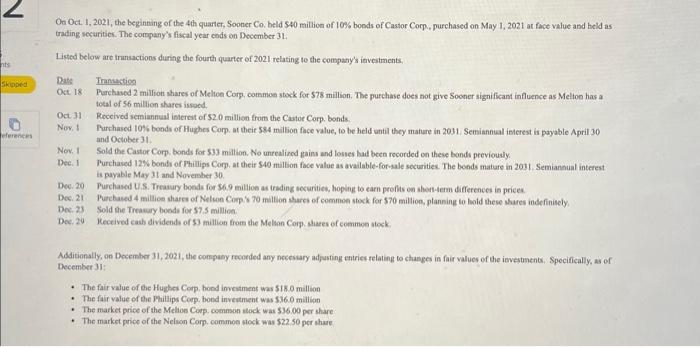

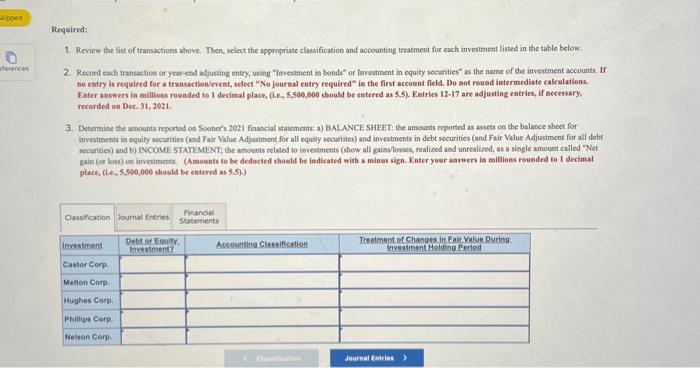

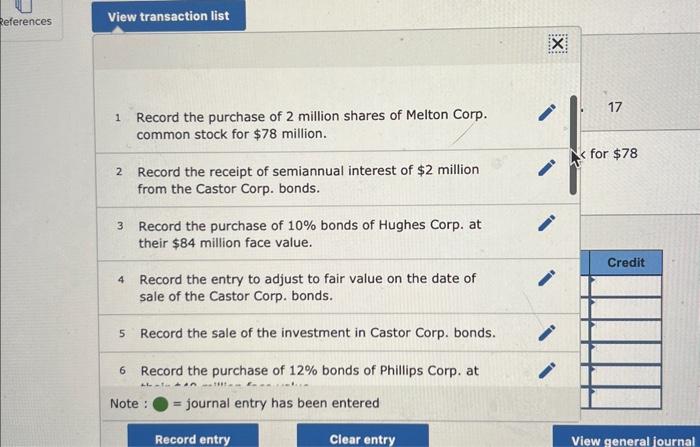

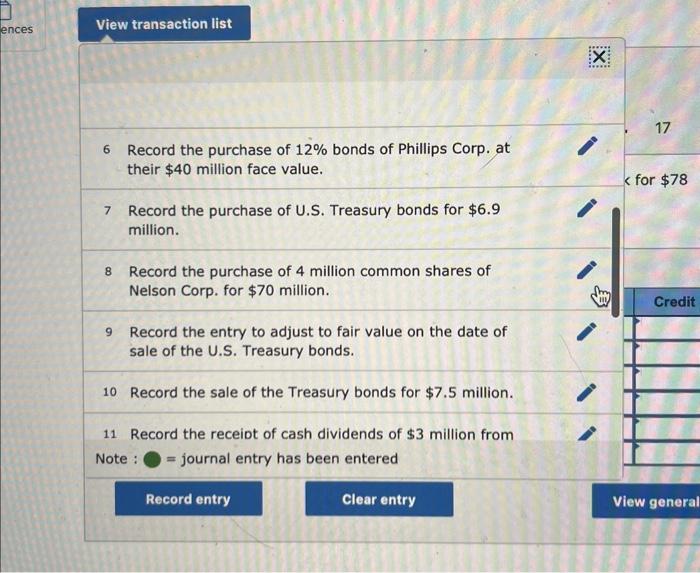

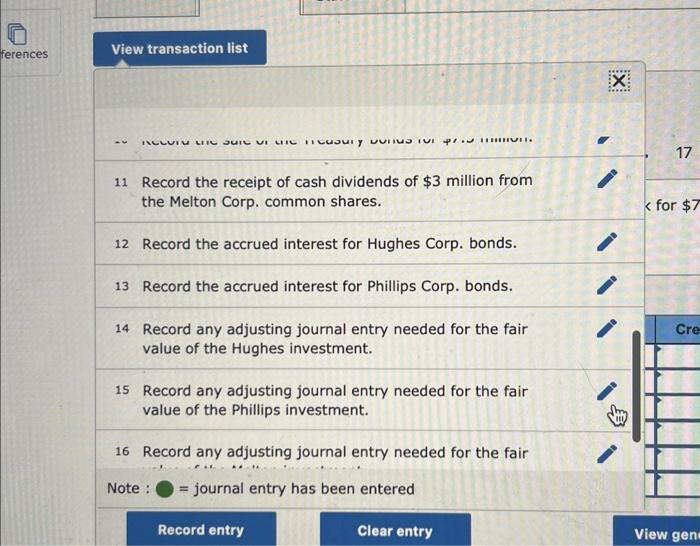

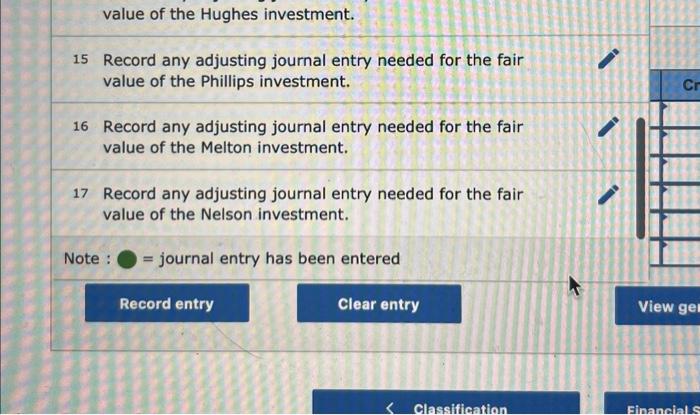

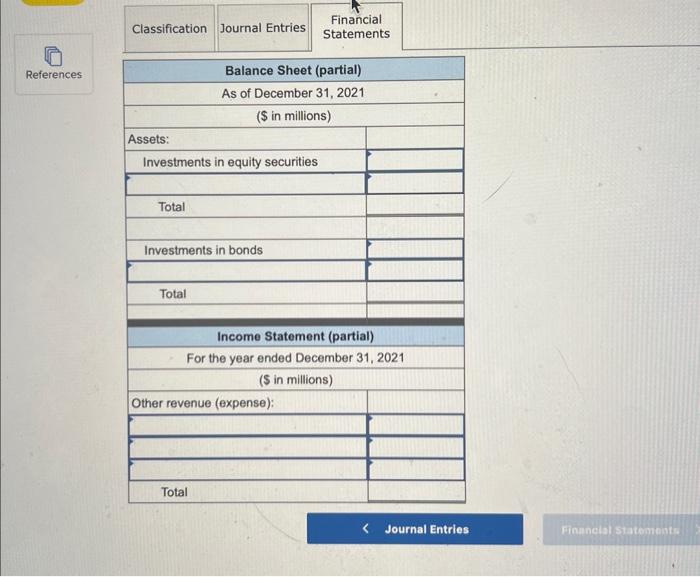

View transaction list 6 Record the purchase of 12% bonds of Phillips Corp. at their $40 million face value. 17 7 Record the purchase of U.S. Treasury bonds for $6.9 million. 8 Record the purchase of 4 million common shares of Nelson Corp. for $70 million. 9 Record the entry to adjust to fair value on the date of sale of the U.S. Treasury bonds. 10 Record the sale of the Treasury bonds for $7.5 million. 11 Record the receiot of cash dividends of $3 million from Note : = journal entry has been entered Record entry Clear entry View general 1 Record the purchase of 2 million shares of Melton Corp. common stock for $78 million. 2 Record the receipt of semiannual interest of $2 million from the Castor Corp. bonds. 3 Record the purchase of 10% bonds of Hughes Corp. at their $84 million face value. 4 Record the entry to adjust to fair value on the date of sale of the Castor Corp. bonds. 5 Record the sale of the investment in Castor Corp. bonds. 6 Record the purchase of 12% bonds of Phillips Corp. at value of the Hughes investment. 15 Record any adjusting journal entry needed for the fair value of the Phillips investment. 16 Record any adjusting journal entry needed for the fair value of the Melton investment. 17 Record any adjusting journal entry needed for the fair value of the Nelson investment. Note : = journal entry has been entered Record entry Clear entry View transaction list 11 Record the receipt of cash dividends of $3 million from the Melton Corp. common shares. 17 12 Record the accrued interest for Hughes Corp. bonds. 13 Record the accrued interest for Phillips Corp. bonds. 14 Record any adjusting journal entry needed for the fair value of the Hughes investment. 15 Record any adjusting journal entry needed for the fair value of the Phillips investment. 16 Record any adjusting journal entry needed for the fair Note : = journal entry has been entered Record entry Clear entry View gen Journal Entries Financiar statoments 1. Review the list of transacticos above. Then, velect the appropriate classification and accoanting treatment for each investment listed in the table below. 2. Record each transaction or ycar-esd adjusting entry, usiog "levestment in bonds" or levestment in cquily securities" as the name of the investment accounts, If Enter answers in millions roended to 1 decimal place, (i.e, 5,500,000 should be catered as 5.5). Eairies 1217 are adjusting entries, if accessary, recerded en Dec, 31,2021 . 3. Determine the arnounts rsported on Soconer's 2021 financial staiements: a) BALANCE SHERT: the amounts reported as asets on the balance sheet for investrnents in equity sectarities (and Fair Value Adjastment for all equaty secarites) and investments in debt securities (and Fair Value Adjustment for all debe securities) and b) INCOME STATEMENT; the amounts related to investments (how all gainvlosses, realizod and unetalimed, as a single amount called Tiet place, (Ce., 5,500,000 sheuld be entered as 5.5) ) On Oct. 1, 2021, the beginning of the 4th quarter, Sooner Co. beld $40 million of 10% bonds of Castor Corp., purchased on May 1,2021 ar face value and held as trading sesurities. The company's fiscal year ends on December 31. Listed below are inansactions during the fourth quarter of 2021 relating to the company's investments; Dats Trinsaction Oxt I8 Parchased 2 millon shares or Melion Corp, cornmon stock for 578 million. The purchase does not give Sooner significant influence as Melton has a total of 56 milion shares iseocd. Oct 31 Received semiannual interest of $2.0 million from the Castor Corp. bonds. Now, 1 Rurchased 10% boods of Hughes Corp. at their 584 miltion face value, to be beld watil they mature in 2031 . Semiannual interest is payable April 30 and October 31 . Nov, I Sold the Castor Corp. bonds for $33 milion. No unrealized gains and losies had been recorded on these bonds previously. Dec. 1 Purchased 12% bondr of Phillips Corp, at their 540 million face value as available-for-sale securities. The bends mature in 2031 , Semiannual interest is payable May 3t and November 30. Dec. 23 Sold the Treaury boods for 57.5 million. Dee, 20 Received eash dividende of $3 million from the Meltan Corp. shares of common atosk. Additionally, on Decenber 31,2021, the company recoeded any necevary adfusting entries relating to shasees in fair values of the ievestunents, Specifically, as of December 31: - The fair value of the Hughes Copp, hond investment was 518.0 million - The fair value of the Mhillips Comp, bond investment was $36.0 million - The market price of the Melion Corp. common atock was $36.00 per share - The market price of the Neluon Corp. commes stock was $22.50 per share