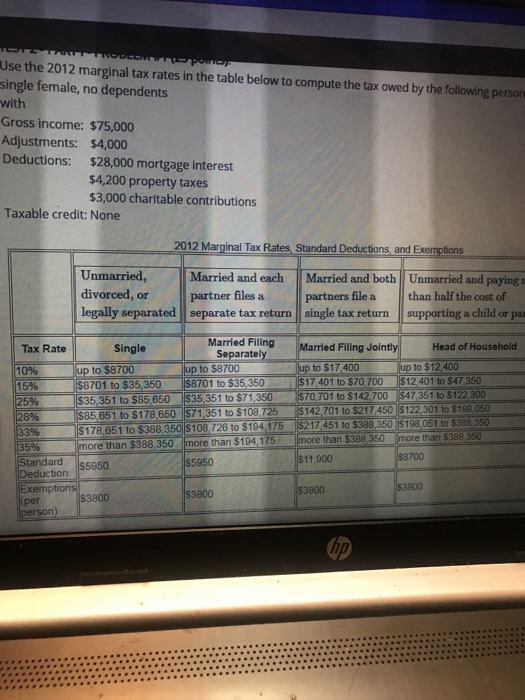

VITROCCHI Powe Use the 2012 marginal tax rates in the table below to compute the tax owed by the following person single female, no dependents with Gross income: $75,000 Adjustments: $4,000 Deductions: $28,000 mortgage interest $4,200 property taxes $3,000 charitable contributions Taxable credit: None 2012 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, or legally separated Married and each partner files a separate tax return Married and both Unmarried and paying 1 partners file a than half the cost of single tax return supporting a child or pas Tax Rate Married Filing Single Married Filing Jointly Head of Household Separately up to $8700 up to $8700 up to $17.400 up to $12,400 IS8701 to $35,350 $8701 to $35,350 $17,401 to $70,700 $12,401 to $47.350 $35.351 to $85,650 $35,351 to $71,350 $70,701 to $142,700 $47 351 to $122 300 28% $85.651 to $178,650 $71,351 to $108.72515142,701 to $217,450 $122,301 to $198.050 33% S 178.651 to $388,350 S 108.726 to $194 175 $217 451 to $388,350 $198,051 to $388 350 3596 more than $388,350 more than $194,175 more than $388, 350 more than $388 350 Standard lego $5950 55950 88700 S11,900 Deduction Exemptions 53800 $3800 $3800 $3800 (per person) (per person) $3800 $3800 $3800 a. Determine the adjusted gross income. (For this portion of the problem, all supporting written work should Failure to do will cause a point(s) reduction in your grade. You shoul b. Determine the taxable income. (For this portion of the problem, all supporting written work (a very thu sentences, and/or every detailed step, including complete sentences, shown on your paper, including your answer. Failure to do will cause a attempt to enter your answer into Knewton.) c. Determine the income tax. (For this portion of the problem, all supporting written work (a very thoror sentences, and/or every detailed step, including complete sentences, of hc shown on your paper, including your answer. Failure to do will cause a por attempt to enter your answer into Knewton.) Provide your answer below: VITROCCHI Powe Use the 2012 marginal tax rates in the table below to compute the tax owed by the following person single female, no dependents with Gross income: $75,000 Adjustments: $4,000 Deductions: $28,000 mortgage interest $4,200 property taxes $3,000 charitable contributions Taxable credit: None 2012 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, or legally separated Married and each partner files a separate tax return Married and both Unmarried and paying 1 partners file a than half the cost of single tax return supporting a child or pas Tax Rate Married Filing Single Married Filing Jointly Head of Household Separately up to $8700 up to $8700 up to $17.400 up to $12,400 IS8701 to $35,350 $8701 to $35,350 $17,401 to $70,700 $12,401 to $47.350 $35.351 to $85,650 $35,351 to $71,350 $70,701 to $142,700 $47 351 to $122 300 28% $85.651 to $178,650 $71,351 to $108.72515142,701 to $217,450 $122,301 to $198.050 33% S 178.651 to $388,350 S 108.726 to $194 175 $217 451 to $388,350 $198,051 to $388 350 3596 more than $388,350 more than $194,175 more than $388, 350 more than $388 350 Standard lego $5950 55950 88700 S11,900 Deduction Exemptions 53800 $3800 $3800 $3800 (per person) (per person) $3800 $3800 $3800 a. Determine the adjusted gross income. (For this portion of the problem, all supporting written work should Failure to do will cause a point(s) reduction in your grade. You shoul b. Determine the taxable income. (For this portion of the problem, all supporting written work (a very thu sentences, and/or every detailed step, including complete sentences, shown on your paper, including your answer. Failure to do will cause a attempt to enter your answer into Knewton.) c. Determine the income tax. (For this portion of the problem, all supporting written work (a very thoror sentences, and/or every detailed step, including complete sentences, of hc shown on your paper, including your answer. Failure to do will cause a por attempt to enter your answer into Knewton.) Provide your answer below