Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Walmart Stores Statement of Cash Flows Annual Data | Millions of US $ except per share data Net Income/Loss Total Depreciation And Amortization -

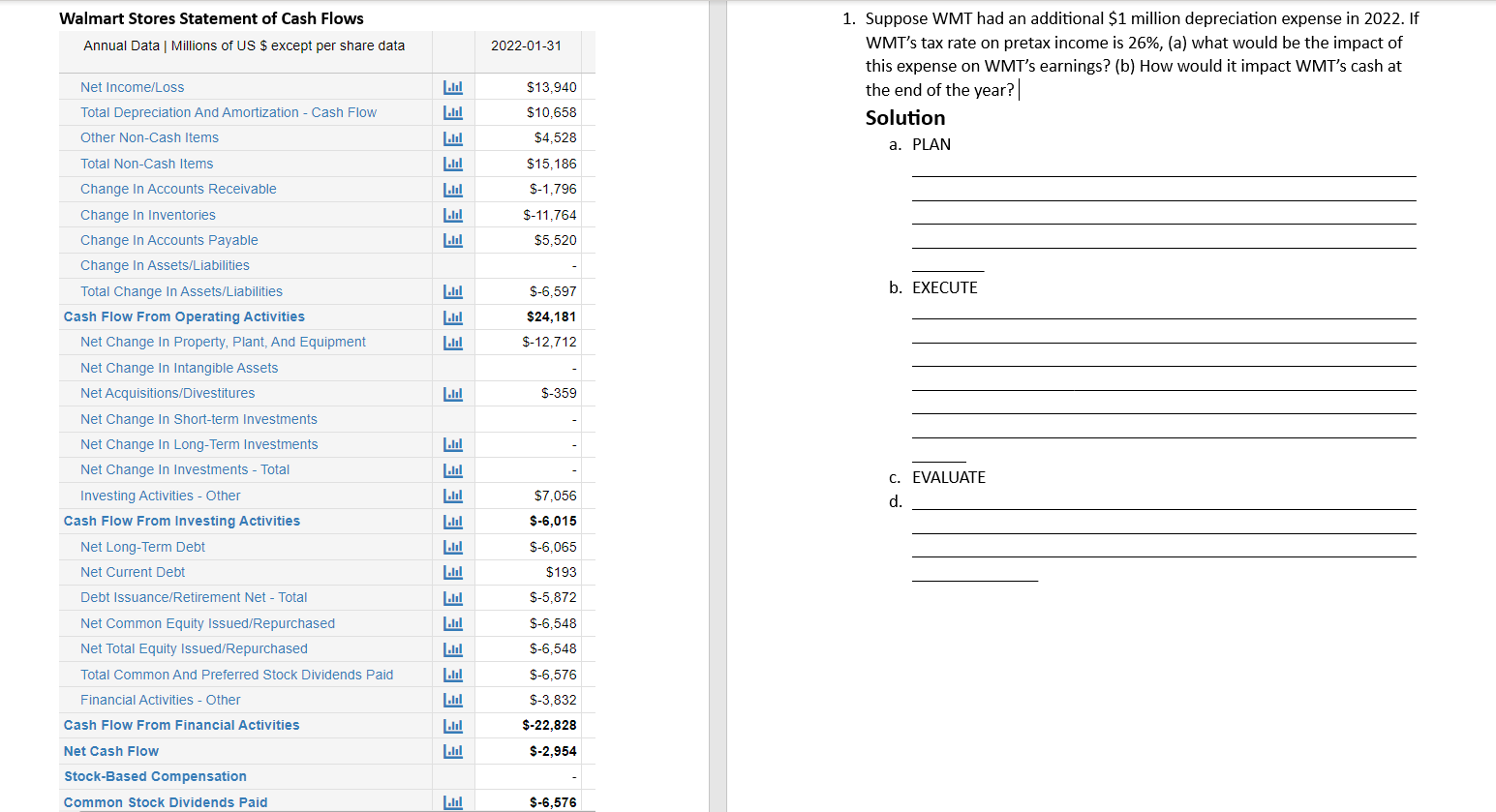

Walmart Stores Statement of Cash Flows Annual Data | Millions of US $ except per share data Net Income/Loss Total Depreciation And Amortization - Cash Flow Other Non-Cash Items Total Non-Cash Items Change In Accounts Receivable Change In Inventories Change In Accounts Payable Change In Assets/Liabilities Total Change In Assets/Liabilities Cash Flow From Operating Activities Net Change In Property, Plant, And Equipment Net Change In Intangible Assets Net Acquisitions/Divestitures Net Change In Short-term Investments Net Change In Long-Term Investments Net Change In Investments - Total Investing Activities - Other Cash Flow From Investing Activities Net Long-Term Debt Net Current Debt Debt Issuance/Retirement Net - Total Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased Total Common And Preferred Stock Dividends Paid Financial Activities - Other Cash Flow From Financial Activities Net Cash Flow Stock-Based Compensation Common Stock Dividends Paid EEEEEEE EEE 3 Lul EEEEEEEEEEEEE Lul 2022-01-31 $13,940 $10,658 $4,528 $15,186 $-1,796 $-11,764 $5,520 $-6,597 $24,181 $-12,712 $-359 $7,056 $-6,015 $-6,065 $193 $-5,872 $-6,548 $-6,548 $-6.576 $-3,832 $-22,828 $-2,954 $-6,576 1. Suppose WMT had an additional $1 million depreciation expense in 2022. If WMT's tax rate on pretax income is 26%, (a) what would be the impact of this expense on WMT's earnings? (b) How would it impact WMT's cash at the end of the year? | Solution a. PLAN b. EXECUTE c. EVALUATE d. Walmart Stores Statement of Cash Flows Annual Data | Millions of US $ except per share data Net Income/Loss Total Depreciation And Amortization - Cash Flow Other Non-Cash Items Total Non-Cash Items Change In Accounts Receivable Change In Inventories Change In Accounts Payable Change In Assets/Liabilities Total Change In Assets/Liabilities Cash Flow From Operating Activities Net Change In Property, Plant, And Equipment Net Change In Intangible Assets Net Acquisitions/Divestitures Net Change In Short-term Investments Net Change In Long-Term Investments Net Change In Investments - Total Investing Activities - Other Cash Flow From Investing Activities Net Long-Term Debt Net Current Debt Debt Issuance/Retirement Net - Total Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased Total Common And Preferred Stock Dividends Paid Financial Activities - Other Cash Flow From Financial Activities Net Cash Flow Stock-Based Compensation Common Stock Dividends Paid EEEEEEE EEE 3 Lul EEEEEEEEEEEEE Lul 2022-01-31 $13,940 $10,658 $4,528 $15,186 $-1,796 $-11,764 $5,520 $-6,597 $24,181 $-12,712 $-359 $7,056 $-6,015 $-6,065 $193 $-5,872 $-6,548 $-6,548 $-6.576 $-3,832 $-22,828 $-2,954 $-6,576 1. Suppose WMT had an additional $1 million depreciation expense in 2022. If WMT's tax rate on pretax income is 26%, (a) what would be the impact of this expense on WMT's earnings? (b) How would it impact WMT's cash at the end of the year? | Solution a. PLAN b. EXECUTE c. EVALUATE d. Walmart Stores Statement of Cash Flows Annual Data | Millions of US $ except per share data Net Income/Loss Total Depreciation And Amortization - Cash Flow Other Non-Cash Items Total Non-Cash Items Change In Accounts Receivable Change In Inventories Change In Accounts Payable Change In Assets/Liabilities Total Change In Assets/Liabilities Cash Flow From Operating Activities Net Change In Property, Plant, And Equipment Net Change In Intangible Assets Net Acquisitions/Divestitures Net Change In Short-term Investments Net Change In Long-Term Investments Net Change In Investments - Total Investing Activities - Other Cash Flow From Investing Activities Net Long-Term Debt Net Current Debt Debt Issuance/Retirement Net - Total Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased Total Common And Preferred Stock Dividends Paid Financial Activities - Other Cash Flow From Financial Activities Net Cash Flow Stock-Based Compensation Common Stock Dividends Paid EEEEEEE EEE 3 Lul EEEEEEEEEEEEE Lul 2022-01-31 $13,940 $10,658 $4,528 $15,186 $-1,796 $-11,764 $5,520 $-6,597 $24,181 $-12,712 $-359 $7,056 $-6,015 $-6,065 $193 $-5,872 $-6,548 $-6,548 $-6.576 $-3,832 $-22,828 $-2,954 $-6,576 1. Suppose WMT had an additional $1 million depreciation expense in 2022. If WMT's tax rate on pretax income is 26%, (a) what would be the impact of this expense on WMT's earnings? (b) How would it impact WMT's cash at the end of the year? | Solution a. PLAN b. EXECUTE c. EVALUATE d.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Impact on WMTs earnings Reported pretax income Net income 1 Tax rate 13940 billion 1 26 13940 bill...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started