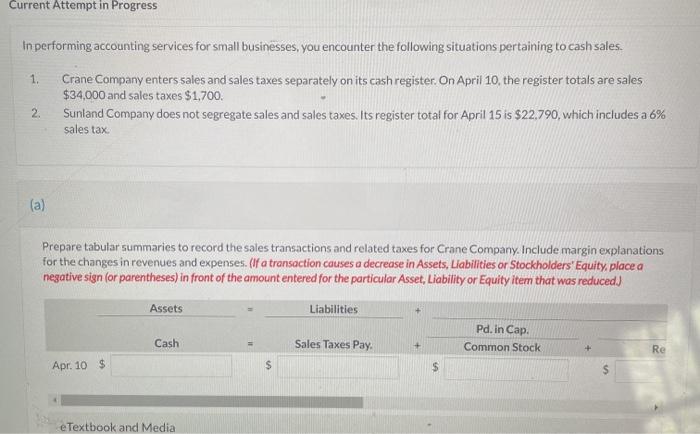

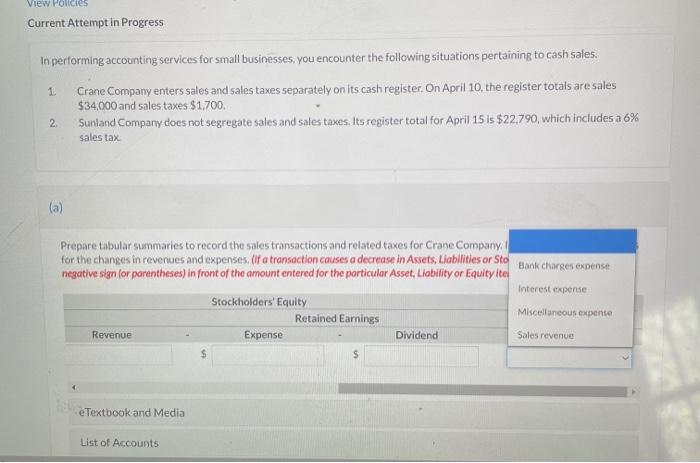

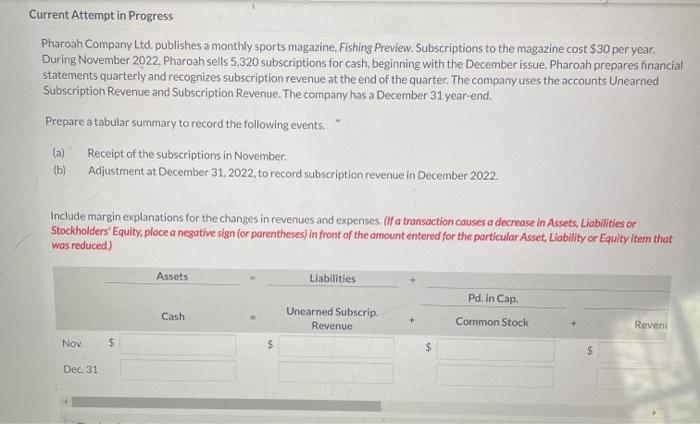

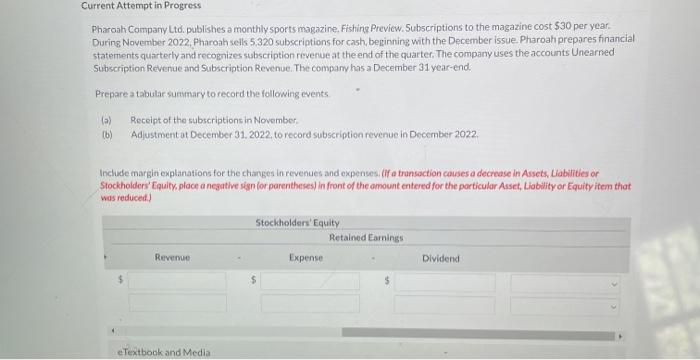

View Policies Current Attempt In Progress In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1 Crane Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $34,000 and sales taxes $1.700 Sunland Company does not segregate sales and sales taxes. Its register total for April 15 is $22.790, which includes a 6% 2 sales tax (a) Prepare tabular summaries to record the sales transactions and related taxes for Crane Company for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Sto Bank charges expense negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity ite Interest expense Stockholders' Equity Miscellaneous expense Retained Earnings Revenue Expense Dividend Sales revenue e Textbook and Media List of Accounts Current Attempt in Progress Pharoah Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $30 per year. During November 2022, Pharoah sells 5,320 subscriptions for cash, beginning with the December issue. Pharoah prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare a tabular summary to record the following events. (a) (b) Receipt of the subscriptions in November: Adjustment at December 31, 2022, to record subscription revenue in December 2022 Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Pd. in Cap Unearned Subscrip Common Stock Reveni Revenue Cash Nov. $ $ Dec 31 Current Attempt in Progress Pharoah Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $30 per year. During November 2022, Pharoah sells 5320 subscriptions for cash, beginning with the December issue. Pharoah prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare a tabular summary to record the following events. (a) Receipt of the subscriptions in November (6) Adjustment at December 31, 2022. to record subscription revenue in December 2022 Include margin explanations for the changes in revenues and expenses of a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced) Stockholders' Equity Retained Earnings Expense Revenue Dlvidend eTextbook and Media