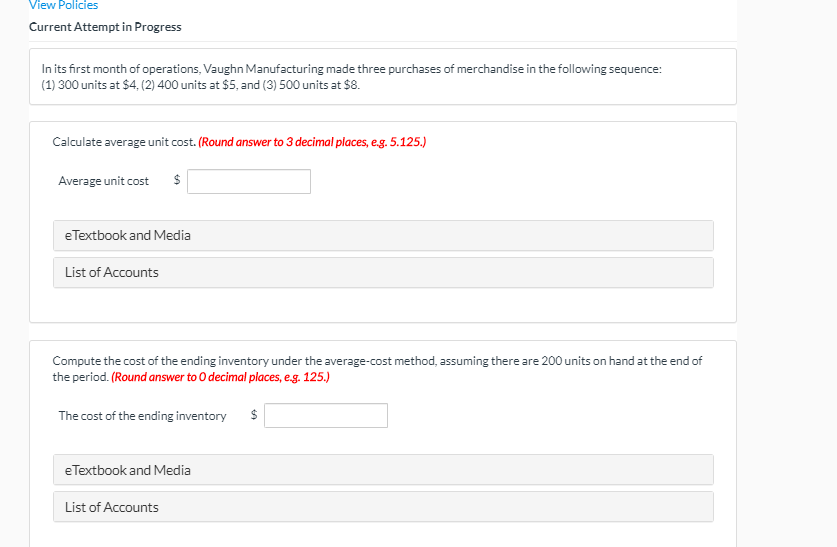

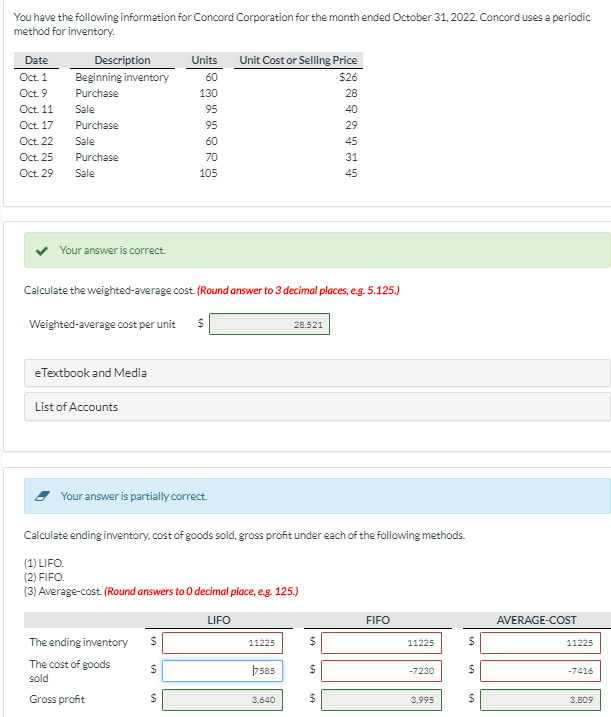

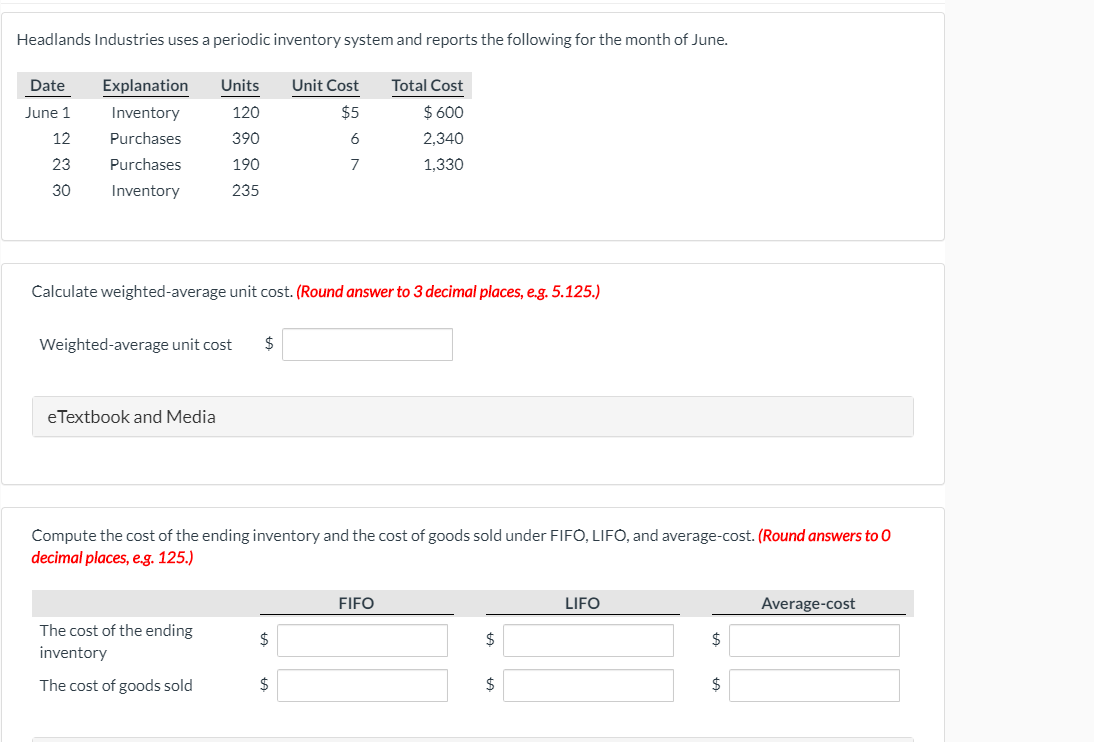

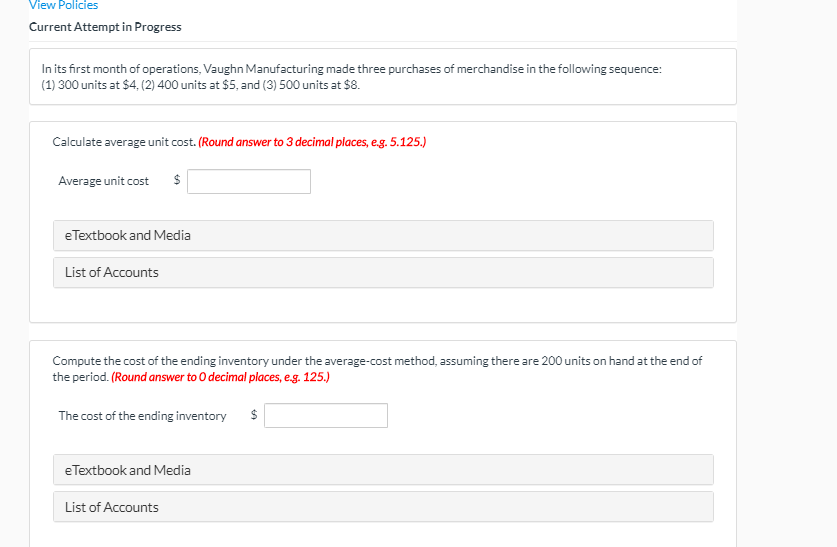

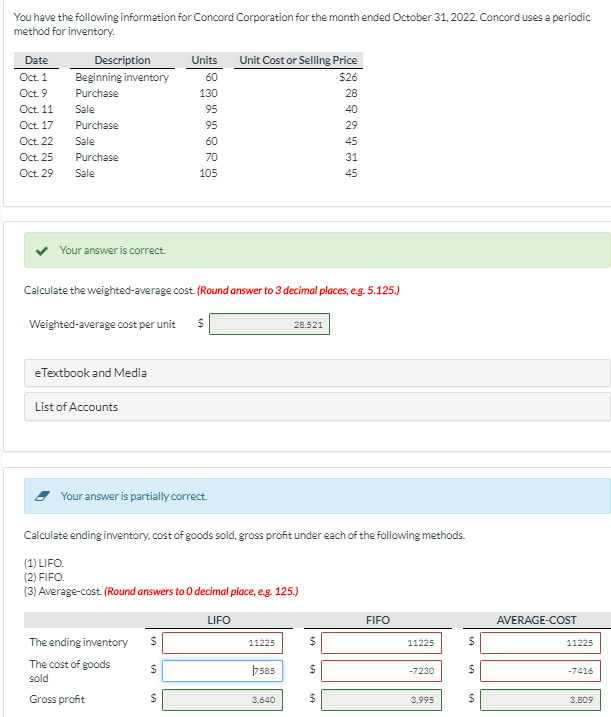

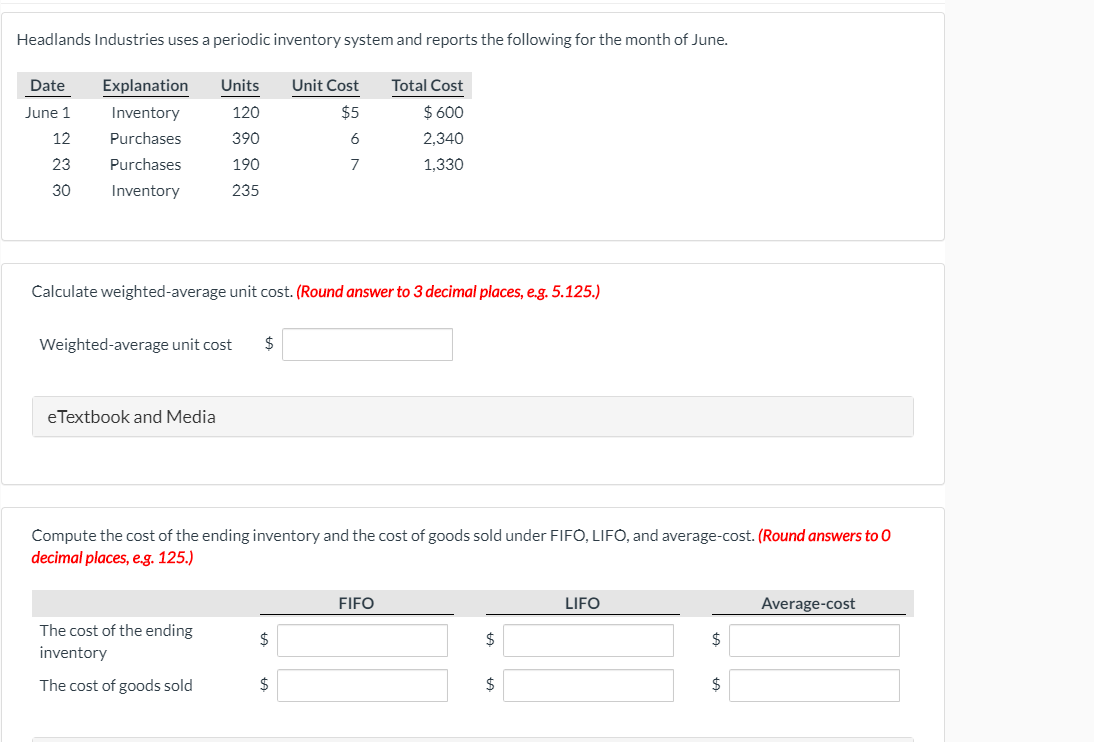

View Policies Current Attempt in Progress In its first month of operations, Vaughn Manufacturing made three purchases of merchandise in the following sequence: (1) 300 units at $4. (2) 400 units at $5, and (3) 500 units at $8. Calculate average unit cost. (Round answer to 3 decimal places, eg. 5.125.) Average unit cost $ e Textbook and Media List of Accounts Compute the cost of the ending inventory under the average-cost method, assuming there are 200 units on hand at the end of the period. (Round answer to decimal places, e.g. 125.) The cost of the ending inventory $ eTextbook and Media List of Accounts You have the following information for Concord Corporation for the month ended October 31, 2022. Concord uses a periodic method for inventory. Date Description Units Unit Cost or Selling Price Oct 1 Beginning inventory 60 $26 Oct. 9 Purchase 130 28 Oct. 11 Sale 95 40 Oct. 17 Purchase 95 29 Oct 22 Sale 60 45 Oct 25 Purchase 70 31 Oct 29 Sale 105 45 Your answer is correct. Calculate the weighted-average cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average cost per unit $ 28.521 eTextbook and Media List of Accounts Your answer is partially correct. Calculate ending inventory.cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round answers to decimal place, eg. 125.) LIFO FIFO AVERAGE-COST $ 11225 S 11225 $ 11225 The ending inventory The cost of goods sold Gross profit $ 17585 $ -7230 $ -7416 TA 3,640 $ 3,995 $ 3,809 Headlands Industries uses a periodic inventory system and reports the following for the month of June. Date Units Unit Cost June 1 $5 Explanation Inventory Purchases Purchases Total Cost $600 2,340 1,330 120 390 190 12 6 23 7 30 Inventory 235 Calculate weighted average unit cost. (Round answer to 3 decimal places, eg. 5.125.) Weighted average unit cost $ e Textbook and Media Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round answers to O decimal places, e.g. 125.) FIFO LIFO Average-cost The cost of the ending inventory $ $ $ The cost of goods sold $ $