Answered step by step

Verified Expert Solution

Question

1 Approved Answer

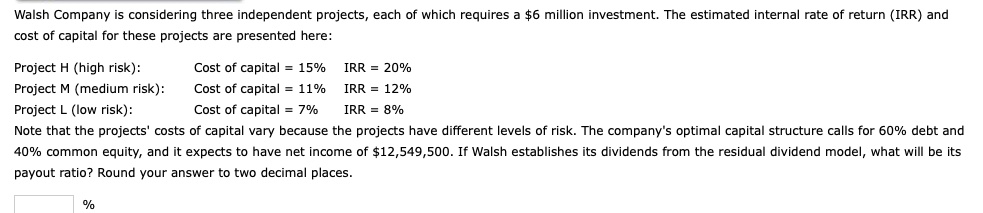

Walsh Company is considering three independent projects, each of which requires a $ 6 million investment. The estimated internal rate of return ( IRR )

Walsh Company is considering three independent projects, each of which requires a $ million investment. The estimated internal rate of return IRR and

cost of capital for these projects are presented here:

Note that the projects' costs of capital vary because the projects have different levels of risk. The company's optimal capital structure calls for debt and

common equity, and it expects to have net income of $ If Walsh establishes its dividends from the residual dividend model, what will be its

payout ratio? Round your answer to two decimal places.

Walsh Company is considering three independent projects, each of which requires a $ million investment. The estimated internal rate of return IRR and cost of capital for these projects are presented here:

Project H high risk: Cost of capital IRR

Project M medium risk: Cost of capital IRR

Project L low risk: Cost of capital IRR

Note that the projects' costs of capital vary because the projects have different levels of risk. The company's optimal capital structure calls for debt and common equity, and it expects to have net income of $ If Walsh establishes its dividends from the residual dividend model, what will be its payout ratio? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started