Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WACC= 9.69% *please show workings clearly* Question 5 25 Marks Based on the Weighted Average Cost of Capital calculated in question 4, Micron Industries decides,

WACC= 9.69%

WACC= 9.69%

*please show workings clearly*

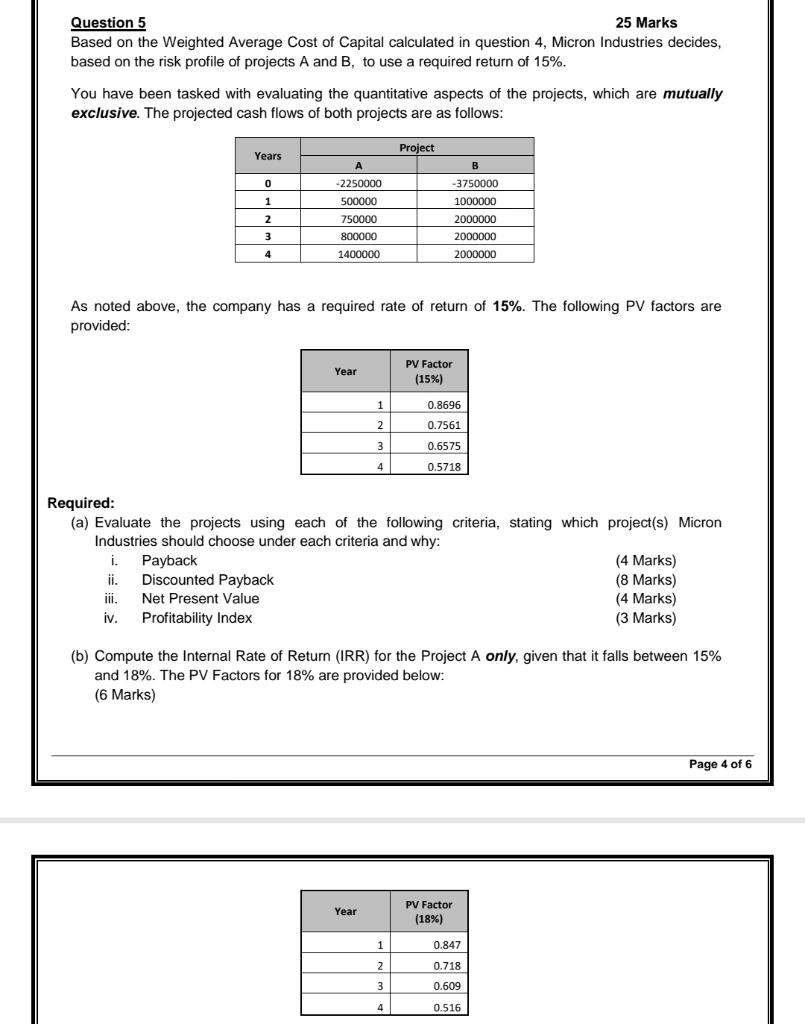

Question 5 25 Marks Based on the Weighted Average Cost of Capital calculated in question 4, Micron Industries decides, based on the risk profile of projects A and B, to use a required return of 15%. You have been tasked with evaluating the quantitative aspects of the projects, which are mutually exclusive. The projected cash flows of both projects are as follows: Project Years A 0 -2250000 1 500000 750000 B -3750000 1000000 2000000 2000000 2 3 800000 1400000 4 2000000 As noted above, the company has a required rate of return of 15%. The following PV factors are provided: Year PV Factor (15%) 1 0.8696 2 0.7561 3 0.6575 4 0.5718 Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Micron Industries should choose under each criteria and why: i. Payback (4 Marks) ii. Discounted Payback (8 Marks) iii. Net Present Value (4 Marks) iv. Profitability Index (3 Marks) (b) Compute the Internal Rate of Return (IRR) for the Project A only, given that it falls between 15% and 18%. The PV Factors for 18% are provided below: (6 Marks) Page 4 of 6 Year PV Factor (18%) 1 0.847 2 0.718 3 0.609 4 0.516Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started