Answered step by step

Verified Expert Solution

Question

1 Approved Answer

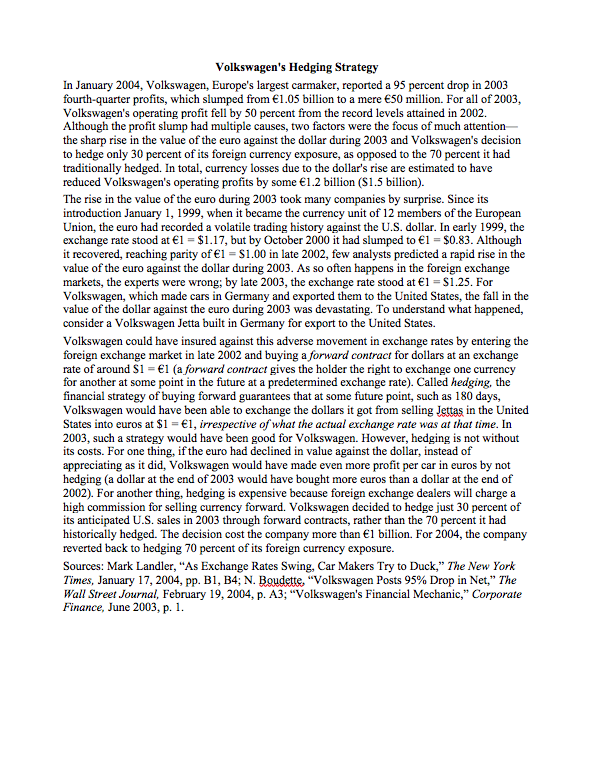

Volkswagen's Hedging Strategy In January 2004, Volkswagen, Europe's largest carmaker, reported a 95 percent drop in 2003 fourth-quarter profits, which slumped from 1.05 billion

Volkswagen's Hedging Strategy In January 2004, Volkswagen, Europe's largest carmaker, reported a 95 percent drop in 2003 fourth-quarter profits, which slumped from 1.05 billion to a mere 50 million. For all of 2003, Volkswagen's operating profit fell by 50 percent from the record levels attained in 2002. Although the profit slump had multiple causes, two factors were the focus of much attention- the sharp rise in the value of the euro against the dollar during 2003 and Volkswagen's decision to hedge only 30 percent of its foreign currency exposure, as opposed to the 70 percent it had traditionally hedged. In total, currency losses due to the dollar's rise are estimated to have reduced Volkswagen's operating profits by some 1.2 billion ($1.5 billion). The rise in the value of the euro during 2003 took many companies by surprise. Since its introduction January 1, 1999, when it became the currency unit of 12 members of the European Union, the euro had recorded a volatile trading history against the U.S. dollar. In early 1999, the exchange rate stood at 1 = $1.17, but by October 2000 it had slumped to 1 = $0.83. Although it recovered, reaching parity of 1 = $1.00 in late 2002, few analysts predicted a rapid rise in the value of the euro against the dollar during 2003. As so often happens in the foreign exchange markets, the experts were wrong; by late 2003, the exchange rate stood at 1 = $1.25. For Volkswagen, which made cars in Germany and exported them to the United States, the fall in the value of the dollar against the euro during 2003 was devastating. To understand what happened, consider a Volkswagen Jetta built in Germany for export to the United States. Volkswagen could have insured against this adverse movement in exchange rates by entering the foreign exchange market in late 2002 and buying a forward contract for dollars at an exchange rate of around $1 = 1 (a forward contract gives the holder the right to exchange one currency for another at some point in the future at a predetermined exchange rate). Called hedging, the financial strategy of buying forward guarantees that at some future point, such as 180 days, Volkswagen would have been able to exchange the dollars it got from selling Jettas in the United States into euros at $1 = 1, irrespective of what the actual exchange rate was at that time. In 2003, such a strategy would have been good for Volkswagen. However, hedging is not without its costs. For one thing, if the euro had declined in value against the dollar, instead of appreciating as it did, Volkswagen would have made even more profit per car in euros by not hedging (a dollar at the end of 2003 would have bought more euros than a dollar at the end of 2002). For another thing, hedging is expensive because foreign exchange dealers will charge a high commission for selling currency forward. Volkswagen decided to hedge just 30 percent of its anticipated U.S. sales in 2003 through forward contracts, rather than the 70 percent it had historically hedged. The decision cost the company more than 1 billion. For 2004, the company reverted back to hedging 70 percent of its foreign currency exposure. Sources: Mark Landler, "As Exchange Rates Swing, Car Makers Try to Duck," The New York Times, January 17, 2004, pp. B1, B4; N. Boudette, "Volkswagen Posts 95% Drop in Net," The Wall Street Journal, February 19, 2004, p. A3; "Volkswagen's Financial Mechanic," Corporate Finance, June 2003, p. 1.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

By entering the foreign exchange market at the end of 2002 and purchasing a forward dollar contract ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started