Question

Vortex Company Vortex was founded in 2015 as a LLC. The main activity of the company is selling the vacuum cleaners. You were hired as

Vortex

Company Vortex was founded in 2015 as a LLC. The main activity of the company is selling the vacuum cleaners. You were hired as an independent expert to prepare the financial statements for 2018 year.

Additional data:

1) 2)

3)

Reporting date for the company December 31, 2018. The company should prepare the financial statements according to

International Accounting Standards (IAS).

The reporting currency current units (CU)

You have to analyze the following transactions:

-

1) On July 1, 2018 there was concluded a rent contract for one year. The contract

came into force from the sign date. The rent payment in amount of 15,000 CU

was paid on July 5, 2018 and was recorded as Prepaid rent.

-

2) Accounts receivable include:

-

Account of company Breeze in amount of 10 500 CU.

-

Account of company ABC in amount of 5 600 CU.

-

-

3) On December 29, 2018 sales were made in amount of 25,800 CU. This

transaction was not recorded. The payment is expected to be received in the

first decade of January, 2019.

-

4) On December 20, 2018 there was purchased a software for 35,000 CU. Cost of

this purchase was reflected in Other administrative expenses.

-

5) Company uses periodic system of inventory, and the weighted-average

st inventory system. According to data, on December 1 . 2018 the company had

220 units of inventory costing 44,000 CU. During December the following purchases were made:

-

Dec.5 - 150 units at a price of 209.90 CU per unit;

-

Dec.12 170 units at a price of 215 CU per unit;

-

Dec. 18 120 units at a price of 220 CU per unit. According to inventory taking, on December 31 2018 there were 276 units of inventory available in the stock.

-

-

6) According to accounting policy, the company uses percentage of credit sales method for accounting of bad debt expenses. 70% of sales were made on credit. 2.5% were estimated to be bad debt.

-

7) On December 25, 2018 one of the client of the company, whose indebtedness to the company was in amount of 5,300 CU, was declared to be a bankrupt. The accountant of the company did not pay attention to this event and did not make any entries with respect to it.

-

8) Administrative building was build and started to be used from October 1, 2016. The accounting policy of the company states the following:

-

Salvage value of the building is 2% of its initial cost;

-

Double-declining method is used for calculating depreciation;

-

Useful life of the building is 25 years.

-

For accounting of all fixed assets the company uses the cost method.

-

-

9) A lorry that is required for the delivery of products to customers was acquired on June 25, 2018. The accounting policy uses the unit-of-production method for calculating depreciation. The salvage value was estimated to be 3,500 CU, the useful life was 800,000 km, and the total kilometers logged on December 31, 2018 was 52,000 km.

-

10) Income tax rate is 20%.

Required:

-

Prepare the adjusting journal entries, all entries should have the calculations. (Write the names of journal entries and codes of the used accounts). You should also do the closing entries.

-

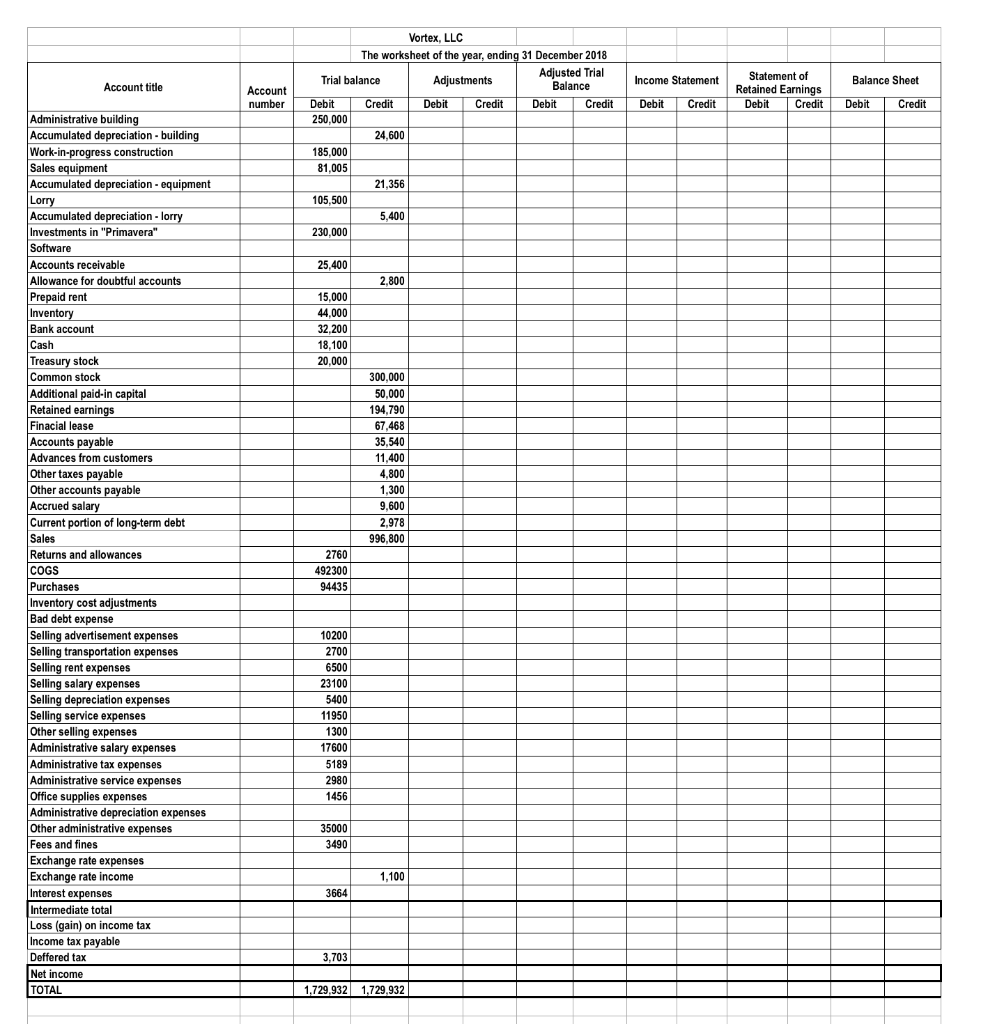

Fill in the worksheet. You may add additional accounts if they are needed.

Make all the numbers round. All calculations should be done on a monthly basis.

Requirements:

- Complete the adjusting journal entries in the General Journal

Make the closing entries.

- Fill-in the Work Sheet (Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet)

- Complete the Financial Statements (IS, Statement of Retained Earnings, Balance Sheet)

- Submit the whole assignment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started