Answered step by step

Verified Expert Solution

Question

1 Approved Answer

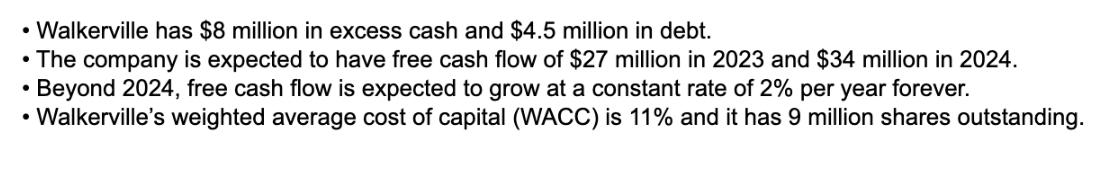

Walkerville has $8 million in excess cash and $4.5 million in debt. The company is expected to have free cash flow of $27 million

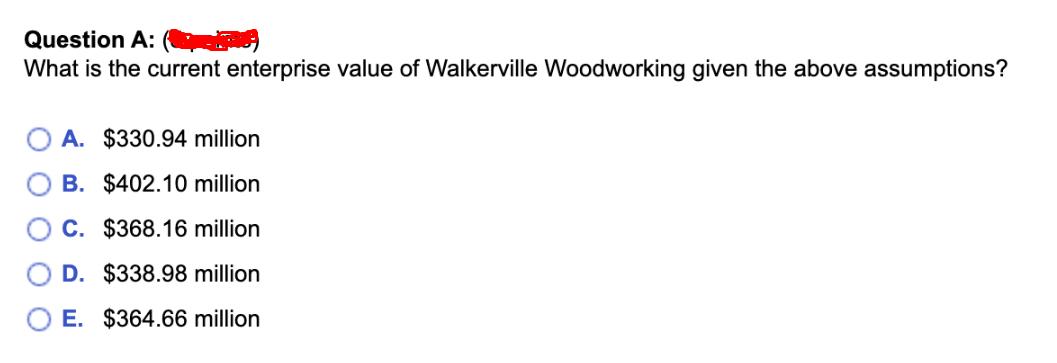

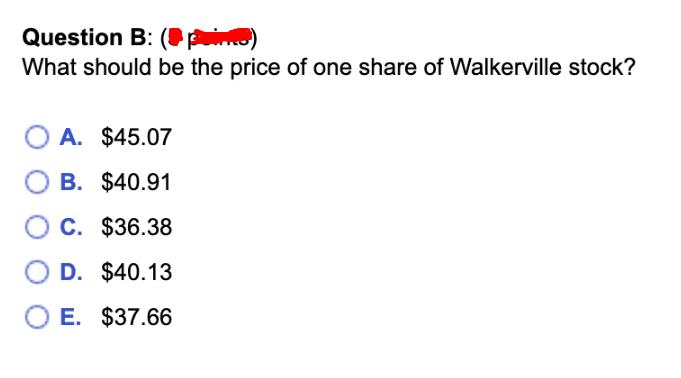

Walkerville has $8 million in excess cash and $4.5 million in debt. The company is expected to have free cash flow of $27 million in 2023 and $34 million in 2024. Beyond 2024, free cash flow is expected to grow at a constant rate of 2% per year forever. Walkerville's weighted average cost of capital (WACC) is 11% and it has 9 million shares outstanding. . Question A: (pl) What is the current enterprise value of Walkerville Woodworking given the above assumptions? A. $330.94 million B. $402.10 million C. $368.16 million D. $338.98 million E. $364.66 million Question B: (pink) What should be the price of one share of Walkerville stock? O A. $45.07 B. $40.91 OC. $36.38 O D. $40.13 OE. $37.66

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the sources the answers to the questions a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started