Answered step by step

Verified Expert Solution

Question

1 Approved Answer

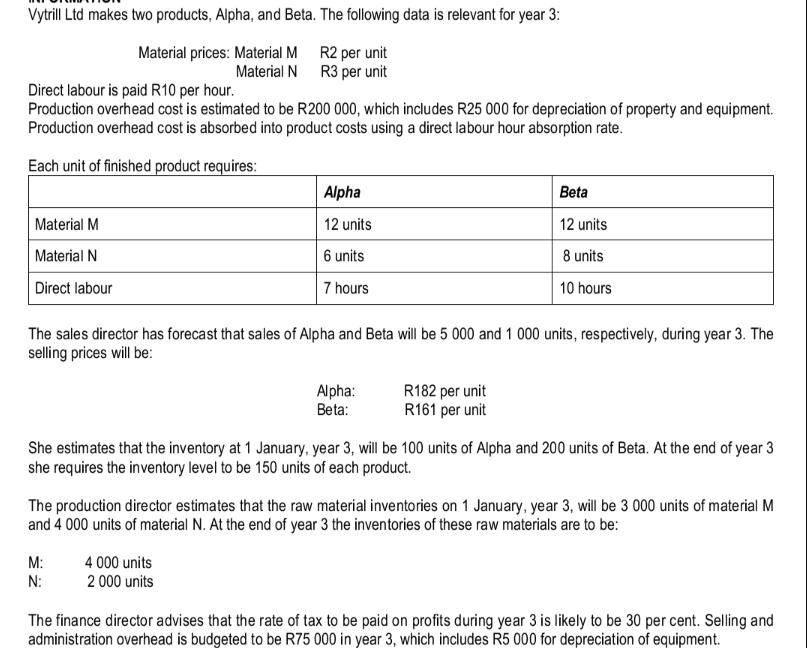

Vytrill Ltd makes two products, Alpha, and Beta. The following data is relevant for year 3: Material prices: Material M Material N R2 per

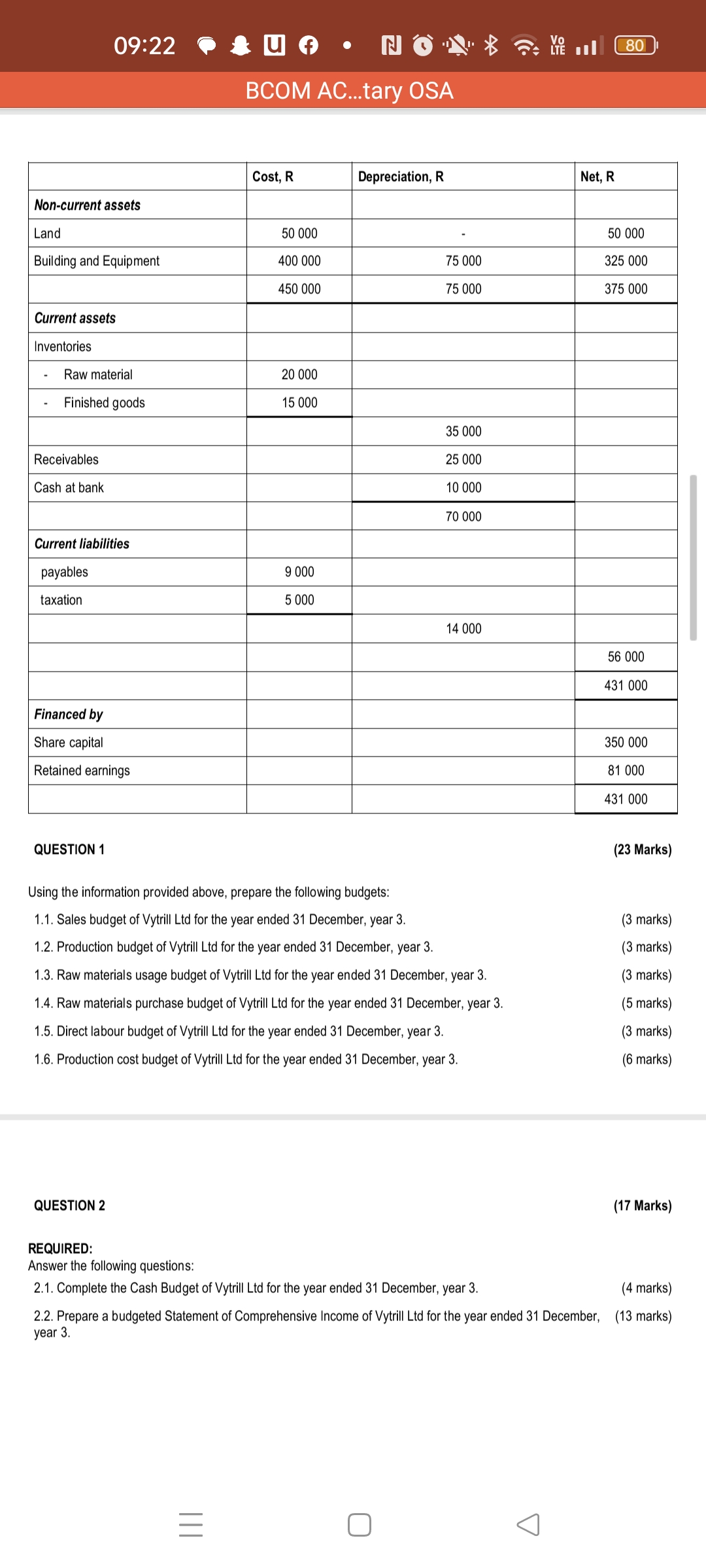

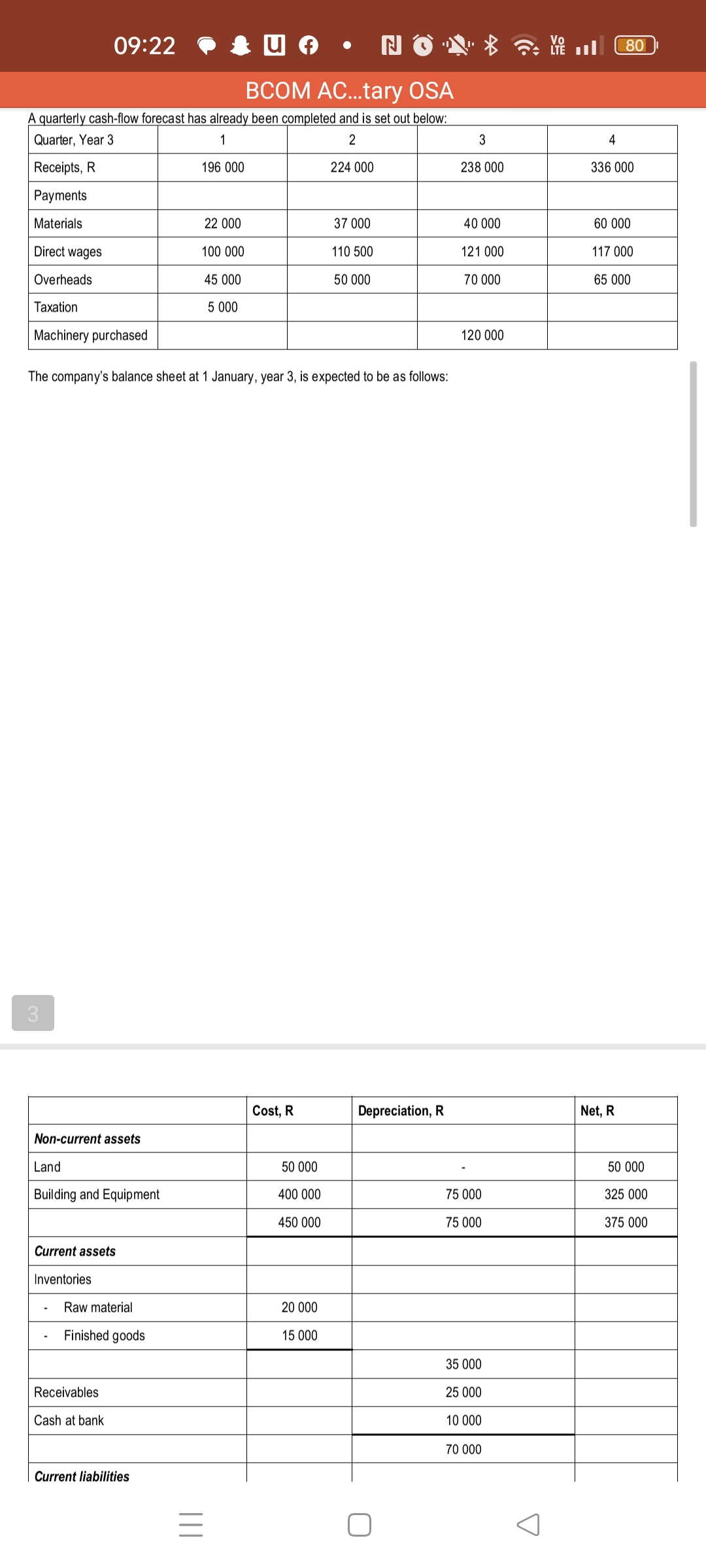

Vytrill Ltd makes two products, Alpha, and Beta. The following data is relevant for year 3: Material prices: Material M Material N R2 per unit R3 per unit Direct labour is paid R10 per hour. Production overhead cost is estimated to be R200 000, which includes R25 000 for depreciation of property and equipment. Production overhead cost is absorbed into product costs using a direct labour hour absorption rate. Each unit of finished product requires: Material M Material N Direct labour Alpha 12 units 6 units 7 hours The sales director has forecast that sales of Alpha and Beta will be 5 000 and 1 000 units, respectively, during year 3. The selling prices will be: M: N: Alpha: Beta: 4 000 units 2 000 units Beta 12 units 8 units 10 hours R182 per unit R161 per unit She estimates that the inventory at 1 January, year 3, will be 100 units of Alpha and 200 units of Beta. At the end of year 3 she requires the inventory level to be 150 units of each product. The production director estimates that the raw material inventories on 1 January, year 3, will be 3 000 units of material M and 4 000 units of material N. At the end of year 3 the inventories of these raw materials are to be: The finance director advises that the rate of tax to be paid on profits during year 3 is likely to be 30 per cent. Selling and administration overhead is budgeted to be R75 000 in year 3, which includes R5 000 for depreciation of equipment. Non-current assets Land Building and Equipment 09:22 Current assets Inventories Raw material Finished goods Receivables Cash at bank Current liabilities payables taxation Financed by Share capital Retained earnings QUESTION 1 QUESTION 2 BCOM AC...tary OSA Cost, R ||| 50 000 400 000 450 000 = 20 000 15 000 9 000 5 000 Depreciation, R 75 000 75 000 35 000 25 000 10 000 Using the information provided above, prepare the following budgets: 1.1. Sales budget of Vytrill Ltd for the year ended 31 December, year 3. 1.2. Production budget of Vytrill Ltd for the year ended 31 December, year 3. 1.3. Raw materials usage budget of Vytrill Ltd for the year ended 31 December, year 3. 1.4. Raw materials purchase budget of Vytrill Ltd for the year ended 31 December, year 3. 1.5. Direct labour budget of Vytrill Ltd for the year ended 31 December, year 3. 1.6. Production cost budget of Vytrill Ltd for the year ended 31 December, year 3. 70 000 14 000 REQUIRED: Answer the following questions: 2.1. Complete the Cash Budget of Vytrill Ltd for the year ended 31 December, year 3. Net, R 80 50 000 325 000 375 000 56 000 431 000 350 000 81 000 431 000 (23 Marks) (3 marks) (3 marks) (3 marks) (5 marks) (3 marks) (6 marks) (4 marks) 2.2. Prepare a budgeted Statement of Comprehensive Income of Vytrill Ltd for the year ended 31 December, (13 marks) year 3. (17 Marks) 09:22 3 BCOM AC...tary OSA A quarterly cash-flow forecast has already been completed and is set out below: Quarter, Year 3 1 2 Receipts, R 196 000 Payments Materials Direct wages Overheads Taxation Machinery purchased Non-current assets Land Building and Equipment Current assets Inventories The company's balance sheet at 1 January, year 3, is expected to be as follows: Raw material Finished goods Receivables Cash at bank Current liabilities 22 000 100 000 45 000 5 000 ||| Cost, R 50 000 400 000 450 000 20 000 15 000 224 000 N 37 000 110 500 50 000 Depreciation, R 3 238 000 40 000 121 000 70 000 120 000 75 000 75 000 35 000 25 000 10 000 70 000 4 80 336 000 60 000 117 000 65 000 Net, R 50 000 325 000 375 000

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each requirement and calculate the budgets accordingly QUESTION 1 11 Sales Budget Alpha 5000 units R182 R910000 Beta 1000 units R161 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started