Answered step by step

Verified Expert Solution

Question

1 Approved Answer

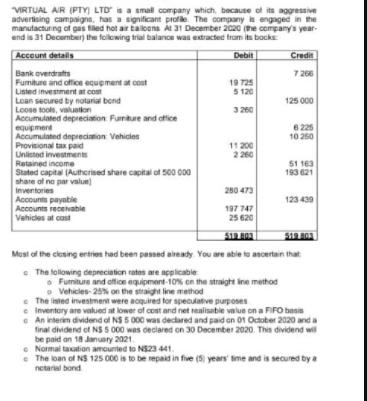

VIRTUAL AIR (PTY LTD is a smal company which, bncause of its aggresive adverteing campaigna, has a significant profie The company in engaged in

VIRTUAL AIR (PTY LTD is a smal company which, bncause of its aggresive adverteing campaigna, has a significant profie The company in engaged in the manutacturing of gas tiled hot air tailoana At 31 December 2020 (the company's year- end is 31 December) the folowing trial balance was extracted tram its bocks Acceunt details Debit Credit 7 266 Bank overdrafts Fumiture and office equement at cost Listed investmernt at com Loan secured by notarial bond Loose toole, valuatkon Accumulated depreciation Furnture and ofice equipment Accumulated depreciation Vehicies Provisional tax paid Unistod investments Retained income Stated capital (Autherised share capital of 500 000 shate of no par valun) Inventories Accounts payatile Accounts recevabie Vehices at cost 19 725 5 120 3 260 125 000 6 225 10 260 11 200 2 260 S1 163 193 21 280 473 123 439 197 747 25 620 Must of the clesing ertrien had been pessed aireaty You are able to ancertan that e The tollowing depreciation rates are applicabie Fumiture and ofioe equipment-10% cn the straight ine method o Vehicles- 25% on the straight line method e The isted investment were acquired for speculative purposes e Inventory are valued at lower of cost and net realisable value on a FIFO basis e An interim dividend of NS 5 000 was decared and paid an O1 October 2020 and a final dividend ef NS 5 000 was declared on 30 December 2020. This dividend wil be paid an 18 January 2021 e Normal taation amounted to NS23 441. e The loan of NS 125 000 is to be repaid in five (5 years' ime and is secured by a netarial bond T A TO 31 ete are retee of HSn i A 31 bete aN Eme FRECoie su 5 urta 21 etn 24

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Calculations Note 1 Taxation Taxation 23441 Less Tax Provisions 11200 Closing Provision 12241 Note2 Retained Income Opening Balance 51163 Les...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started