Question

Virus Solutions (Pty) Ltd is the manufacturer of various antivirus vaccines and chronic medicines. Some of the patents under which their medicines had been produced

Virus Solutions (Pty) Ltd is the manufacturer of various antivirus vaccines and chronic medicines. Some of the patents under which their medicines had been produced expired after the prescribed time limit. Now they are faced with generic competition in the global market.

The marketing and sales departments of Virus Solutions employed you as a consultant to determine for the company what they can expect will happen to the sales of a certain anticholesterol drug called Cholestolvin once the patent right expires and a generic competitor also enters the market. The competitor has already conducted various sample tests and marketing campaigns and has very good data on what they think their prices will be. Virus Solutions also intends to launch a big advertisement and marketing campaign aimed at doctors, hospitals and clinics to boost sales.

The company sells this product through more than 150 independent chemists, clinics and private hospitals. Virus Solutions marketing research team developed the demand equation below for expected daily sales of Cholestolvin, based on its average retail sales over the last 18 months, data of its competitors and income data of its clients.

The following are the independent variables and their current values:

Q = quantity sold per month (sales)

P (in rand) = Price of monthly packet of Cholestolvin = R1 020

Pc (in rand) = Price of leading and only competitors product Anticholes = R1 050

Y (in rand) = Average per capita income in the country = R25 000

A (in rand) = Virus Solutions monthly advertising expenditure = R20 000

S (in units) = Total number of packets of anti-cholesterol tablets sold across the country per day = 100 000

F (critical value) = 3.38 at 5% level of significance

Tc = 3.33

Ty = 2.9 Required: Note: Show all calculations and relevant formulas.

2.1. What is the meaning of the parameters 22P, 12PC and 3.2Y? (3 Marks)

2.2. Calculate the total quantity of Cholestolvin that Virus Solutions can expect to sell per day. (3 Marks)

2.3. What portion (%) of the total daily market can Virus Solutions expect to take up? And what type of market is the cholesterol medicine? (2 Marks)

2.4. Calculate the elasticities for the price of Cholestolvin (P), the product of the leading competitor Anticholes (PC), average income (Y) and advertising expenditure (A). (5 Marks)

2.5. What will happen to the revenue of the company if Virus Solutions decides to increase its price, given that all other factors will stay the same. (Hint: Use the price elasticity value.) What kind of product is Cholestolvin? (2 marks)

2.6. Calculate the standard deviation values for the competitors product Anticholes and income (Y). (4 Marks)

2.7. How significant are the independent variables in total and individually to explain the total quantity of sales that Virus Solutions can expect? (12 Marks)

2.8. Assume that the following changes take place in the market for anti-cholesterol medicine: The price (P) of Cholestolvin drops to R950, the price of the competitors product Anticholes increases to R1 150 and the average per capita income of the country increases to R28 000.

2.8.1. Calculate the new quantity of Cholestolvin that Virus Solutions can expect to sell. (3 Marks)

2.8.2. Calculate the arch elasticity of demand, cross-price elasticity of demand and income elasticity of demand for Cholestolvin. (6 marks)

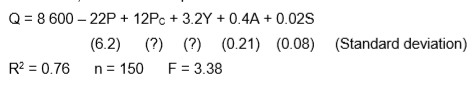

Q = 8 600 - 22P + 12Pc + 3.2Y + 0.4A + 0.02S (6.2) (?) (?) (0.21) (0.08) (Standard deviation) R2 = 0.76 n = 150 F = 3.38 Q = 8 600 - 22P + 12Pc + 3.2Y + 0.4A + 0.02S (6.2) (?) (?) (0.21) (0.08) (Standard deviation) R2 = 0.76 n = 150 F = 3.38Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started