Answered step by step

Verified Expert Solution

Question

1 Approved Answer

w QS 3-1GAAP and adjusting entries LO2 For each of the following, identify the primary GAAP that has been violated and explain why. 1. Delta

w

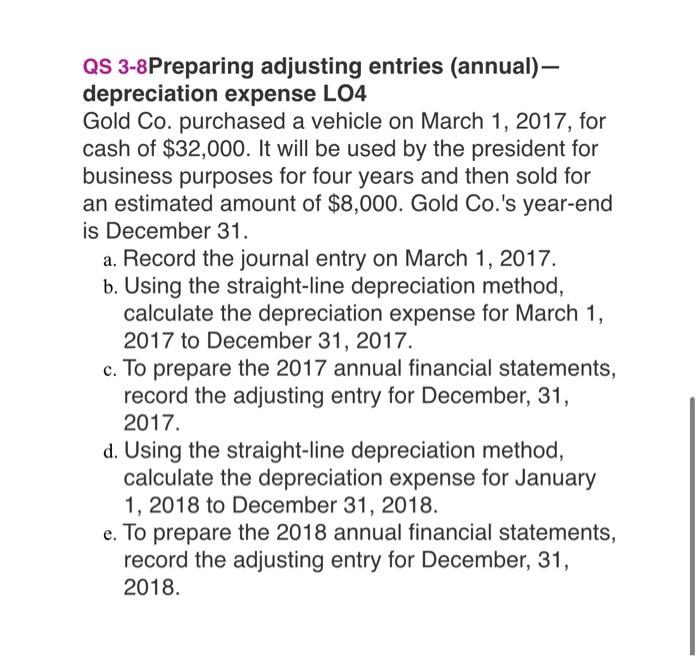

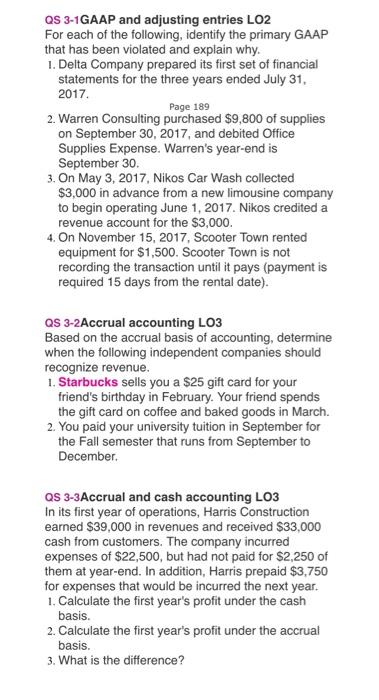

QS 3-1GAAP and adjusting entries LO2 For each of the following, identify the primary GAAP that has been violated and explain why. 1. Delta Company prepared its first set of financial statements for the three years ended July 31, 2017. Page 189 2. Warren Consulting purchased $9,800 of supplies on September 30, 2017, and debited Office Supplies Expense. Warren's year-end is September 30. 3. On May 3, 2017, Nikos Car Wash collected $3,000 in advance from a new limousine company to begin operating June 1, 2017. Nikos credited a revenue account for the $3,000. 4. On November 15, 2017, Scooter Town rented equipment for $1,500. Scooter Town is not recording the transaction until it pays (payment is required 15 days from the rental date). QS 3-2Accrual accounting LO3 Based on the accrual basis of accounting, determine when the following independent companies should recognize revenue. 1. Starbucks sells you a $25 gift card for your friend's birthday in February. Your friend spends the gift card on coffee and baked goods in March. 2. You paid your university tuition in September for the Fall semester that runs from September to December. QS 3-3Accrual and cash accounting LO3 In its first year of operations, Harris Construction earned $39,000 in revenues and received $33,000 cash from customers. The company incurred expenses of $22,500, but had not paid for $2,250 of them at year-end. In addition, Harris prepaid $3,750 for expenses that would be incurred the next year. 1. Calculate the first year's profit under the cash basis. 2. Calculate the first year's profit under the accrual basis. 3. What is the difference? QS 3-4Preparing adjusting entries (annual)- prepaid expense LO4 My An M31. MEY Stud Muffin Bakery prepares financial statements on an annual basis and has a December 31, 2017 year- end. On July 1, 2017, the bakery purchased a one- year insurance policy for $12,000 cash. The insurance policy covers July 1, 2017 to June 30, 2018. a. How much does the insurance policy cost per month? b. How many months are between July 1, 2017 and December 31, 2017? c. Record the journal entry on July 1, 2017. d. In order to prepare the annual financial statements, record the adjusting journal entry on December 31, 2017. Page 190 QS 3-5Preparing adjusting entries (annual)- supplies LO4 B Organic Market, a grocery store, purchased supplies for $12,000 cash on July 1, 2017. As of December 31, 2017, $7,000 had been used and $5,000 of supplies had not been used. Organic Market prepares financial statements on an annual basis and has a December 31 year-end. a. Record the journal entry on July 1, 2017. b. In order to prepare the annual financial statements, record the adjusting journal entry to reflect the amount of supplies used as of December 31, 2017. c. On January 1, 2018, how much supplies does Organic Market have? QS 3-6Preparing adjusting entries (annual)- prepaid expense LO4 Kiss the Chef Co., a cooking school, purchased a two-year insurance policy on April 1, 2017, paying cash of $7,680. Its year-end is December 31. a. Record the journal entry on April 1, 2017. b. How many months are between April 1, 2017 and December 31, 2017? Record the adjusting entry on December 31, 2017. c. How many months are between January 1, 2018 and December 31, 2018? Record the adjusting entry on December 31, 2018. d. How many months of the insurance policy are left in 2019? QS 3-7Preparing adjusting entries (annual)- depreciation LO4 On January 1, 2017, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash. Taco Taqueria estimates that the equipment will last five years (useful life). The restaurant expects to sell the equipment for $2,000 at the end of five years. Taco Taqueria prepares financial statements on an annual basis and has a December 31 year-end. a. Record the journal entry on January 1, 2017. b. What is the formula to calculate straight-line depreciation? Page 191 c. Using the straight-line depreciation method, calculate the annual depreciation for 2017 (Jan. 1 to Dec. 31 2017). d. In order to prepare the annual financial statements, record the adjusting journal entry for depreciation on December 31, 2017. QS 3-8Preparing adjusting entries (annual)- depreciation expense LO4 Gold Co. purchased a vehicle on March 1, 2017, for cash of $32,000. It will be used by the president for business purposes for four years and then sold for an estimated amount of $8,000. Gold Co.'s year-end is December 31. a. Record the journal entry on March 1, 2017. b. Using the straight-line depreciation method, calculate the depreciation expense for March 1, 2017 to December 31, 2017. c. To prepare the 2017 annual financial statements, record the adjusting entry for December, 31, 2017. d. Using the straight-line depreciation method, calculate the depreciation expense for January 1, 2018 to December 31, 2018. e. To prepare the 2018 annual financial statements, record the adjusting entry for December, 31, 2018. QS 3-1GAAP and adjusting entries LO2 For each of the following, identify the primary GAAP that has been violated and explain why. 1. Delta Company prepared its first set of financial statements for the three years ended July 31, 2017. Page 189 2. Warren Consulting purchased $9,800 of supplies on September 30, 2017, and debited Office Supplies Expense. Warren's year-end is September 30. 3. On May 3, 2017, Nikos Car Wash collected $3,000 in advance from a new limousine company to begin operating June 1, 2017. Nikos credited a revenue account for the $3,000. 4. On November 15, 2017, Scooter Town rented equipment for $1,500. Scooter Town is not recording the transaction until it pays (payment is required 15 days from the rental date). QS 3-2Accrual accounting LO3 Based on the accrual basis of accounting, determine when the following independent companies should recognize revenue. 1. Starbucks sells you a $25 gift card for your friend's birthday in February. Your friend spends the gift card on coffee and baked goods in March. 2. You paid your university tuition in September for the Fall semester that runs from September to December. QS 3-3Accrual and cash accounting LO3 In its first year of operations, Harris Construction earned $39,000 in revenues and received $33,000 cash from customers. The company incurred expenses of $22,500, but had not paid for $2,250 of them at year-end. In addition, Harris prepaid $3,750 for expenses that would be incurred the next year. 1. Calculate the first year's profit under the cash basis. 2. Calculate the first year's profit under the accrual basis. 3. What is the difference

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started