Question

Volatility smile or volatility skew refers to the relation between implied volatility and strike price (Hull chapter 19). Quotes for selected call options on Facebook

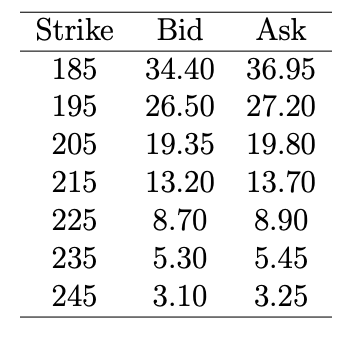

Volatility smile or volatility skew refers to the relation between implied volatility and strike price (Hull chapter 19). Quotes for selected call options on Facebook stock on April 19, 2022 are provided below. Determine implied volatility for each option and plot as a function of strike price. Use midpoint of bid and ask quotes for option price. Facebook does not pay dividends. Assume Facebook stock price is $217.31. Assume the interest rate is 0.29% per annum with continuous compounding. The expiration date of all options is May 20, 2022. To determine implied volatility, input all parameters in Black-Scholes formula and adjust volatility until the price given by the formula matches the price quote. If you use Excel, Goal Seek function can be helpful. The Excel formula =DAYS(DATE(2022,5,20),DATE(2022,4,19)) returns the number of days to expiration. You may use the spreadsheet Black-Scholes Price.xlsx.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started