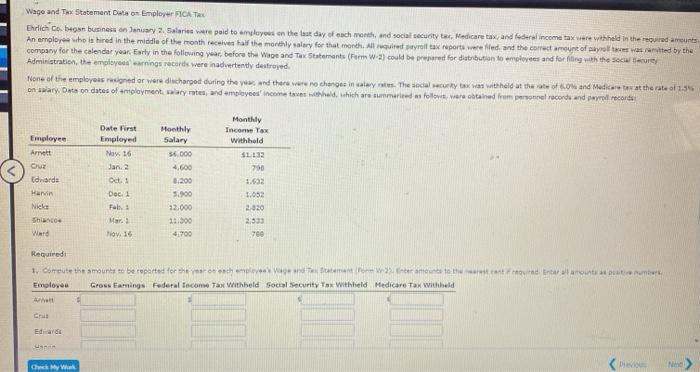

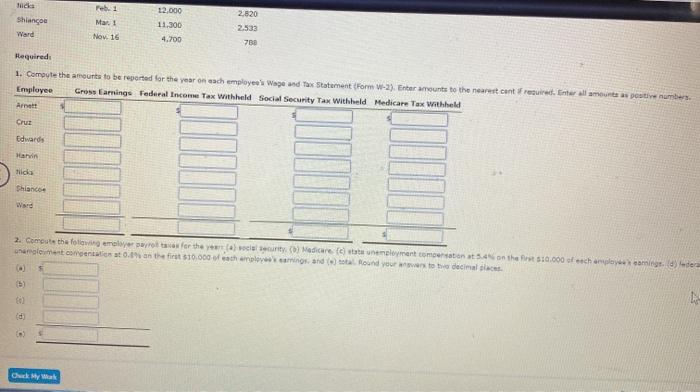

Wage and Twx Statement Data on Employer FICATE Ehrlich co. began business on January 2. Salaries were paid to am layout on the last day of each month and social security tax, Medicare tax and federal income tax were withheld in the required amounts An employee who is hired in the middle of the month receive all the monthly salary for that month. All required payroll tax reports were filed and the correct amount of sayrolles was rented by the company for the calendar year. Early in the following year, before the Wage and Tax Statements (Form W.2) could be preret for distribution to employees and for filing with the source Administration, the employees warnings records were inadvertently destroyed None of the employees signed or were discharged during the year and there were no changes in salwyntes. The social securry tax was withheld at the of 60% and Medicare at the rate of 13 on salary. Ota on dates of payment, ayates, and employees income as held which are summer flowers and from gonnal records and well records Employee Art Cu Date First Employed Nov. 16 Jan 2 Oct. Dec 1 Feb. Monthly Income Tax withheld 11132 790 1.632 Monthly Salary 56.000 4,600 1.200 5.900 12.000 11:30 4.700 darda Hari Niele: Shoe Ward 1.052 2.920 Tov. 16 760 Required 1. Compute the amounts to be reported for the manner amous to the toured Entramos umbes Emolove Grous Earnings Federal Income Tax Withbeld Social Security Tax Withheld Medicare Tax withheld Watt Cra Edward D ide Shianco Ward Feb 1 Mat! Nov. 16 12.000 11.300 2.520 2.533 780 4.700 Required: 1. Compute the amounts to be reported for the year on each employee's Wage and tax Statement Form 1-2). Entramounts to the nearest cant Fruired. Inte all amount as positive numbers Employee Gross Earnings Federal Income Tax Withheld Social Security Tax Withheld Medicare Tax withheld Arne Cruz Edwards Hann Nido Shando Ward 2. Compute the following year for the sun) Medicare fatteniment monto the first 10.000 efecharaming. d) de rolet comentat 0.0on the first 510.000 each welcoming and round you to the decinales