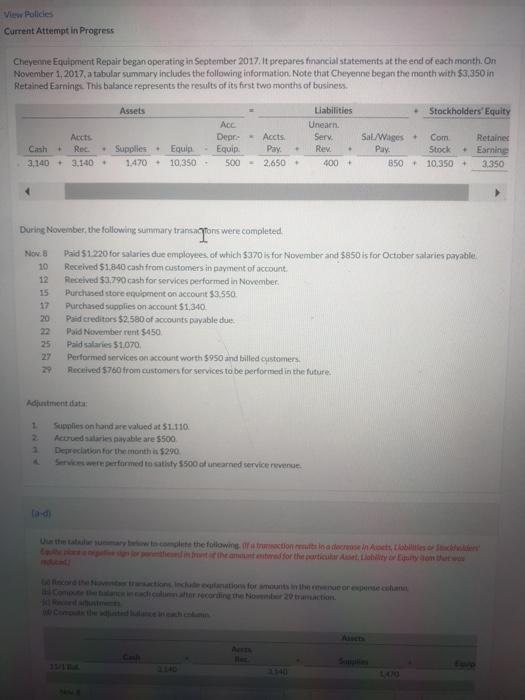

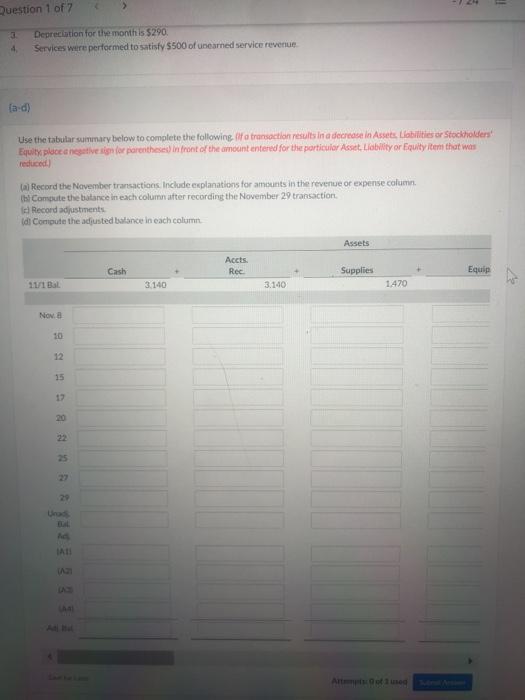

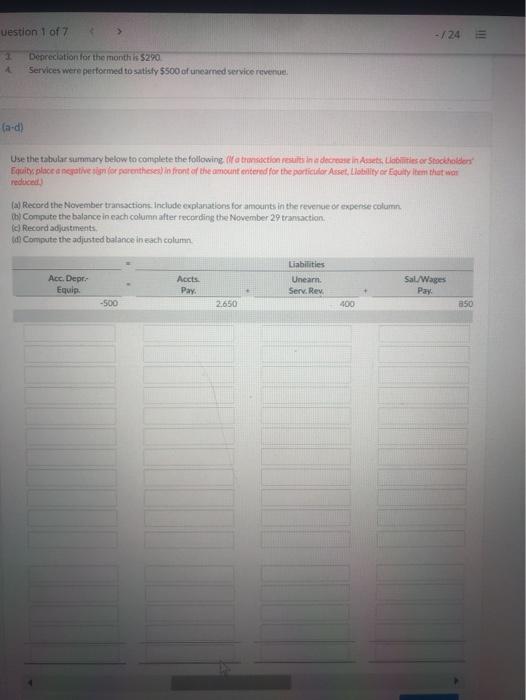

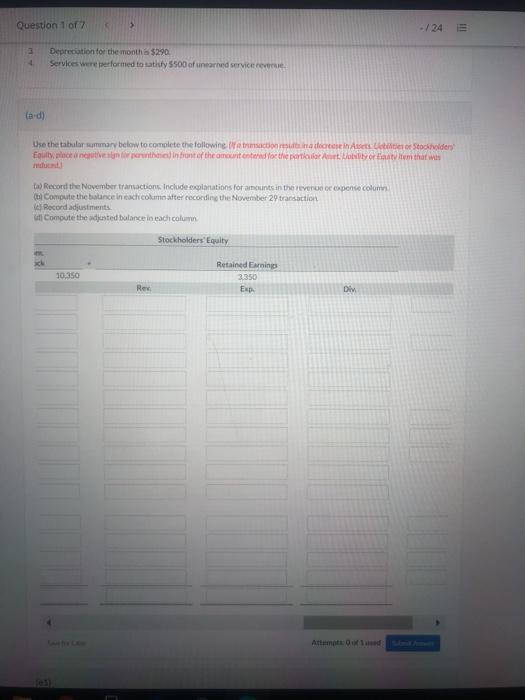

View Policies Current Attempt in Progress Cheyenne Equipment Repair began operating in September 2017 lt prepares financial statements at the end of each month. On November 1, 2017, atabalar summary includes the following information. Note that Cheyenne began the month with $3,350 in Retained Earnings. This balance represents the results of its first two months of business Assets Stockholders' Equity Aucts Liabilities Unearn. Serv Rew 400+ Rec Supplies 1.470 Equip 10,350 Acc Depr Acets Pay 500 2.650 Equip Sal/Wages Com Retaine Pay. Stock Earnine 350 10.350 + 3.350 3,140 - 3.140 During November, the following summary transactors were completed "Tom Now Paid $1.220 for salaries due employees of which $370 is for November and $850 is for October salaries payable, 10 Received $1.840 cash from customers in payment of account 12 Received $3,790 cash for services performed in November 15 Purchased store equipment on account $3.550 17 Purchased supplies on account 51,340 20 Pad creditors $2,580 of accounts payable due 22 Paid November runt $450 25 Pald salaries 51.070 Performed services on account worth $950 and billed customers 29 Received 5760 from customers for services to be performed in the future. Adjustment dat 1 Supplies on hand are valued at $1.110 Acuedes ayable are $500 Dereciation for the month is $290 Services were performed to satisfy S500 of unearned service ad that will the follows tout in a decano, La corrections for month or with > Question 1 of 2 Depreciation for the month is $290, Services were performed to satisfy 5500 of unearned service revenue 4 (ad) Use the tabular summary below to complete the following. If a transaction results in a decrease in Assets abilities or Stockholders' Equitypluce a negative sign for parentheses) in front of the amount entered for the particular Asset Libility or Equity item that was reduced) Lal Record the November transactions include explanations for amounts in the revenue or expense column. the compute the balance in each columnafter recording the November 29 transaction Id Record adjustments td Compute the adjusted stance in each column. Assets Accts. Rec Cash Supplies Equip 111 Bal 3.140 3.140 1.470 Now 12 15 17 20 uestion 1 of 7 > ll! Depreciation for the month is $20 Services were performed to satisfy 5500 of unearned service revenge (a-d) Use the tabular summary below to complete the following a transaction results in a decrease in mets. Labies or Smackholders Equity place a negative in for parentheses) in front of the amount entered for the portictor Asset, Lobility or Equity Item that wor tal Record the November transactions include explanations for amounts in the revenue or expense column. th Compute the balance in each columnafter recording the November 29 transaction Record adjustments Id Compute the adjusted balance in each column Liabilities Accts Acc. Dept. Equip Pay. Unearn. Serv. Rev. Sal/Wages Pay -500 2650 400 aso Question of > HI! 3 4 Depreciation for the month $290 Services were performed to say 5500 of uneared servicerere Use the tablor summary below to complete the followine Watson derece in Arts Stockholders Fonction in front of the amount tored for the post or antitem that was a) Record the November transactions include explanations for amounts in the ever be expense colum ( Compute the ance in each columnafter recording the November 29 transaction Record adjustments Compute the adjusted balance in each column Stockholders' Equity 10.359 Retained Earnings 3.350 Exp Rew Div