Answered step by step

Verified Expert Solution

Question

1 Approved Answer

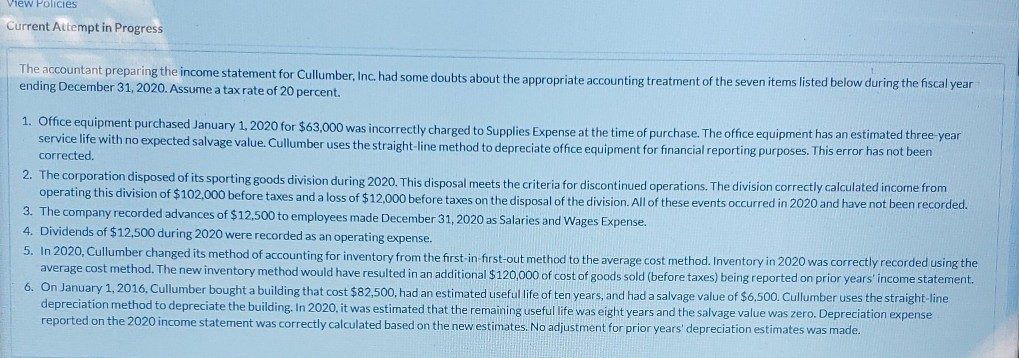

view Policies Current Attempt in Progress The accountant preparing the income statement for Cullumber, Inc. had some doubts about the appropriate accounting treatment of the

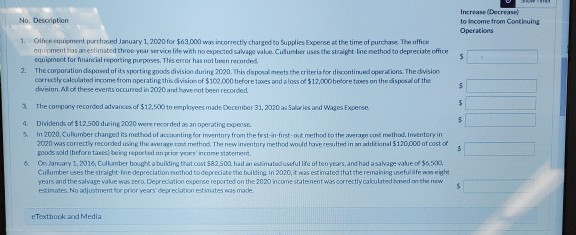

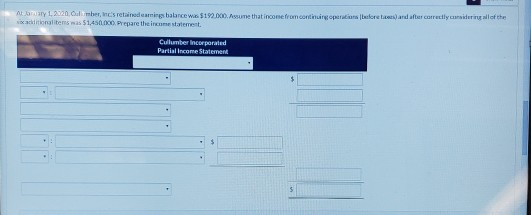

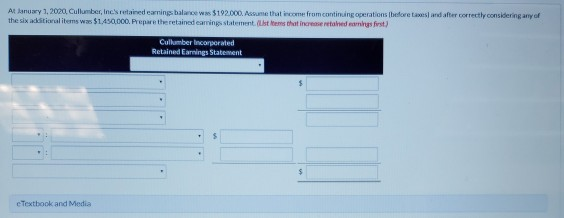

view Policies Current Attempt in Progress The accountant preparing the income statement for Cullumber, Inc. had some doubts about the appropriate accounting treatment of the seven items listed below during the fiscal year ending December 31, 2020. Assume a tax rate of 20 percent. 1. Office equipment purchased January 1, 2020 for $63,000 was incorrectly charged to Supplies Expense at the time of purchase. The office equipment has an estimated three year service life with no expected salvage value. Cullumber uses the straight-line method to depreciate office equipment for financial reporting purposes. This error has not been corrected. 2. The corporation disposed of its sporting goods division during 2020. This disposal meets the criteria for discontinued operations. The division correctly calculated income from operating this division of $102,000 before taxes and a loss of $12,000 before taxes on the disposal of the division. All of these events occurred in 2020 and have not been recorded. 3. The company recorded advances of $12,500 to employees made December 31, 2020 as Salaries and Wages Expense. 4. Dividends of $12,500 during 2020 were recorded as an operating expense. 5. In 2020, Cullumber changed its method of accounting for inventory from the first in first-out method to the average cost method. Inventory in 2020 was correctly recorded using the average cost method. The new inventory method would have resulted in an additional $120,000 of cost of goods sold (before taxes) being reported on prior years'income statement. 6. On January 1, 2016. Cullumber bought a building that cost $82,500, had an estimated useful life of ten years, and had a salvage value of $6,500. Cullumber uses the straight-line depreciation method to depreciate the building. In 2020, it was estimated that the remaining useful life was eight years and the salvage value was zero. Depreciation expense reported on the 2020 income statement was correctly calculated based on the new estimates. No adjustment for prior years' depreciation estimates was made. No. Description Increase Decrease to income from Continuing Operacions 1. Ohce m ent the January 1, 2020 for $63.000 was incorrectly charged to Supplies Experse at the time of purchase. The office e ment has an estimated three year even life with no expected salvage vakuumber uses the straight line method to depreciate the apment for hinancial reportit purposes. This error has not been recorded 3. The comparation dispovidofit porting ad division during 2000. This is al meets the criteria for continued operations. The division correctly called income from operating this division of $100.000 before and a loss of $12.00 bedore s on the disposal of the division. All of the events occurred in 2020 and have not been recorded 3 The company recorded avances of $12.500 toployees made December 31, 2070 Series and Wages Experse 4. Dividends of $12.500 during 2000 were recorded as an operating expense in 2020, Cubumber changed its method of ting for inventory from the first-in-first- method to the same as the inventory in 2020 was correctly recorded in the method. The new inventory method would results in w onal $120,000 of cost of goods sold before an d an eyewinne statement & Ontary 1, 2016 Calumberg abuilding that cost 582 00 had a stimated use of tanyans, and had a salvat value of $500, Culumber uses the straight line depreciation method to depreciate the building in 2020, was estimated that the remaining useful life was years and the salvage value waszero Depreciation expense reported on the 2020 income statement was correctly calculated bored on the new tes. No adjustment for prior vers' depreciation estimates was made Textbook and Media Cullum corporated Partial income statement n d after correctly considering any of Al Manuary 1, 2020, Cullumber, ine's retained earning balance $192.000, une that come from continuing operations before a the six aditional items was $1450.000. Prepare the retaineering statement that increas e d a s first) Culkumber incorporated Retired Earning statement e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started