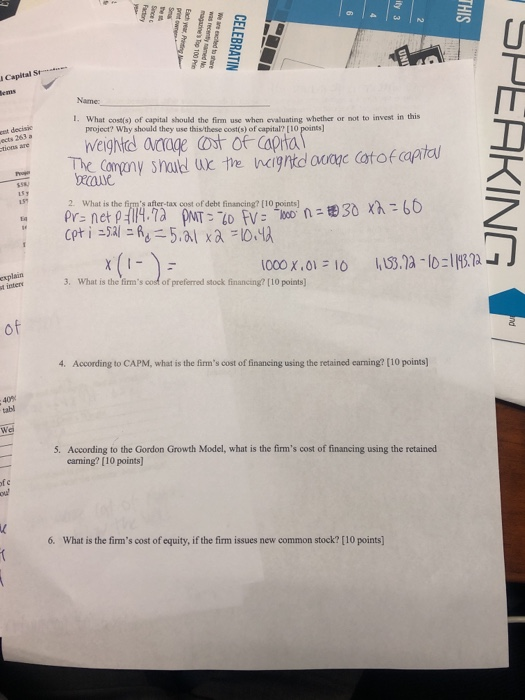

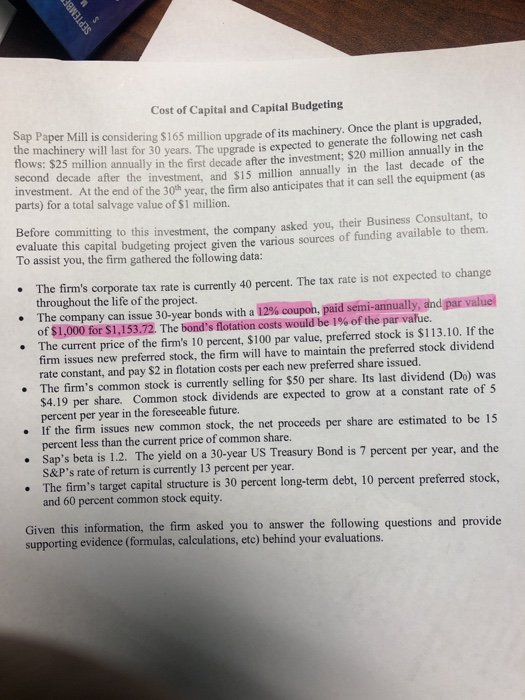

W ity 3 THIS Each year, Pring nawet 100 ande CELEBRATIN Capital St Name 1. What costs) of capital should the firm use when evaluating whether or not to invest in this project? Why should they use this these cost(s) of capital? [10 points] et decisie acts 263 stions we Weighted acrage Ost of capital The company shaib ux the weight SPEAKING onc cotof capital because Y2 - 10 2. What is the firm's after-tax cost of debt financing? (10 points) 2 Pr=net P. {114.72 PMT = 60 FV = 1000 n = 8 Cpt i =521 = Rg=5.21 x 2 =10.12 1000 X.01-10 3. What is the firm's cost of preferred stock financing? [10 points) 163.12 - 10-143.72J sistent of 4. According to CAPM, what is the firm's cost of financing using the retained earning? [10 points) 401 5. According to the Gordon Growth Model, what is the firm's cost of financing using the retained caming? [10 points] 13 6. What is the firm's cost of equity, if the firm issues new common stock? [10 points] SEPTEM Cost of Capital and Capital Budgeting aper Mill is considering $165 million upgrade of its machinery. Once the plant is upgraded, cry will last for 30 years. The upgrade is expected to generate the following net cash 25 million annually in the first decade after the investment; $20 million annually in the second decade after the investment and S15 million annually in the last decade of the investment. At the end of the 30th year, the firm also anticipates that it can sell the equipment (as parts) for a total salvage value of $1 million. Before committing to this investment, the company asked you, their Business Consultant, to evaluate this capital budgeting proiect given the various sources of funding available to them. To assist you, the firm gathered the following data: The firm's corporate tax rate is currently 40 percent. The tax rate is not expected to change throughout the life of the project. The company can issue 30-year bonds with a 1296 coupon, paid semi-annually and par value of $1,000 for $1,153.72. The bond's flotation costs would be 1% of the par value. e current price of the firm's 10 percent, $100 par value, preferred stock is $113.10. If the firm issues new preferred stock, the firm will have to maintain the preferred stock dividend rate constant, and pay $2 in flotation costs per each new preferred share issued. The firm's common stock is currently selling for $50 per share. Its last dividend (Do) was $4.19 per share. Common stock dividends are expected to grow at a constant rate of 5 percent per year in the foreseeable future. If the firm issues new common stock, the net proceeds per share are estimated to be 15 percent less than the current price of common share. Sap's beta is 1.2. The yield on a 30-year US Treasury Bond is 7 percent per year, and the S&P's rate of return is currently 13 percent per year. The firm's target capital structure is 30 percent long-term debt, 10 percent preferred stock, and 60 percent common stock equity. Given this information, the firm asked you to answer the following questions and provide supporting evidence (formulas, calculations, ete) behind your evaluations